Managed Futures Yield (Carry)

Overview

Dive into the world of managed futures and learn about the strategies of return stacking in portfolio construction.

Key Topics

Managed Futures, Yield, Carry

What is Managed Futures Yield?

Managed Futures Carry, also known as Carry Trading in the context of managed futures, refers to investment strategies that seek to profit from the yield differential between financial instruments, primarily implemented through futures contracts. Carry strategies are executed by professional investment managers, often Commodity Trading Advisors (CTAs), as part of a broader portfolio management process. The core premise of carry strategies is that assets with higher carry will outperform those with lower carry over time, assuming all other factors remain constant.

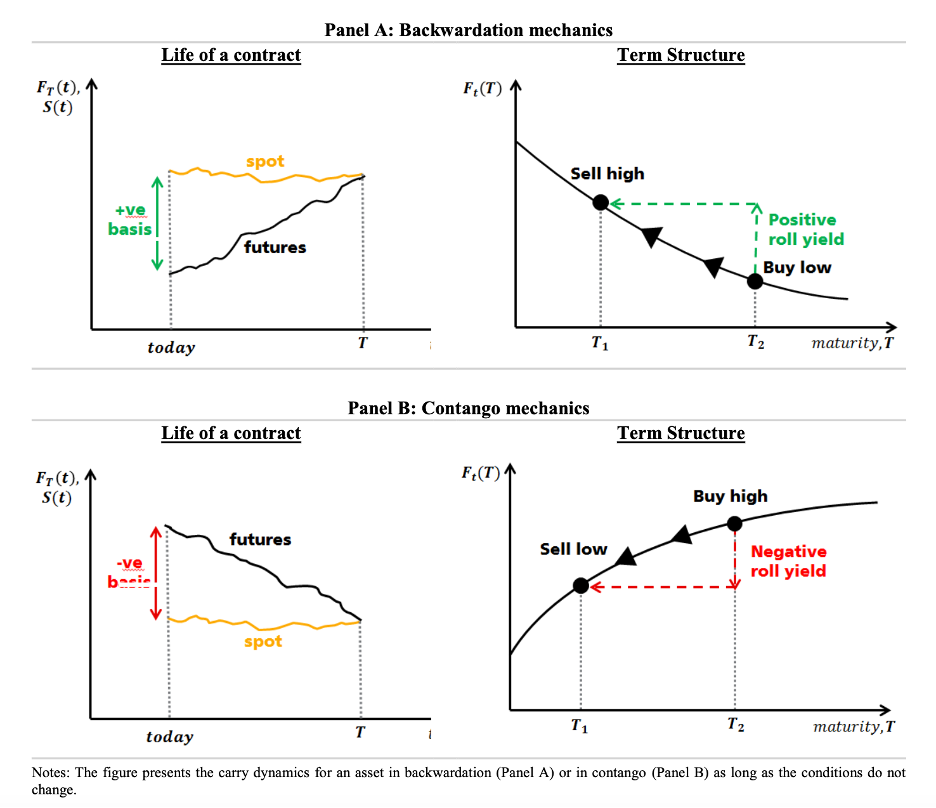

Carry can be defined as the return on an asset assuming its price remains unchanged (Ilmanen 2011, Koijen et al. 2013). In the context of futures markets, carry is often represented by the difference between the spot price and the futures price of an asset. This difference, also known as the basis, can be negative (contango) or positive (backwardation), providing opportunities for carry traders.

Source: Baltas (2017)

Similar to trend following strategies, carry strategies in managed futures typically involve holding a significant portion of assets in cash-equivalent positions (e.g., money market funds or short-term Treasury bills). These cash holdings serve as collateral for futures positions. A typical carry portfolio might consist of a 100% allocation to cash, with additional long and short positions in futures contracts based on their carry characteristics.

Carry strategies can be applied across a wide range of asset classes, including:

- Commodities: Capitalizing on the term structure of commodity futures.

