Return Stacked® Academic Review

Using Trend-Following Managed Futures to Increase Expected Withdrawal Rates

Authors

Andrew K. Miller, CFA, CFP

SSRN Electronic Journal

Key Topics

return stacking, portable alpha, diversification, managed futures, trend following, carry, bonds, equities, yield, risk management, portfolio construction, capital efficiency

Enhancing Retirement Portfolios with Trend-Following Strategies

Determining a sustainable withdrawal rate is a critical aspect of retirement planning. The conventional “4% rule” has long served as a guideline, suggesting that withdrawing 4% of an initial portfolio, adjusted for inflation annually, could sustain a retiree for 30 years. However, in today’s environment of low yields and increased market volatility, this rule is under scrutiny.

Andrew K. Miller’s study investigates how incorporating trend-following managed futures into retirement portfolios can enhance resilience and potentially increase safe withdrawal rates. By utilizing historical simulations that capture the autocorrelation inherent in trend-following strategies, Miller examines portfolio performance across various market conditions. The research compares a traditional portfolio of 50% stocks and 50% bonds (the 50/50 portfolio) with a modified portfolio allocating 50% to stocks, 40% to bonds, and 10% to trend-following managed futures (the 50/40/10 portfolio).

Analyzing the Impact on Safe Withdrawal Rates

Miller’s study provides insightful analysis on how diversification with trend-following managed futures affects safe withdrawal rates, defined as the maximum sustainable withdrawal rate over a 30-year period (SAFEMAX).

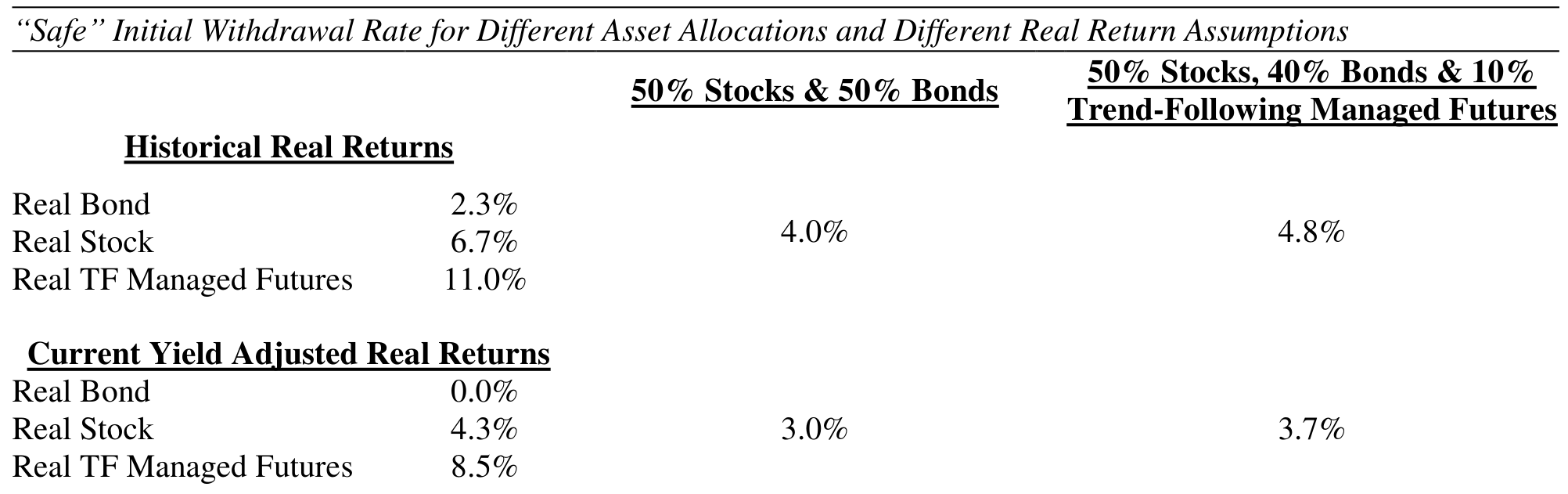

Figure 1: Safe Initial Withdrawal Rates for Different Portfolios and Real Return Assumptions (Original: Exhibit 5)

This table reports the SAFEMAX using two different asset allocations: 1) 50% market cap-weighted stocks and 50% intermediate-term bonds, and 2) 50% market cap-weighted stocks, 40% intermediate-term bonds, and 10% Trend-Following Managed Futures. It also uses two sets of return assumptions for each allocation: 1) real return statistics from historical data (Exhibit 1), and 2) real return statistics adjusted for current bond yields (Exhibit 2).

The table demonstrates that under historical real returns, the 50/40/10 portfolio supports a SAFEMAX of 4.8%, outperforming the traditional 50/50 portfolio’s 4.0%. Even when adjusting for a low-yield environment, the 50/40/10 portfolio sustains a higher SAFEMAX of 3.7% compared to 3.0%. This indicates that even a modest allocation to trend-following managed futures can enhance portfolio resilience and allow for higher withdrawal rates.

To test the robustness of these findings, Miller also analyzes a scenario where the trend-following managed futures strategy has a reduced Sharpe ratio of 0.50, significantly lower than historical levels.

