Financial advisors face multiple risks tied to market cycles that can impact their personal finances and business stability. In this article, we’ll explore a portfolio construction approach that utilizes basic diversification concepts with Return Stacking to help minimize adverse economic impacts while maximizing chances of business success.

(This article is written by Rodrigo Gordillo.)

Business Risk, Diversification, Inflation

The Five Key Advisor Business Risks

There are five key ways adverse markets can hurt advisors:

- Personal investment portfolio declines

- Near-term revenue drops as assets under management fall

- Long-term revenue suffers as clients withdraw assets

- Job loss risk at large firms if revenues fall sufficiently

- Valuation declines for advisor-owned RIAs as revenue multiples contract

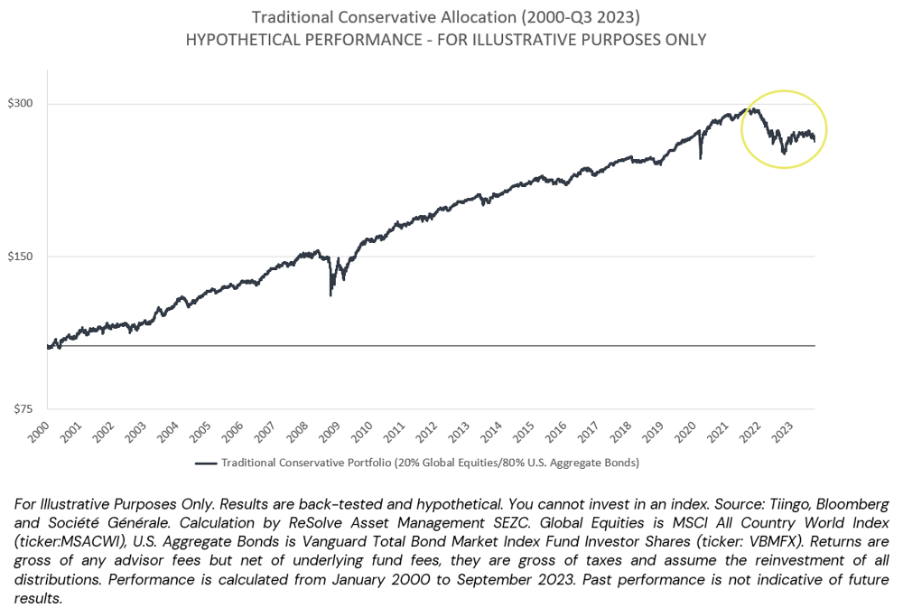

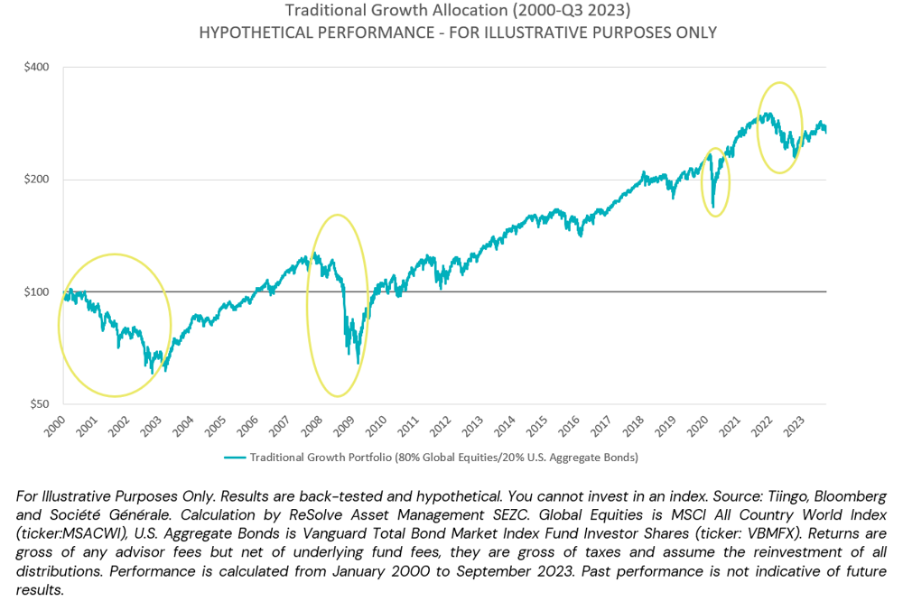

Traditional Advisor Client Portfolios and Market Risk

Understanding traditional advisor client types can show us how business revenue aligns with market risks. We can visualize how these risks have looked for Advisors who work predominately with retirees. This advisor type will have a revenue-weighted average portfolio that is dominated by bonds. Here we show a 20%/80% bond/stock split as a representative portfolio that provides a genuine balance between non-inflationary positive growth shocks and negative growth shocks. However, volatility in interest rates – which can be caused by things like sudden changes in inflation expectations or central bank policy – are likely the leading cause in business revenue volatility. This type of advisory business has cruised trough for nearly 40 years but has felt some serious pain for the first time beginning in 2022 due to large changes in inflation expectations.