- Currencies: Profiting from interest rate differentials between countries

- Fixed Income: Capitalizing on yield curve differences across maturities

- Equities: Utilizing dividend yields or implied dividends in index futures

To enhance diversification, carry strategy managers often trade a diverse set of contracts, ranging from dozens to hundreds. Some managers have expanded into synthetic and alternative markets to further diversify their holdings.

Carry strategies are predominantly systematic in nature, relying on quantitative models to assess carry opportunities across various assets. These models typically consider factors such as:

- Yield differentials

- Term structure of futures curves

- Roll yields

- Implied yields (e.g., dividend yields for equity index futures)

While both carry and trend following strategies fall under the managed futures umbrella, they differ in their fundamental approach. Trend following seeks to profit from price momentum, while carry strategies aim to benefit from yield differentials. However, both strategies can be complementary in a diversified managed futures portfolio (Fuertes at al. 2010).

The dispersion in available carry signals, asset classes traded, and implementation methods means that there can be significant variation between different carry strategy managers, despite the high-level strategy concept being similar. This diversity underscores the importance of understanding the specific approach of each manager when evaluating carry strategies within and across the managed futures space.

In terms of the underlying methodology of a carry strategy, there are a few different ways of implementing a carry strategy:

Cross Sectional / Relative Value Carry: This investment strategy is executed within a single asset class, where an investor seeks to exploit the yield differentials between instruments of similar nature but differing characteristics. By simultaneously purchasing assets with higher yields and shorting those with lower yields, the investor aims to capitalize on the relative value differences within the same asset class, such as within the bond or currency markets. This approach is predicated on the assumption that the yield disparities provide a compensatory return for assumed risks.

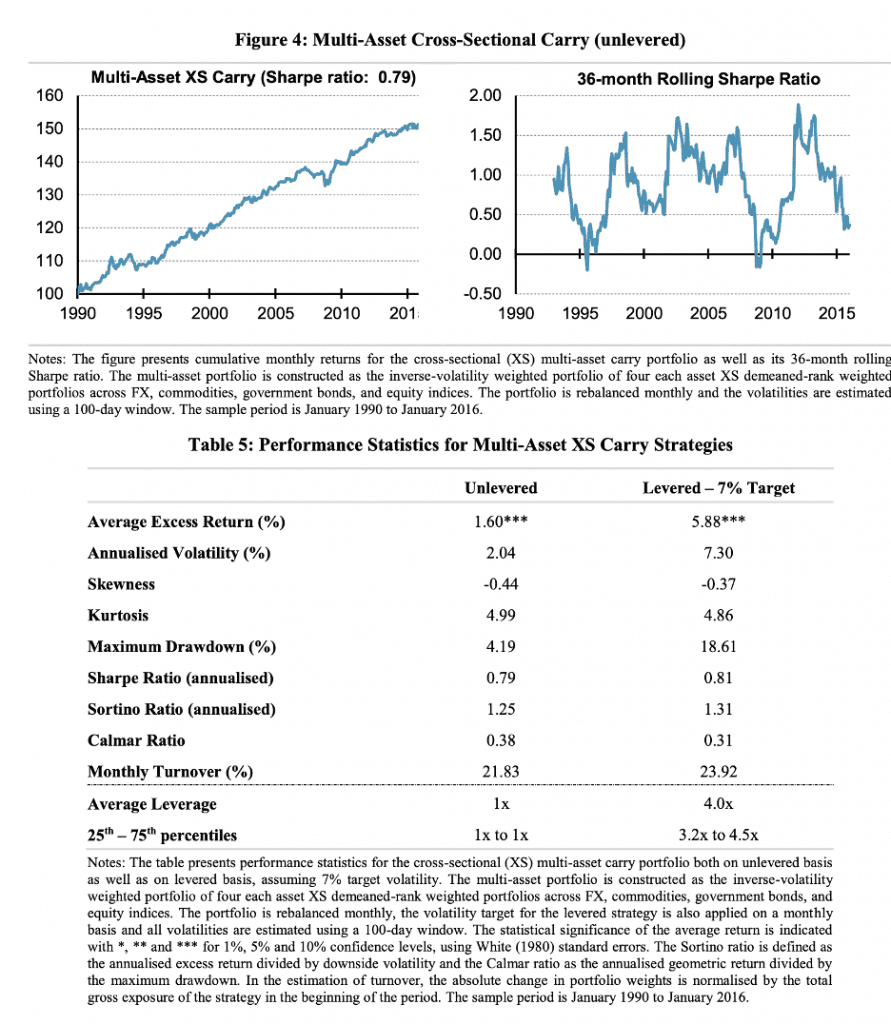

Source: Baltas (2017)

