Return Stacking and Taxes

Overview

This article explores a hypothetical example of a return stacked strategy and how the composition of the strategy can impact the after-tax returns of the portfolio.

Key Topics

Return Stacking, Capital Efficiency, Tax Efficiency

Introduction

It has been said that “any investment strategy can be ruined with high enough fees.” The same can be said for taxes. It is no surprise, then, that tax efficiency is one of the most common questions we receive about return stacked® strategies, as well as a core consideration when we build portfolios.

In this brief article, we will walk through the tax efficiency of a hypothetical return stacked® strategy that provides 100% exposure to U.S. equities and 100% exposure to a managed futures trend following strategy.

In line with SEC guidance, we will assume the maximum marginal Federal tax rate but no State tax. At the time of writing, that implies an ordinary income tax rate of 37%, a short-term capital gains rate of 37%, a long-term capital gains rate of 20%, and a qualified dividend rate of 20%.

While taxes are based upon realized returns, we can use expected returns to create an estimate of long-term tax drag of holding such a strategy in a taxable account.

We will employ long-term capital market assumptions provided by JP Morgan, but the larger framework is not specific to these assumptions. The expected returns are:

- Large-Cap U.S. Equities: 8.2%

- Large-Cap Dividends: 1.6%

- Risk-Free Rate: 2.9%

- Managed Futures Trend Following (Excess): 3.1% (based upon the long-term excess returns of the managed futures trend industry)

Were we to simply stack the trend following strategy on top of U.S. equities, we would have a pre-tax expected return of 11.3% (8.2% + 3.1% = 11.3%). Unfortunately, achieving a return stacked® portfolio is not quite that simple.

In practice, we must employ leverage, which often requires using capital efficient derivatives like futures contracts to achieve our exposure and holding cash (or cash equivalents like U.S. Treasury Bills) as collateral. For our strategy, for every $100 invested, we will assume the following structure:

- $75 U.S. Equities

- $25 U.S. Treasury Bills

- $25 of notional exposure in S&P 500 E-Mini Futures

- $100 of exposure to the Managed Futures Trend Strategy

This has immediate ramifications for our pre-tax returns, as the cost of leverage embedded in S&P 500 E-Mini Futures has historically been about 0.4% higher than the rate of return in U.S. Treasury Bills. Therefore, we have a pre-tax expected return that looks more like:

75% x 8.2% + 25% x 2.9% + 25% x (8.2% – 2.9% – 0.4%) + 100% x 3.1% = 11.2%

Even before we consider taxes, we see a slight decrease in our expected return from the cost of leverage.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

Folding taxes into the expected returns is fairly simple, though it requires us to make a few more assumptions:

- First, in the managed futures trend strategy, we must estimate the proportion of the expected return that comes from trading commodity futures. This is important because most managed futures strategies use a Cayman “blocker” structure to trade their commodity exposure, which provides the benefit of not having to issue Form K-1s, but has the downside of transforming the profit and loss into ordinary income. The rest of the futures contracts receive Section 1256 treatment, which means 60% long-term and 40% short-term capital gains (for a blended rate of 26.8%). Using long-term contribution analysis, we estimate that approximately 25% of the long-term returns of a diversified multi-asset trend strategy comes from commodities.

- We will assume that the 75% of the portfolio held in U.S. equities is buy and hold and any rebalancing is managed tax efficiently; i.e. there are no realized gains or losses in the position outside of dividends.

- Finally, it is worth noting that many investors believe that if futures contracts are traded within an ETF, they are tax-managed in the same manner that individual stocks and bonds are. Unfortunately, this is not true and realized profit in futures contracts will be fully taxed.

