Portable Alpha: Enhancing Portfolio Returns Through Strategy Separation

Overview

Key Topics

Portable Alpha, Return Stacking, Capital Efficiency, Portfolio Construction

Table of Contents

Introduction to Portable Alpha

In an investing environment dominated by discussions of increased private market allocations and the potential demise of the 60/40 portfolio, portable alpha strategies offer a compelling alternative. The core concept involves separating beta (passive market returns) from alpha (performance derived from active management) to build more efficient portfolios. Investors often achieve beta exposure through derivatives, leveraging capital-efficient instruments to mimic market returns. This frees up capital to pursue other return sources, including active strategies.

Portable alpha rests on the principle that asset allocation and alpha generation are distinct pursuits. This separation allows investors to manage risk and potentially enhance returns without drastically altering their asset allocation. Fundamentally, it’s an investment application adaptable to various scenarios and facilitating several possible goals.

Portable alpha’s history stretches back to the 1980s, with PIMCO’s StocksPLUS strategy among the earliest examples. This strategy collateralizes equity index derivatives with an actively managed short-term bond portfolio, aiming to provide alpha from credit selection in addition to stock market returns.2 Although the term itself is relatively recent in the investment lexicon, the concept (sometimes referred to as “Transportable Alpha” or “Return Stacking”), has existed since at least the early 1990s.3 Peter Bernstein, in his 2007 book Capital Ideas Evolving, highlighted StocksPLUS as potentially the first product to seek alpha outside the primary asset holding.4

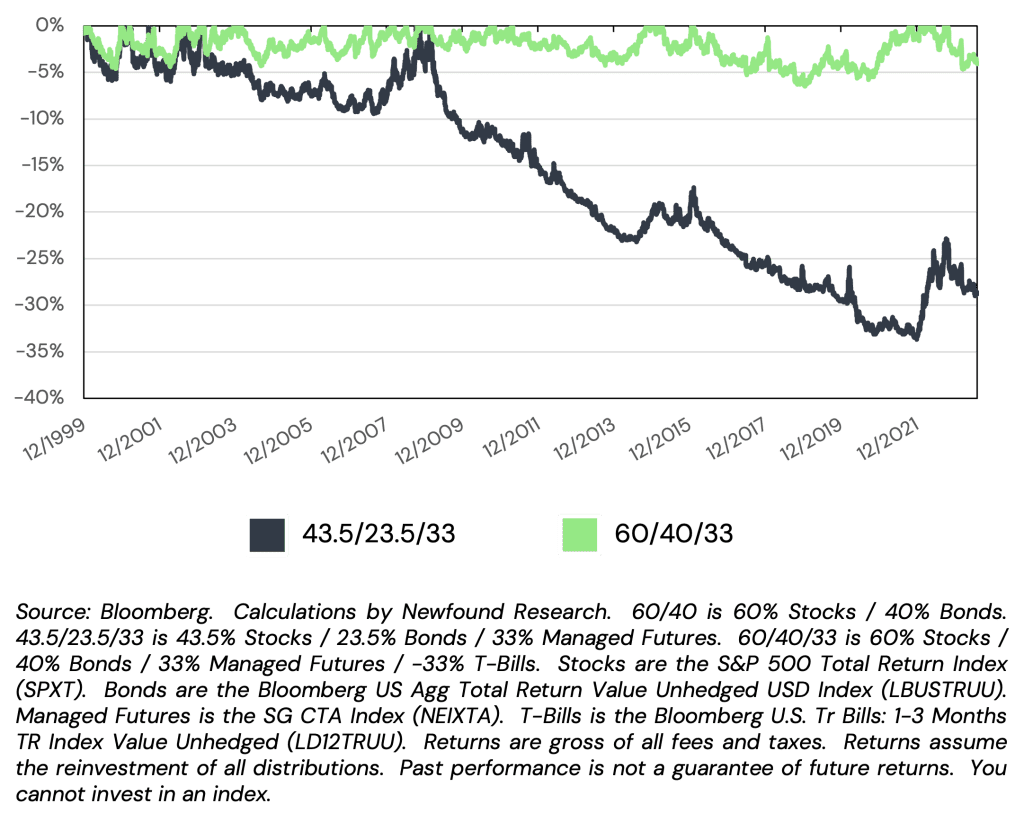

The strategy gained significant traction in the early 2000s, with 25% of CIOs at the top 50 public pension funds adopting some form by 2008. However, the Great Financial Crisis damaged its reputation, leading many to believe it too risky due to mismatched liquidity and heightened correlations during the crisis. Despite this setback, portable alpha has resurged in recent years, driven by the need for enhanced returns in a low-yield environment, improved portfolio efficiency, and the increasing acceptance of alternative investments. As AQR’s Jeremy Getson noted, “It’s hard to recall after the Great Financial Crisis, back in 2010 or 2012, how toxic some of those terms were. Portable alpha was not a cool thing.”1 Recent renewed interest underscores investors’ ongoing search for optimized portfolios and alpha generation, and a deeper awareness of the opportunities and risks.