Calendar Spread Carry: This strategy is commonly applied in the futures market, where an investor takes long positions in contracts with nearer expiration dates and short positions in those with later dates, or vice versa, depending on which configuration is expected to be more profitable. This setup aims to exploit discrepancies in the yield curves of different maturity dates. Importantly, by structuring the positions this way, exposure to parallel shifts in the term structure is largely eliminated, although vulnerability to non-parallel shifts in yield curves remains.

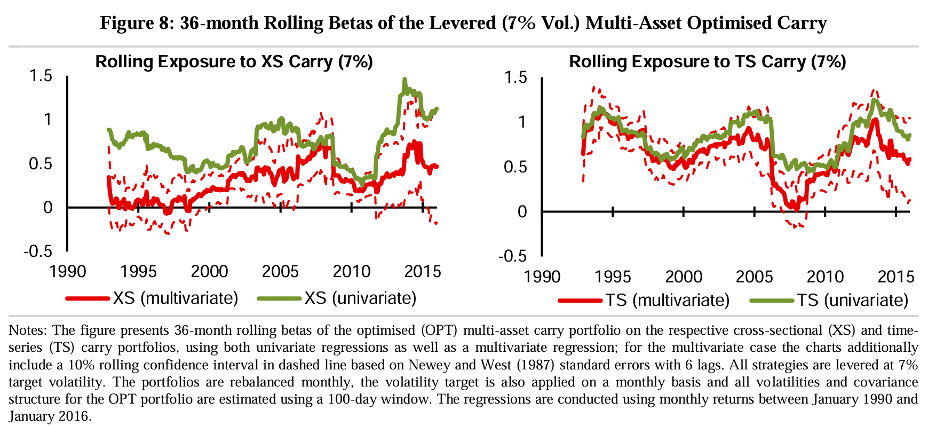

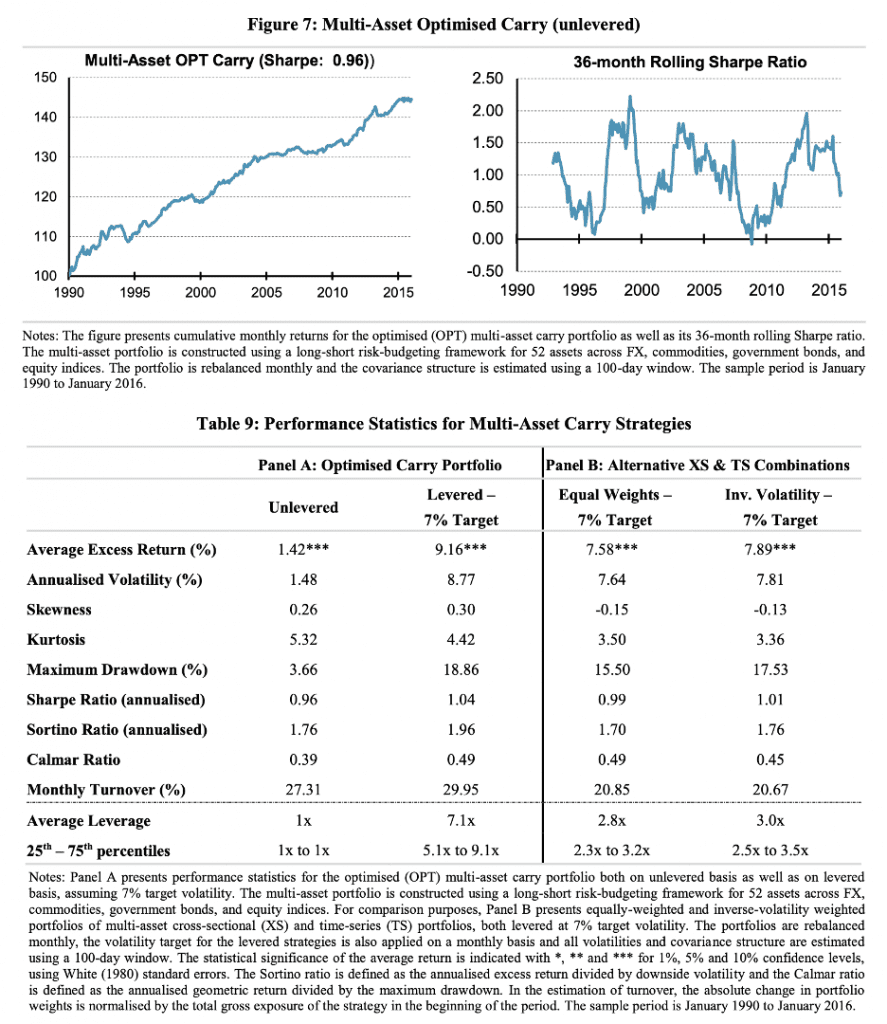

Optimized Carry: In contrast to a naïve carry portfolio construction, which typically utilize inverse volatility weighting schemes, an optimized carry portfolio embeds both the carry metric of the assets in the universe as well as the correlations between them to achieve a portfolio optimized for its carry-to-risk characteristics.

