Return Stacked® Academic Review

Momentum Strategies in Futures Markets and Trend-following Funds

Authors

Akindynos-Nikolaos Baltas and Robert Kosowski

Working Paper

Exploring Time-Series Momentum and Trend-Following in Futures Markets

In the ever-evolving landscape of financial markets, investors continuously seek strategies that offer robust returns while mitigating risk. Trend-following, particularly time-series momentum strategies, has garnered significant attention for its ability to capitalize on persistent price movements across various asset classes. In their working paper, “Momentum Strategies in Futures Markets and Trend-following Funds,” Akindynos-Nikolaos Baltas and Robert Kosowski delve into the intricacies of time-series momentum in futures markets and its relationship with Commodity Trading Advisors (CTAs).

The authors aim to dissect the performance drivers of CTAs by examining time-series momentum strategies implemented across a diverse set of futures contracts. Their motivation stems from the need to understand whether the strong historical performance of trend-following strategies is sustainable and scalable, given concerns about potential capacity constraints as assets under management grow.

To achieve this, Baltas and Kosowski analyze 71 futures contracts over a 35-year period from 1978 to 2012. The dataset includes commodities, equity indices, currencies, and bonds, providing a comprehensive view of global markets. They construct momentum portfolios rebalanced at daily, weekly, and monthly frequencies, employing various lookback periods to capture trends of different durations. By utilizing the Yang and Zhang (2000) volatility estimator, which accounts for overnight price movements and drift, they accurately measure volatility and adjust positions accordingly.