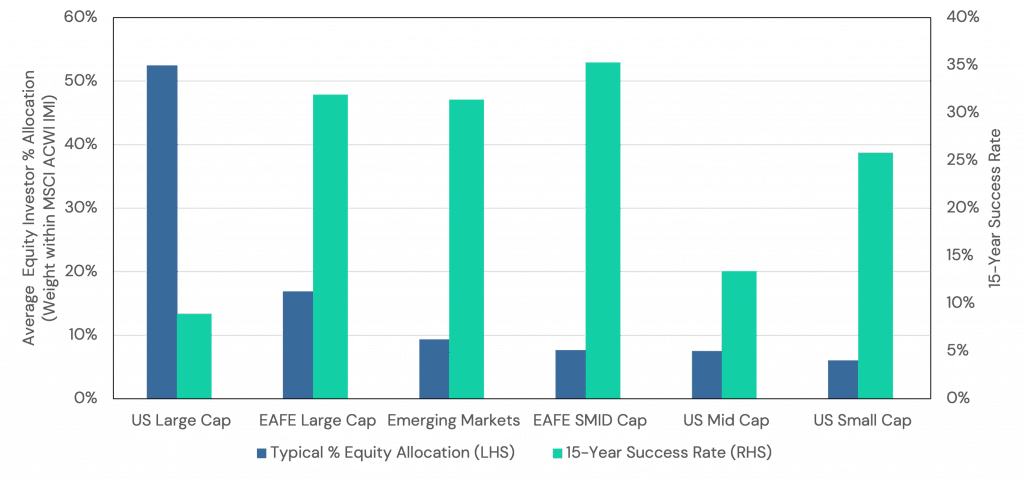

Figure 1. Alpha has been hardest to find where investors have the largest allocations