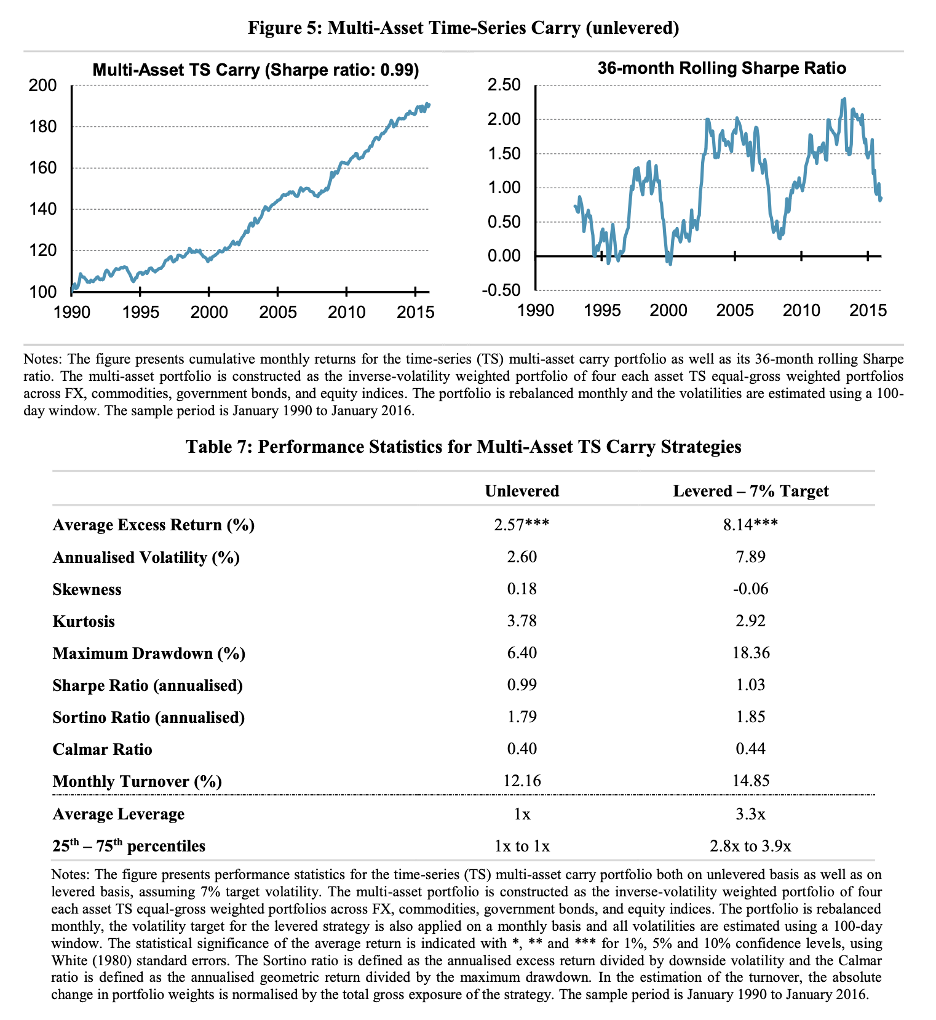

Source: Baltas (2017)

The figure above, from Baltas (2017), depicts an optimized multi-asset carry portfolio’s betas to both cross-sectional and time-series carry implementations. As we can see, the optimized implementation holds exposure to both the cross-sectional and time-series implementations.

Source: Baltas (2017)

History of Carry Strategies

The concept of carry in financial markets has a long and rich history, with roots tracing back to early commodity and currency trading. However, its formal recognition and systematic exploitation as an investment strategy have evolved significantly over time.

One of the earliest documented observations of carry-like behavior can be traced to the forward exchange market in the late 19th and early 20th centuries. During this period, traders began to notice and exploit interest rate differentials between countries, laying the groundwork for what would later be known as the “carry trade” in currency markets.

In the realm of commodities, the theory of storage, developed by Holbrook Working in the 1940s, provided a foundation for understanding the relationship between spot and futures prices (Working, 1933). This theory helped explain the concept of convenience yield initially proposed by Nicholas Kaldor, which is closely related to carry in commodity markets (Kaldor, 1939).

Notable economists and investors who contributed to the development and understanding of carry strategies include:

- John Maynard Keynes (1883 – 1946): Introduced the concept of “normal backwardation” in futures markets, which is closely related to carry.

- Holbrook Working (1895 – 1985): Conducted research into the Theory of Storage, which relates the supply and demand of an individual commodity to that of its future term structure as well as the volatility of its market prices.

- Nicholas Kaldor (1908 – 1986): In addition to his work on political economics, Kaldor extended Working’s theory of storage to argue that “[the] stocks of all goods possess a yield”, coining the term Convenience Yield, the implied return on holding the underlying asset as opposed to the associated financial derivative of that asset.

