Return Stacked® Academic Review

Time Series Momentum

Authors

Tobias J. Moskowitz, Yao Hua Ooi, Lasse Heje Pedersen

Journal of Financial Economics

Time Series Momentum

URL

return stacking, portable alpha, diversification, managed futures, trend following

Exploring the Predictive Power of Past Returns

In their groundbreaking 2012 study, “Time Series Momentum,” Moskowitz, Ooi, and Pedersen challenge the efficient market hypothesis by revealing a persistent phenomenon in asset returns. The authors investigate time series momentum (TSMOM), showing that an asset’s own past performance is a strong predictor of its future returns. Specifically, they find that past 12-month returns can be used to forecast future performance across a diverse set of 58 liquid futures instruments, including equity indices, currencies, commodities, and bonds.

The study demonstrates that positive past returns often lead to positive future returns, while negative past returns tend to be followed by further declines. This pattern persists for about 12 months before partially reversing, suggesting a temporal momentum effect that is distinct from cross-sectional momentum, which compares relative performance across assets at a given time.

The authors construct TSMOM trading strategies and show that they deliver substantial abnormal returns that are uncorrelated with traditional risk factors, including market beta, size, value, and even cross-sectional momentum. This finding implies the existence of a common factor driving time series momentum across different asset classes, offering new insights into asset pricing and market behavior.

Visualizing the Momentum Phenomenon

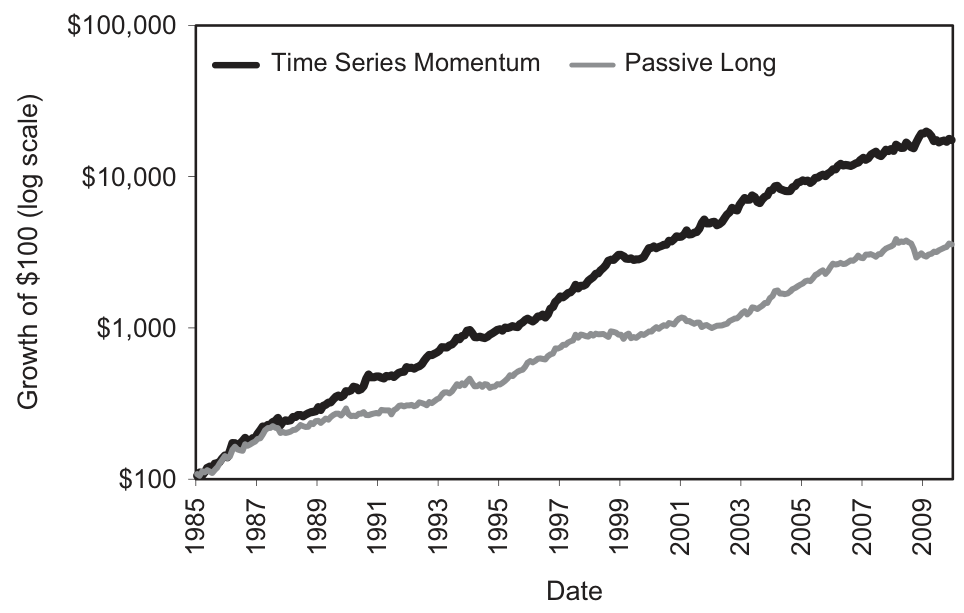

Figure 1: Cumulative Excess Return of Time Series Momentum Strategy vs. Passive Long Strategy (Original: Figure 3)

Plotted are the cumulative excess returns of the diversified TSMOM portfolio and a diversified portfolio of the possible long position in every futures contract we study. The TSMOM portfolio is defined in Eq. (5) and across all futures contracts summed. Sample period is January 1985 to December 2009.

Figure 1 compares the cumulative excess returns of the diversified time series momentum strategy to a passive long strategy with equivalent ex-ante volatility. Over the period from January 1985 to December 2009, the TSMOM strategy exhibits a consistent upward trajectory, significantly outperforming the passive approach. This visualization highlights the potential of time series momentum to generate superior risk-adjusted returns over the long term.