Empirical Findings and Performance Analysis

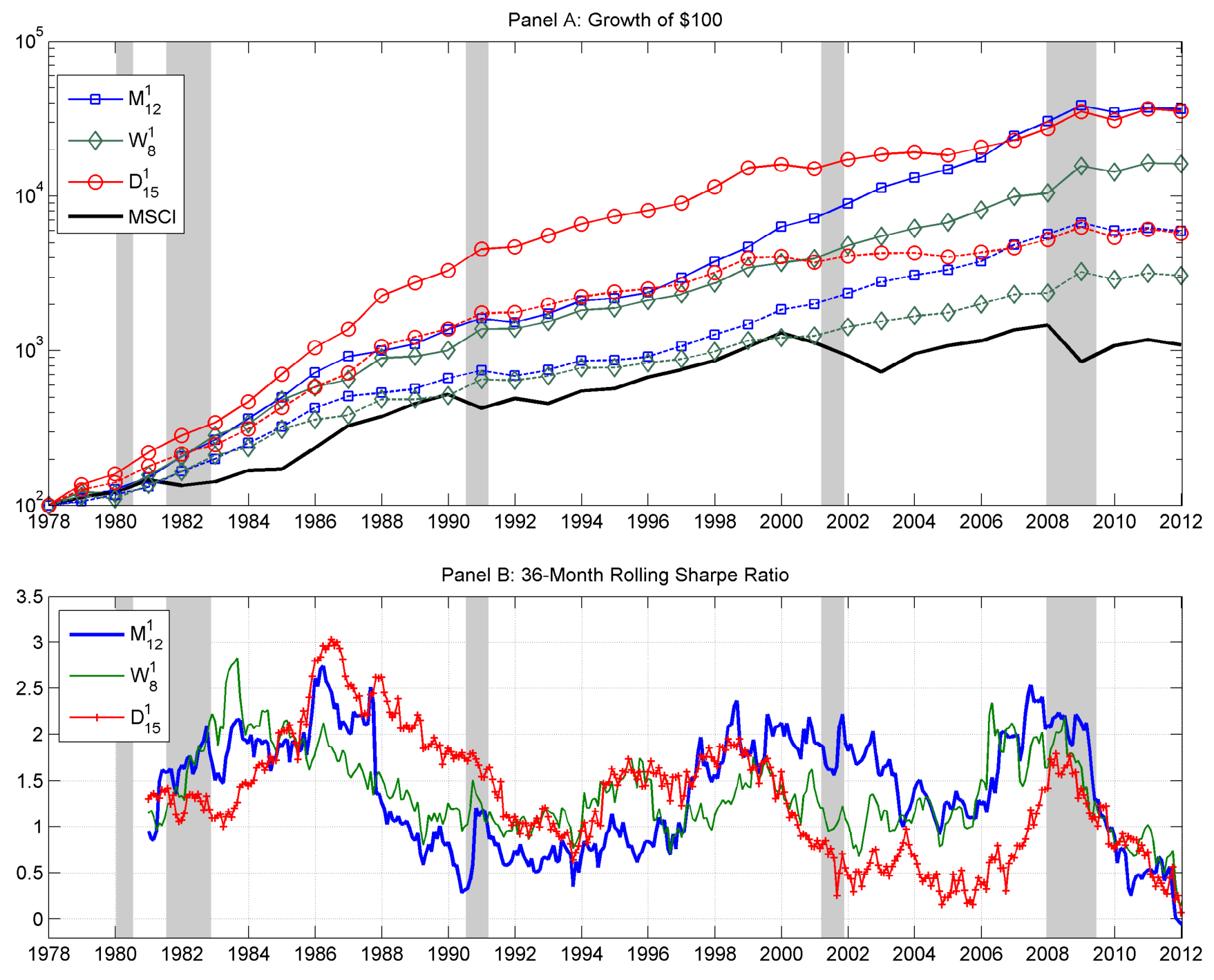

The study’s findings underscore the efficacy of time-series momentum strategies and their significant correlation with CTA performance. The authors present compelling visual evidence to support their conclusions.

Figure 1: Historical Performance of Time-Series Momentum Strategies (Original: Figure 2)