- Koijen, Moskowitz, Pedersen, and Vrugt: This group of researchers extended the notion of “Carry” outside of currencies and commodities to a multi-asset context, including global equities, global bonds, US Treasuries, credit, and options (Koijen et al. 2013). The researchers found “that carry is a strong positive predictor of returns in each of the major asset classes” studied.

The evolution of carry strategies in managed futures can be broadly divided into several phases:

- Early Recognition (1970s-1980s): As futures markets expanded, traders began to recognize the potential of carry trades, particularly in currency and commodity markets.

- Academic Exploration (1990s-2000s): Researchers started to systematically study carry as a potential source of returns across various asset classes.

- Systematic Implementation (2000s-2010s): With advancements in computing power and data availability, managed futures funds began to incorporate carry as a systematic strategy alongside trend following.

- Multi-Asset Carry (2010s-present): Carry strategies expanded beyond traditional currency and commodity markets to include fixed income, equities, and alternative assets (Koijen et al. 2018).

- The development of carry as a risk premia strategy gained significant traction in the early 2000s. Researchers and practitioners began to view carry as a systematic source of returns that could be harvested across multiple asset classes. This perspective was reinforced by studies showing that carry strategies exhibited low correlation with traditional asset classes, making them attractive for portfolio diversification (Ilmanen 2011).

- In modern portfolio management, carry strategies have become an integral part of many managed futures programs. They are often combined with other strategies, such as momentum and value, to create more robust and diversified investment approaches.

As carry strategies continue to evolve, they remain a subject of ongoing research and innovation in the managed futures industry. The interplay between carry and other factors, such as momentum and value, continues to be an area of active investigation, promising further refinements in strategy design and implementation.