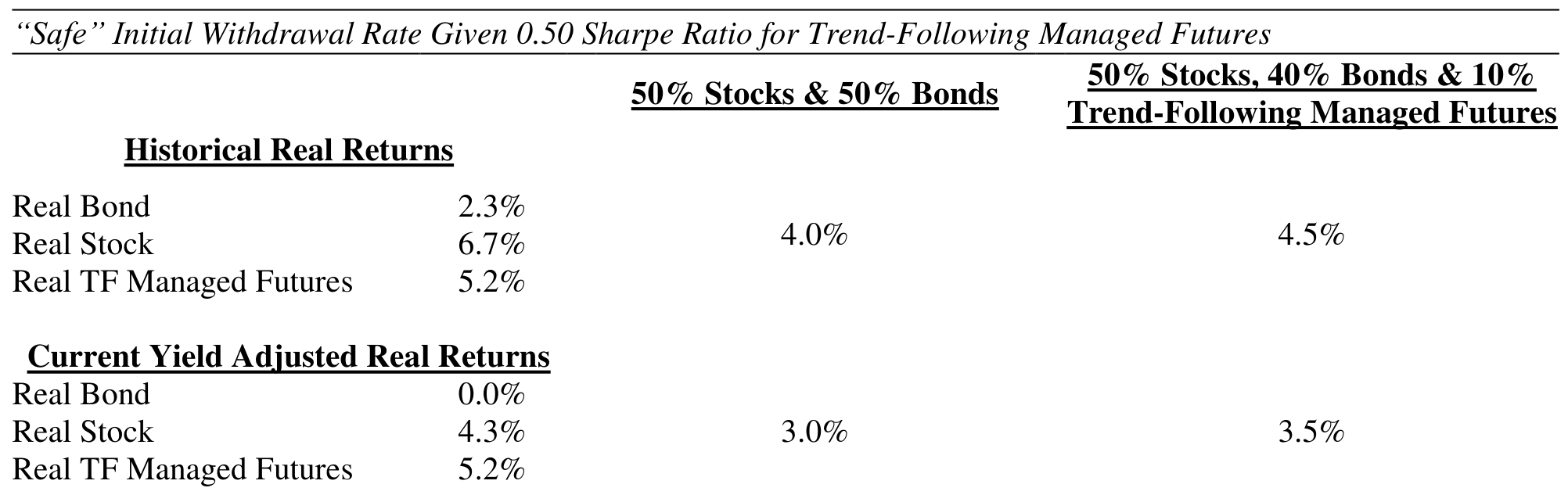

Figure 2: Safe Initial Withdrawal Rates Assuming 0.50 Sharpe Ratio for Trend-Following Managed Futures (Original: Exhibit 6)

This table reports the SAFEMAX using two different asset allocations: 1) 50% market cap-weighted stocks and 50% intermediate-term bonds, and 2) 50% market cap-weighted stocks, 40% intermediate-term bonds, and 10% Trend-Following Managed Futures. Trend-Following Managed Futures real return statistics from Exhibit 3 are used in both scenarios, along with stock and bond returns from: 1) real return statistics from historical data (Exhibit 1), and 2) real return statistics adjusted for current bond yields (Exhibit 2).

Even with the conservative Sharpe ratio, the 50/40/10 portfolio maintains a SAFEMAX advantage, supporting a 4.5% withdrawal rate under historical returns and 3.5% when adjusted for lower yields, compared to 4.0% and 3.0% respectively for the 50/50 portfolio. This underscores the diversification benefits of including trend-following managed futures, even if their future performance lags historical averages. Miller further notes that even without a risk premium over bonds, the diversification alone improves safe initial withdrawal rates by 0.18%.

Implications for Return Stacked Portfolios

The findings of Miller’s research resonate with the principles of return stacking, where additional uncorrelated return streams are layered onto a core portfolio to enhance performance without proportionally increasing risk. By integrating trend-following managed futures—an asset class with low correlation to both stocks and bonds—investors can achieve greater capital efficiency and improve portfolio outcomes.

Trend-following strategies can act as a form of portable alpha, delivering returns independent of traditional markets. This concept aligns with return stacking, as discussed in Portable Alpha: Enhancing Portfolio Efficiency. By adding such strategies, investors effectively “stack” returns from alternative sources onto their existing portfolios.

Moreover, trend-following managed futures can contribute to a portfolio’s ability to generate carry—the return received from holding an asset. Integrating these strategies allows for more consistent return streams regardless of market direction, an aspect further explored in Trend Following in Managed Futures.

The study illustrates that the addition of trend-following managed futures does not significantly alter the risk profile of a traditional portfolio but enhances its robustness. This approach is at the heart of return stacking strategies, where diversification across uncorrelated assets leads to improved risk-adjusted returns.

Conclusion

Andrew K. Miller’s paper provides compelling evidence that incorporating trend-following managed futures into retirement portfolios can improve safe withdrawal rates and enhance overall portfolio resilience. Even with conservative return assumptions, the diversification benefits contribute to better outcomes for retirees.

The research highlights the importance of strategic asset allocation and diversification in today’s challenging investment landscape. By embracing principles of return stacking and integrating uncorrelated return streams, investors can construct more efficient and robust portfolios.

For those interested in exploring these concepts further, the article on Return Stacking and Portfolio Construction offers a comprehensive overview of building diversified portfolios using innovative strategies.