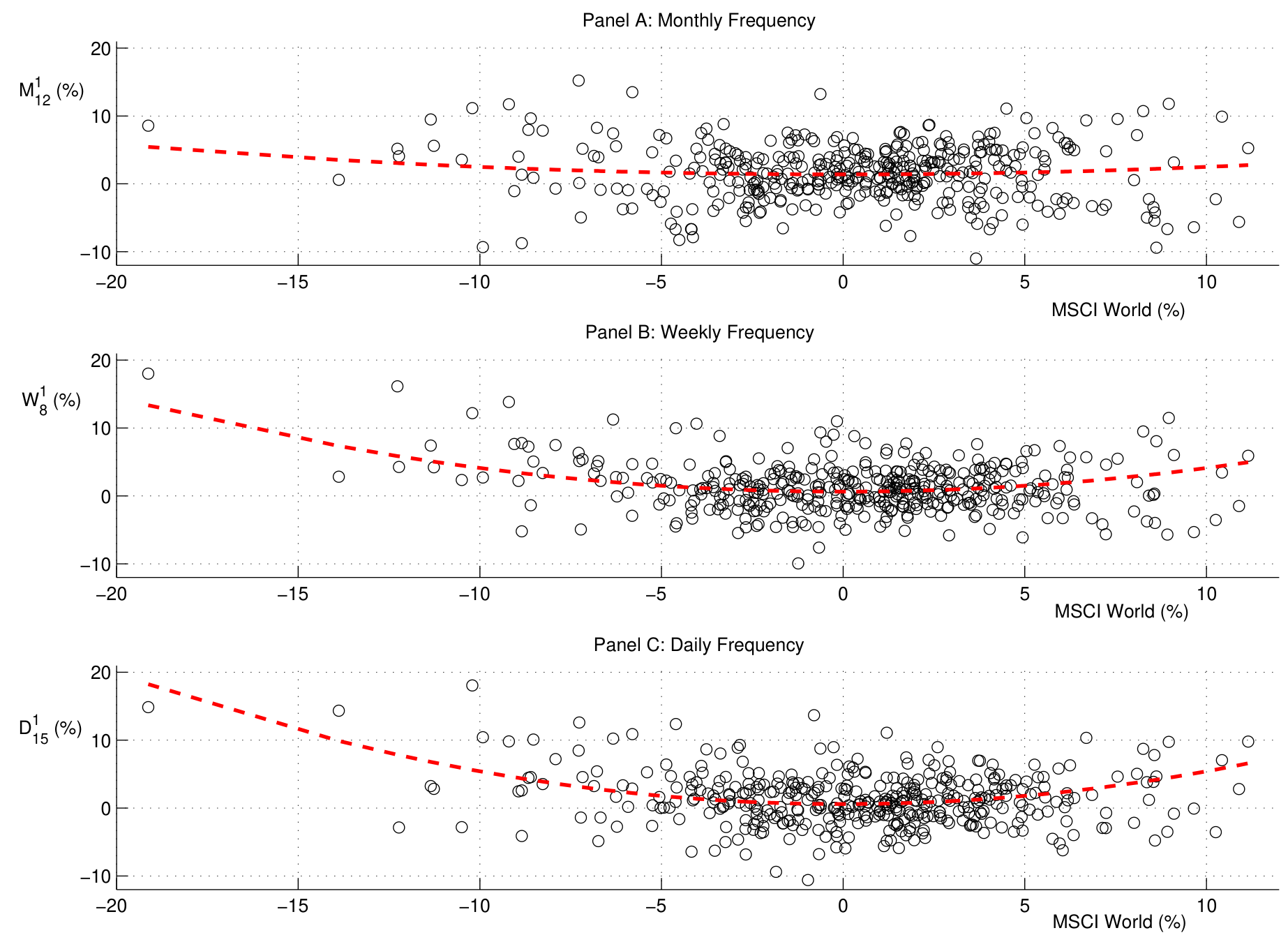

Figure 2: Time-Series Momentum Smiles (Original: Figure 3)

Figure 2 demonstrates the “momentum smile,” revealing that time-series momentum strategies tend to perform well during both strong bull and bear markets but may underperform during flat or choppy periods. This characteristic signifies that these strategies are adept at capturing significant market trends, regardless of direction, making them valuable for diversification purposes.

Importantly, the authors address concerns about capacity constraints. By analyzing fund flows and strategy performance, they find no statistically significant evidence that increasing assets under management adversely affects the effectiveness of trend-following strategies. This suggests that such strategies are scalable and can accommodate substantial investment without deteriorating returns.

Implications for Return Stacked Portfolio Construction

Time-series momentum strategies, with their demonstrated ability to perform across various market conditions and low correlation with traditional assets, are prime candidates for inclusion in return stacked portfolios. Their crisis alpha properties align well with the goals of diversification and risk mitigation.

For instance, incorporating trend-following strategies into a portfolio can provide exposure to alternative return streams that are not dependent on the performance of equities or bonds. This aligns with the concept of portable alpha, where investors seek to add alpha-generating strategies to a core portfolio without significantly altering its risk profile. By using futures contracts, investors can gain exposure to these alternative strategies efficiently. To delve deeper into how trend-following and managed futures can be integrated into portfolios, readers may refer to our article on managed futures and trend following.

Moreover, the scalability of time-series momentum strategies enhances their suitability for return stacking. Since these strategies do not exhibit significant capacity constraints, they can accommodate the asset sizes required for meaningful portfolio allocations. This scalability ensures that investors can implement return stacking techniques without concern for strategy saturation or diminished returns.

Return stacking is an evolution in portfolio construction that emphasizes capital efficiency and diversification beyond traditional asset classes. For a comprehensive understanding of how return stacking can enhance portfolio outcomes, consider exploring our piece on diversification 2.0 and the evolution of portfolio construction.

Conclusion

The study’s insights are particularly relevant for those interested in return stacking strategies. Incorporating time-series momentum into a return stacked portfolio can offer valuable diversification benefits, crisis alpha, and capital efficiency. As the financial landscape continues to evolve, strategies that leverage alternative sources of return, like trend-following, will play a crucial role in sophisticated portfolio construction.