Theoretical Foundations of Carry Strategies

The persistence and profitability of carry strategies across various asset classes have led researchers to develop theoretical frameworks to explain why carry exists in markets and why it may continue to provide returns. Understanding these theoretical foundations is crucial for investors and portfolio managers considering the inclusion of carry strategies in their portfolio allocations.

Why Carry May Exist in Markets

Carry can be viewed as a risk premium that compensates investors for taking on certain types of risk. Several theories have been proposed to explain the existence and persistence of carry, though no one theory appears to adequately describe the carry return premium:

- Risk Premium Theory: This theory suggests that carry returns compensate investors for bearing systematic risk. In this view, assets with higher carry tend to be riskier, and the excess returns are a reward for this additional risk.

- Market Structure Explanations: Institutional factors, such as regulatory constraints, speculation, hedging demands, and market segmentation, can create persistent carry opportunities.

- Behavioral Finance Perspectives: Investor behavior, including limits to arbitrage, slow-moving capital, and cognitive biases, may contribute to the persistence of carry returns.

Academic Theories and Explanations

Several academic theories have been developed to explain carry across different asset classes:

- Uncovered Interest Rate Parity (UIP) Violation: In currency markets, the failure of UIP to hold consistently creates opportunities for currency carry trades.

- Theory of Storage: In commodity markets, the relationship between spot and futures prices, influenced by storage costs and convenience yields, explains the basis of commodity carry trades.

- Preferred Habitat Theory: In fixed income markets, this theory suggests that investors have preferences for specific maturities, leading to yield curve shapes that can be exploited through carry strategies.

- Illiquidity and Volatility Risk: Investing in a carry strategy holds a positive risk premium, as the investor is compensated for bearing illiquidity and volatility, or jump, risk in periods of financial turmoil.

Carry Across Different Asset Classes

While the concept of carry is universal, its manifestation and drivers can vary across asset classes:

- Currencies: Carry is typically measured as the interest rate differential between two currencies. According to Baltas (2017), higher interest rates are typically “associated with rising inflation, funding liquidity concerns, or consumption growth risk, which render higher-yielding currencies more vulnerable,” with investors demanding a higher interest rate to bear the risk.

- Commodities: Carry is often represented by the convenience yield, which is the return differential between the spot price and the futures price. According to Baltas (2017), “the theory of ‘normal backwardation’ suggests that commodity producers take short futures positions to hedge against price drops and therefore pay a premium to an investor that offers this insurance and takes a long position in the futures contract.” It can be argued that commodity producers benefit from hedging the sale price of their production forward, as the asset owners who provide capital for their operations will agree to better terms, knowing that the sale price is locked in. Additionally, there are costs associated with storing commodities, so the carrying costs implied in financial futures on the commodity should reflect these expenses. These and other factors contribute to positive or negative carry dynamics in different commodities over time.

- Fixed Income: Carry in bond markets is related to the shape of the yield curve and can be measured as the yield differential between different maturities. Term spreads across fixed income maturities are hypothesized to compensate investors for illiquidity risk monetary policy risk, inflation risk, and reinvestment risk.

- Equities: Equity carry can be measured using dividend yields or implied dividends from futures markets. If equity carry serves as compensation for a fundamental risk, it implies that equity indices with higher expected shareholder yields are inherently riskier. Due to the resemblance between dividend yields and the indicators used in equity value investing, it is reasonable to anticipate that the returns (and underlying factors) of an equity carry strategy would align with the equity value premium.

Common Carry Benchmarks

Assessing the performance of managed futures carry strategies presents unique challenges due to the diverse implementation methods and the wide range of assets involved. Unlike more traditional asset classes, there is no single, widely accepted benchmark for carry strategies. However, several approaches have been developed to create benchmarks and replicate carry strategy returns.

Challenges in Benchmarking Carry Strategies

The main challenges in benchmarking carry strategies include:

- Strategy Heterogeneity: Carry strategies can vary significantly in terms of asset classes traded, signal generation, and portfolio construction.