Conversely, Advisors serving growth clients face more equity risk which will dominate their revenue streams. Here we show an 80%/20% Stock/Bond split as a representative portfolio that will thrive during persistent positive growth shock environments but crashes of 20-60% during abrupt or multi-year bear markets. This type of growth oriented client base fully links business revenue to economic cycles, for better or worse.

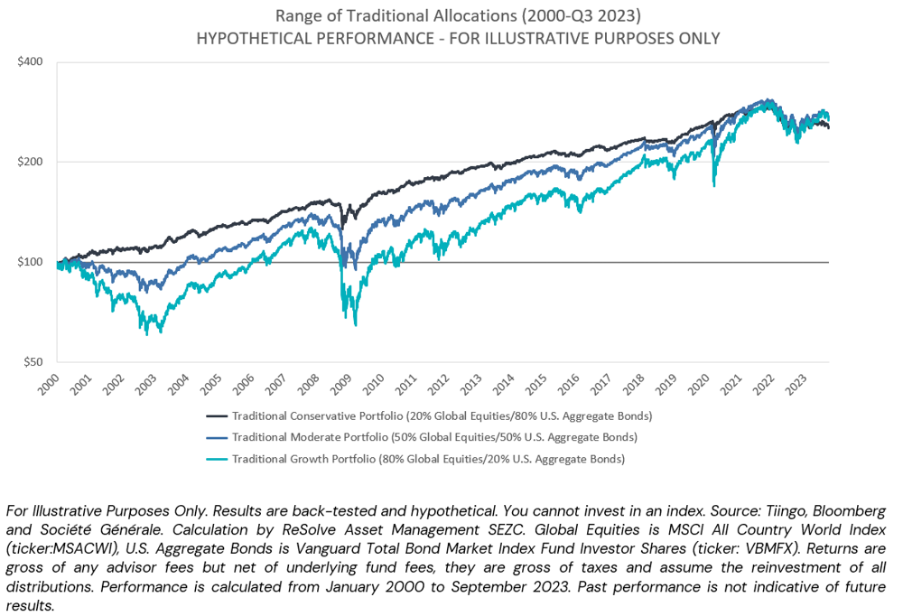

Most advisor revenue likely falls between these extremes. But diversification could provide more stable income across market regimes. The goal is constructing portfolios to weather any conditions while aligning client objectives.

While we often argue that diversification is good for investors, we can also see why diversification would be good for financial advisors’ business risk as well. In an ideal world, an advisor’s revenue-weighted average portfolio would be well diversified and able to weather any market conditions, providing more stable revenue streams for the business.

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Easily backtest & explore different return stacking concepts

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

My Personal History and Perspective on Diversification

My views on resilient portfolio construction stem from personal experience. During my formative years, I gained a unique perspective due to my upbringing in Peru. My father, a mathematician and software developer, established one of the first software development companies in Peru, which initially saw great success. However, in 1989, Peru experienced hyperinflation, with inflation rates soaring from 20% to 7200% within a span of six months. When my family immigrated to Canada, we purchased a house with minimal down payment, only to witness a 50% housing market crash.

We later went back to Peru in 1995 and I saw my father help build one small business after another only to see them struggle hand-in-hand with the more rapid economic cycles that Peru and most developing markets tend to experience. Our family’s financial success was intricately tied to the performance of Peru’s economy.

As I left academia in Canada to transition into the professional world of investing I knew one thing, I needed to detach my personal and family’s success from the luck, good or bad, from any single exogenous macro shock.

Studying market history revealed a few key heuristics that would become the base for my investment framework. To create a robust portfolio you need exposures to:

- Equities for bull markets

- Bonds for non-inflationary bear markets

- Commodities for inflationary regimes

- Gold as a monetary and crisis hedge

As I dug into the benefits of the latter two asset classes I found that they spent at least half of their time with negative returns during most calendar years. So while targeted exposures to these asset classes seemed crucial to have at the right times, they were difficult positions to hold most years for client accounts. Finally, in the mid 2000s I came across Managed Futures Trend managers.

Managed futures are characterized by:

- Low long-term correlation with stocks and bonds

- The ability to trade a wide array of global asset classes including equities, bonds, commodities and currencies

- Flexibility to take both long and short positions

This unique strategy seemed to provide for a good catch all for inflationary regimes, crisis periods and prolonged multi-year bear markets and so this strategy became a crucial component to my business stability plan.