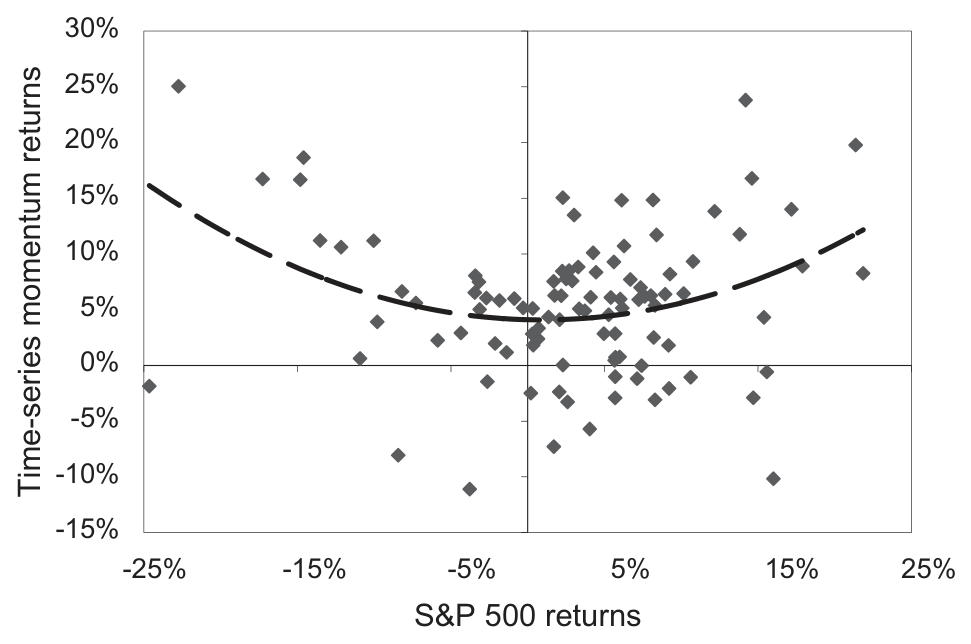

Figure 2: The Time Series Momentum Smile (Original: Figure 4)

The non-overlapping quarterly returns on the diversified (equally weighted across all contracts) 12-month time series momentum or trend strategy are plotted against the contemporaneous returns on the S&P 500.

Figure 2 illustrates the “momentum smile,” showing the TSMOM strategy’s performance during extreme market conditions. The strategy tends to perform exceptionally well during periods of significant market stress, generating high profits in both large up and down markets. This suggests that TSMOM acts as a natural hedge, benefiting from sharp market movements regardless of direction.

Integrating Time Series Momentum into Return Stacked Portfolios

The insights from this study have profound implications for return stacking strategies. Return stacking involves combining multiple uncorrelated or lowly correlated return streams into a single portfolio to enhance diversification and improve risk-adjusted returns. By incorporating time series momentum strategies, investors can add a return source that is relatively uncorrelated with traditional asset classes.

The positive cross-asset correlations observed in TSMOM suggest a common underlying factor driving momentum across markets. This factor is distinct from those influencing the underlying assets, offering additional diversification benefits beyond traditional asset allocation. Including TSMOM in a return stacked portfolio can reduce overall portfolio volatility and enhance performance, especially during periods of market turmoil.

Moreover, the success of TSMOM during extreme market movements aligns well with trend following strategies, which have historically provided positive returns in volatile environments. Integrating trend following and time series momentum into return stacked portfolios allows investors to potentially mitigate the impact of market downturns and capitalize on strong trends, enhancing the resilience of their portfolios.

For more on how trend following can be incorporated into return stacking, see Managed Futures & Trend Following. Additionally, the concept of portable alpha, where investors seek to add uncorrelated returns on top of their existing portfolio, aligns with the integration of TSMOM strategies. To explore this further, refer to Portable Alpha.

Implications for Investors and Portfolio Construction

The discovery of time series momentum by Moskowitz, Ooi, and Pedersen offers valuable insights for investors seeking to enhance their portfolio strategies. The ability of TSMOM strategies to deliver significant abnormal returns uncorrelated with traditional risk factors challenges conventional approaches to asset allocation and risk management.

By incorporating time series momentum into portfolio construction, investors can achieve greater diversification, improve risk-adjusted returns, and potentially protect against downside risks during market stress. The study underscores the importance of exploring alternative return streams and integrating them into a cohesive investment strategy, such as return stacking.

As the financial landscape evolves, continuous research and innovation remain crucial. Time series momentum exemplifies how empirical findings can reshape our understanding of market behavior and inform more robust investment approaches.