- Data Availability: Historical data for some carry-related metrics may be limited or not readily available.

- Implementation Details: The specific methods used for measuring and exploiting carry can differ among managers.

Existing Carry Indices and Benchmarks

Despite these challenges, several indices and benchmarks have been developed to track carry strategy performance with all indices having various implementation differences, as mentioned previously:

- Deutsche Bank CoreSeries FX Carry Balanced Index: Focuses on currency carry trades within G10 currencies.

- S&P GSCI Dynamic Roll Index: Aims to capture long commodity exposure by avoiding rolling into futures contracts in contango, potentially limiting negative carry exposure.

- Bloomberg Carry Indices:

- Bloomberg GSAM FX Carry Index: An equal-weight index of the Bloomberg GSAM G10 FX Carry Index and the Bloomberg GSAM EM FX Carry Index.

- Bloomberg GSAM Bond Futures Carry Index: An index that seeks to gain carry exposure across 10-year world government bonds by taking long positions in high-carry government bonds, and short positions in low-carry government bonds.

- Bloomberg GSAM Commodity Carry Index: Provides commodity carry exposure through a roll yield strategy and a backwardation strategy.

- Bloomberg GSAM Cross-Asset Carry Index: Provides an equal risk-weighted exposure across carry factors in commodities, currencies, and bonds.

- AQR All-Asset Carry Index: A carry index across global currencies, bonds, commodities, and equity indices.

Additional Literature, Theoretical Evidence, and Implications for Portfolios

The body of literature on carry strategies has expanded significantly in recent years, providing deeper insights into their behavior, performance, and role in portfolio construction. This section reviews key academic papers, empirical evidence, and the implications of incorporating carry strategies into investment portfolios.

- Forward and Spot Exchange Rates (Fama, 1984): Fama finds a persistent anomaly, coined the “Forward Premium Puzzle” in which a domestic currency may appreciate relative to a foreign currency if the domestic interest rate is higher than that of the foreign currency.

- Volatility and the Carry Trade (Bhansali, 2007): This paper explores the relationship between volatility and carry trades, highlighting the importance of risk management in carry strategy implementation.

- Carry Trade and Momentum in Currency Markets (Burnside, Eichenbaum, and Rebelo, 2011): Focusing on currency markets, this study examines the relationship between carry trades and momentum strategies, finding that both generate significant excess returns. The authors also posit three potential explanations for the existence of the strategies’ profitability.

- Expected Returns: An Investors Guide to Harvesting Market Rewards (Ilmanen, 2011): In this in-depth book, Ilmanen provides a holistic description of carry across asset classes, potential explanations for the existence of a carry premium, as well as provides an analysis on carry signals as a predictor of future returns.

- Predictability of Currency Carry Trades and Asset Pricing Implications (Bakshi and Panayotov, 2011): The authors find evidence of the predictability of carry trade returns, suggesting some persistence in carry strategy performance.

- Carry (Koijen et al. 2013): This seminal paper provides a comprehensive analysis of carry trades across asset classes. The authors develop a unified framework for measuring carry across asset classes and demonstrate its predictive power for returns across various markets.

- Out-of-Sample Evidence on the Returns to Currency Trading (Accominotti and Chambers, 2013): The authors find positive returns to currency carry, momentum, and value strategies in the 1920s and 1930s, providing further evidence of the potential profitability of such strategies.

- Optimising Cross-Asset Carry (Baltas, 2017): Presents a framework for optimizing carry strategies across multiple asset classes, addressing the challenges of portfolio construction in a multi-asset carry context. Importantly, Baltas finds that the low correlation between asset classes may reduce the downside risk and volatility profile, when compared to a single asset class carry strategy.

- Time-Varying Inflation Risk and Stock Returns (Boons et al. 2020): The authors find that carry premia may be related to time-varying inflation risk, as changes in inflation expectations can impact asset prices and the returns to carry strategies.