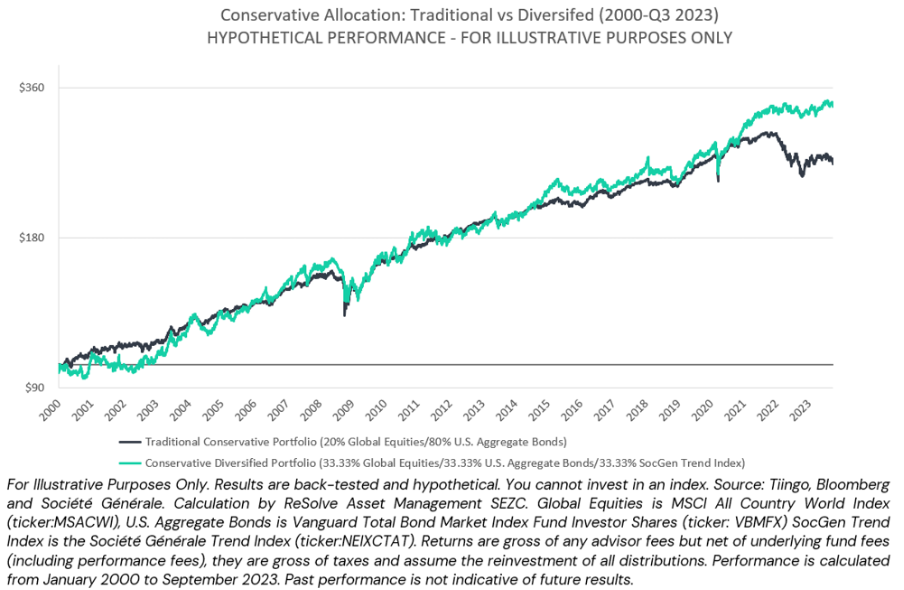

Adding Diversification Across Risk Profiles

Below we’ll visualize a new diversified portfolio with a very basic equal weight allocation across global equities, bonds and a managed futures trend diversifier. So nothing fancy, better weighting schemes will come at a later date! We compare the traditional conservative portfolio with the diversified portfolio first and then continue our comparison to the traditional moderate and growth portfolios with versions of the equal weight diversified portfolio that scale exposures pro-rata by levering to 120% and 150% respectively.

We can observe how the conservative diversified mandate has upside capture that is similar to the traditional allocation over time but fills in the inflation shock gap of 2022. In other words, it improves adverse scenarios and sequence risk, two elements crucial to the success of a retiree in withdrawal.

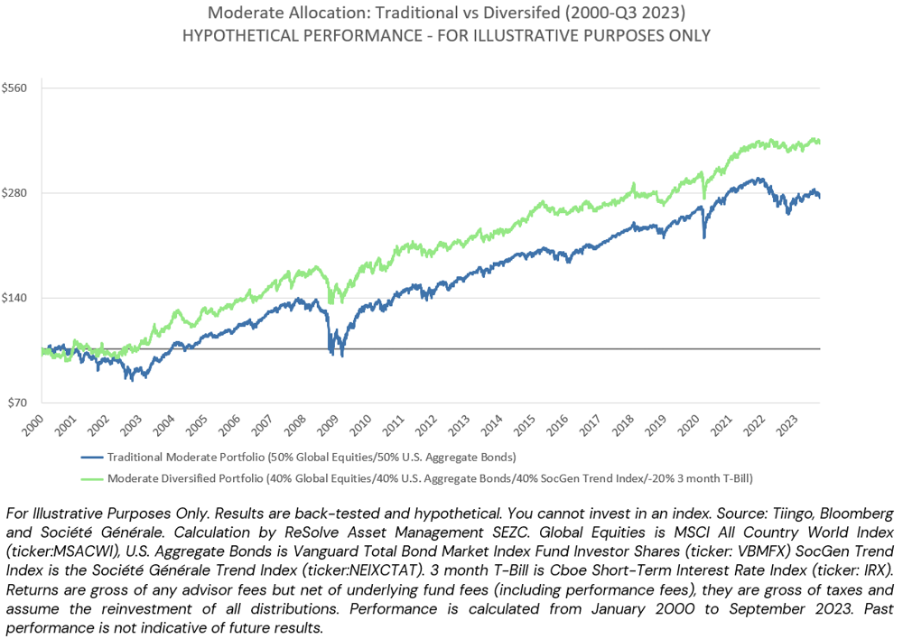

For a moderate investor client base willing to take more daily volatility and drawdown risk, and advisor can help clients achieve their targets, not by forgoing diversification, but by increasing overall exposure to the whole portfolio. In this case a 120% exposure.