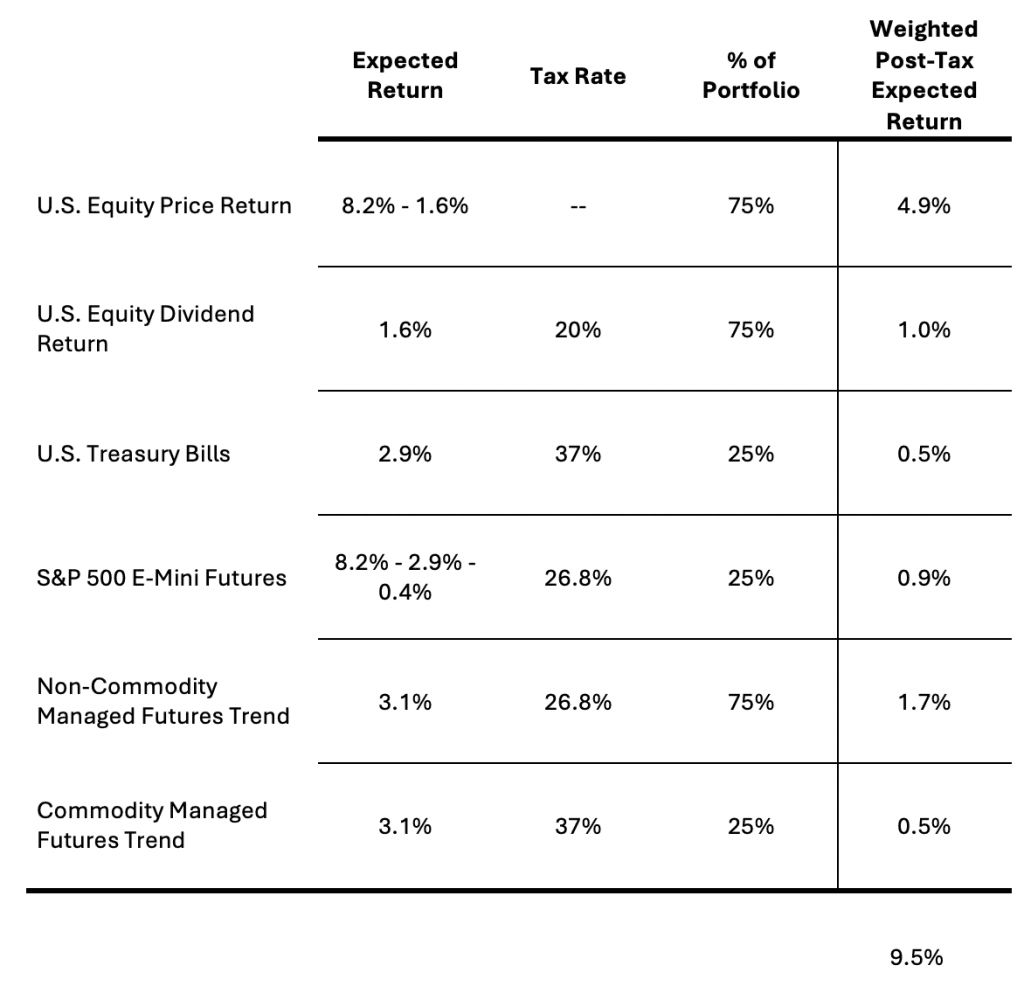

Putting this all together:

Source: JP Morgan and Newfound Research. Calculations by Newfound Research. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. Please consult a financial professional before making any investment decisions.

For comparison, consider a non-stacked managed futures trend fund. The pre-tax expected return would be 6.0% (2.9% from U.S. Treasury Bills + 3.1% from the strategy’s excess returns). Post-tax – using analysis mirror our approach above – the expected return drops to 4.0%. The tax drag ends up being larger than the stacked version because U.S. Treasury Bills are less tax efficient than buy-and-hold equities.

In conclusion, while a return stacked® managed futures strategy has the potential to be more tax efficient than its non-stacked peer, we would still expect a tax drag. While we believe that the post-tax expected return is still attractive relative to an unstacked alternative, investors should strive to maximize their post-tax returns through thoughtful asset location.