Potential Applications to Return Stacking

The unique characteristics of managed futures carry strategies offer several potential applications within the framework of return stacking. This section explores how carry strategies can be integrated into return-stacked portfolios to address various investment objectives.

Below we show some examples of how one might contemplate use cases for managed futures in an investment portfolio.

If you’d like to explore any of these scenarios, please visit the Return Stacked Tools site to find tools to test and visualize these ideas in an intuitive framework.

The Growth Stacker Approach with Carry Strategies

Investors seeking long-term growth can potentially benefit from incorporating carry strategies into a return-stacked portfolio. By leveraging a core equity position and adding a carry strategy overlay, investors may enhance returns while maintaining or potentially reducing overall portfolio risk.

The potential benefits of this approach include:

- Enhanced returns: Carry strategies can provide an additional source of returns alongside equity exposure.

- Improved diversification: The low correlation between carry and equity returns may help reduce overall portfolio volatility.

- Downside protection: During equity market stress, carry strategies may provide partial offsetting returns.

However, investors should be aware of the increased leverage and potential for amplified losses during adverse market conditions.

Increasing Portfolio Diversification Using Carry

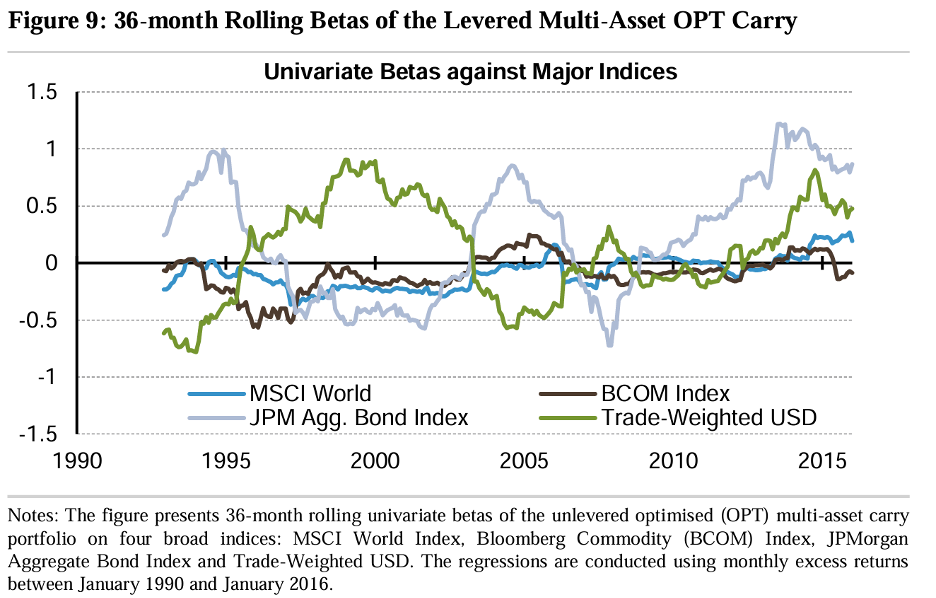

Carry strategies can be used to enhance diversification in traditional stock-bond portfolios. Due to the dynamic nature of the strategy, exposure to any asset class (equities, fixed income, commodities, and currencies) could be either long or short, depending on the carry profile of a given asset at the time.

Figure 11: Rolling Betas of Multi-Asset Carry Strategies

Source: Baltas (2017)

By return stacking a carry strategy on top of a conventional 60/40 portfolio, investors may improve risk-adjusted returns and reduce dependency on the performance of stocks and bonds alone.

The addition of a carry strategy to a traditional portfolio may:

- Improve risk-adjusted returns

- Reduce overall portfolio volatility

- Decrease correlation to both stocks and bonds

- Potentially lower maximum drawdown

Carry as an Inflation Hedge

In inflationary environments, traditional portfolios may struggle as both stocks and bonds can be negatively impacted. Carry strategies, particularly those focused on commodities, may offer some inflation protection.

Incorporating carry strategies through return stacking may help portfolios maintain purchasing power during inflationary periods without sacrificing exposure to traditional assets during non-inflationary times.