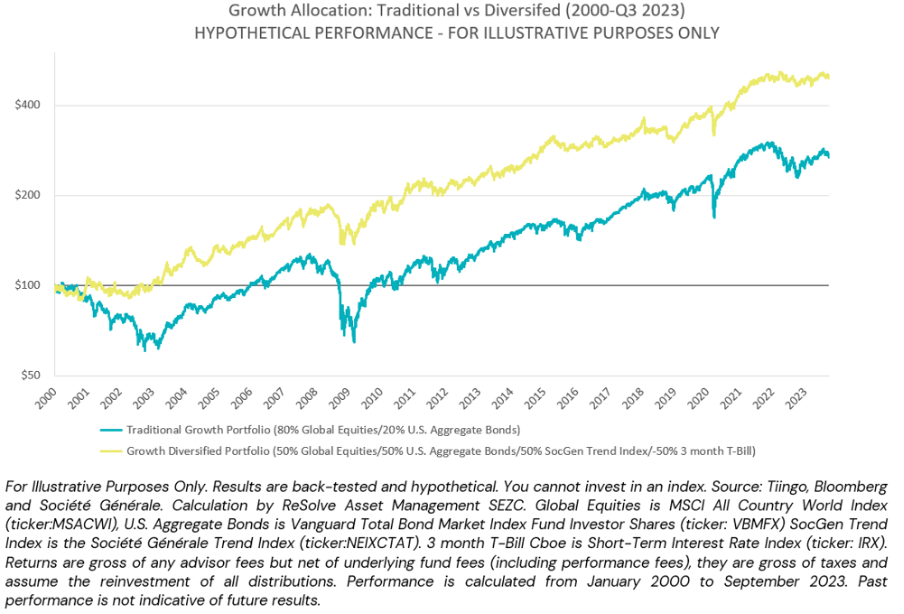

Finally, for a growth oriented client base that requires even higher returns but can bare growth like risk metrics, an advisor may want to lever up to 150% percent.

Putting them all together, your clients, from new professionals to fully retired, get to experience the same general path but at the commensurate level or risk and return that align with their stage in life.

The Return Stacking landscape is ever evolving,

go deeper by connecting with a team member.

Higher Volatility But Lower Adverse Scenario Risk

It is crucial to understand the difference at this point in risks between the traditional and diversified allocations. As we increase gross portfolio exposure to the overall diversified portfolio we will see a higher magnitude of daily portfolio gyrations as well as experiencing higher highs and lower lows. As Corey has always said, risk cannot be eliminated only transformed and in this case the use of diversification plus leverage allows us to distribute the risk OVER TIME rather than experiencing the extra risk ALL AT ONCE.

The key benefit of diversification is in the reduction of a bad sequence of returns that you may experience in the time horizon that you care about while providing the risk and return profile your client base requires. If you are an advisor, you probably have 20 to 30 years to maximize your chances of creating a successful advisory business. We probably want the success of that business to be driven by:

- Thoughtful execution of a robust business plan

- A repeatable business development process

- World class client servicing

- Cost management and intelligent reinvestment of profits.

But if we’re honest and if we were to do a principal component analysis of the success drivers for most advisory practices in 2023, we would find that success has come at the hands of riding 40 years of persistent positive growth shocks, benign inflation and abundant liquidity that has benefited traditional portfolio allocations the most.

New Technologies, New Opportunities

When I first got into the business as a wealth advisor I had to go out of my way to create the private pool structures to deliver this type of diversified portfolio and stacked exposures to my clients. Moreover, I was only able to make them available to accredited investors that in turn had to take liquidity risks via lockups and reduced redemption options along with a significant lack of transparency. Today, the investment world has drastically changed, we now have a wide variety of exchange traded funds and mutual funds that come with pre packaged stacks that will allow us to get access to well managed, cheap leverage to help us put these type of portfolios together.

From a stacking perspective, what we’ve actually done with those three buckets is that the moderate diversified portfolio is 40% bonds, 40% stocks and 40% managed futures trend, means that you’re gonna have to find a 20% managed futures stack somewhere in order to have that expanded exposure. For the growth diversified mandate which IS 50% bonds,50% stocks and 50% managed futures trend advisors are going to need to find a way to get that extra 50 percent stacked exposure to managed futures trend.

So using the return stacked approach to diversification at different stack sizes for different client personas means that advisors and their clients finally be well aligned.

Conclusion

Professional managed futures vehicles with embedded asset class stacks once required niche access. But new and novel ETFs and mutual funds now pre-package these solutions in many forms. Whit these tools Advisors can manage business risks better by incorporating non-correlated alternatives as strategic portfolio complements at different risk levels that may help minimize adverse scenario risks. This philosophy of resilience through diversification with the concepts of Return Stacking has served me well in my career. While challenging in practice, especially if you’re new to these concepts, the benefits over traditional concentration merit consideration. I hope this framework gives advisors food for thought in constructing portfolios built Immunize Business Risk from Bear Markets & Inflation Regimes.