The Mechanics of Portable Alpha

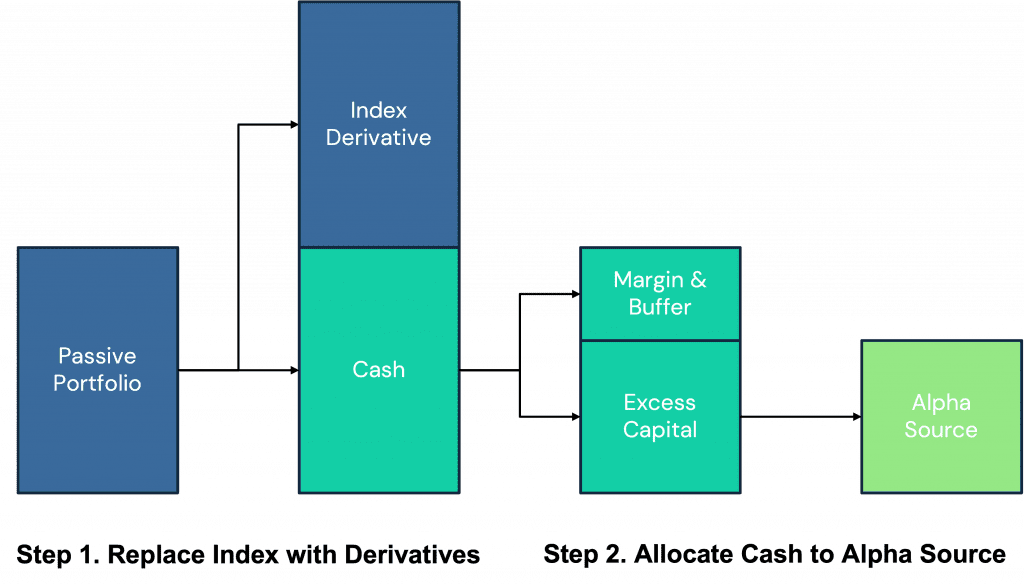

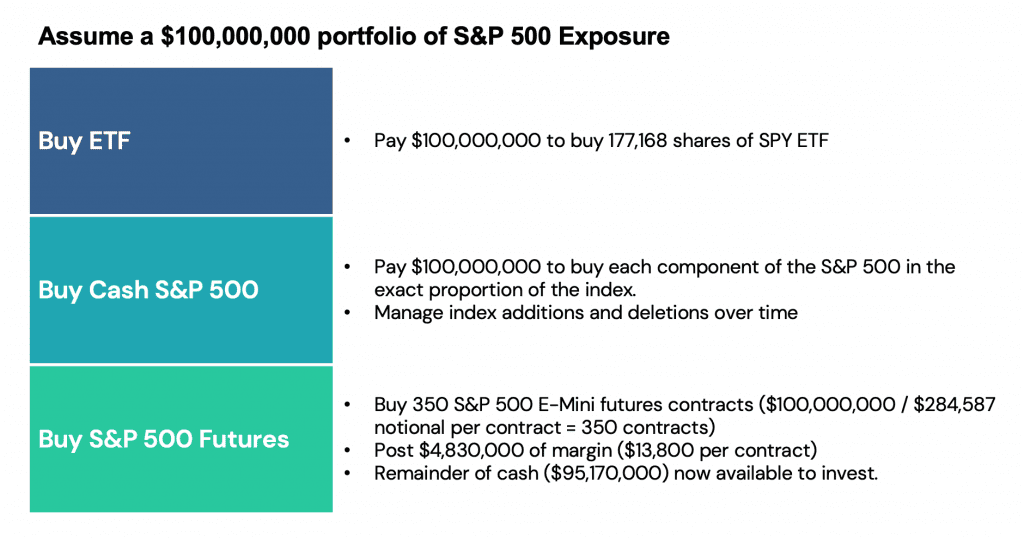

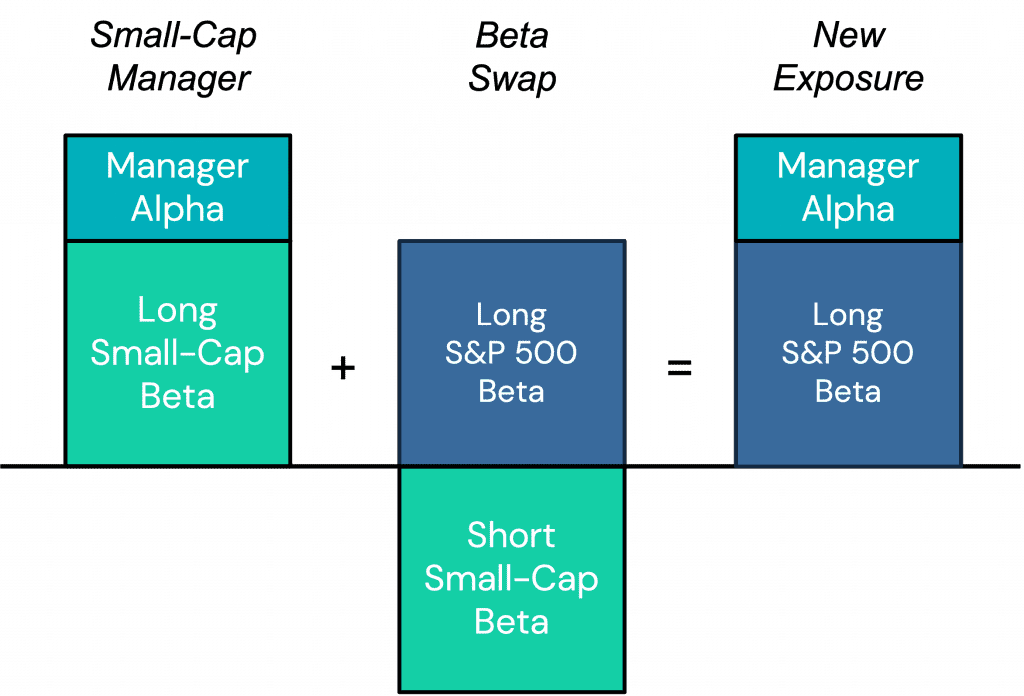

Portable alpha strategies comprise two main components: beta replication and alpha sources. Beta replication often uses capital-efficient instruments (like derivatives) for broad market exposure, while alpha sources are the strategies or investments targeting excess returns above the market. The mechanics typically involve replicating beta through futures or swaps, providing leverage and freeing up cash for alpha-generating allocations.

Figure 3. Replicating beta with capital efficient instruments to free up room for alpha

Beta can be replicated using:

1. Futures contracts: Futures contracts on market indices or asset classes can provide beta exposure with minimal capital requirements.

2. Total Return Swaps: Total return swaps can be used to exchange the returns of a reference asset or index for a fixed or floating rate, providing beta exposure without direct ownership of the underlying assets.

By using these instruments to replicate beta, investors can allocate the majority of their capital to alpha-generating strategies, such as active management, alternative investments, or hedge fund strategies. This approach allows for greater flexibility in the pursuit of alpha, as investors are not constrained by the need to maintain a specific asset allocation to obtain beta exposure.

Alpha sources can include:

1. Active management: Skilled managers consistently focused on outperforming benchmarks.

2. Alternative investments: Non-traditional assets like real estate, private equity, and hedge funds, offering uncorrelated returns and diversification.

3. Hedge fund strategies: Strategies like long/short equity, global macro, and event-driven investing, potentially generating uncorrelated market returns.

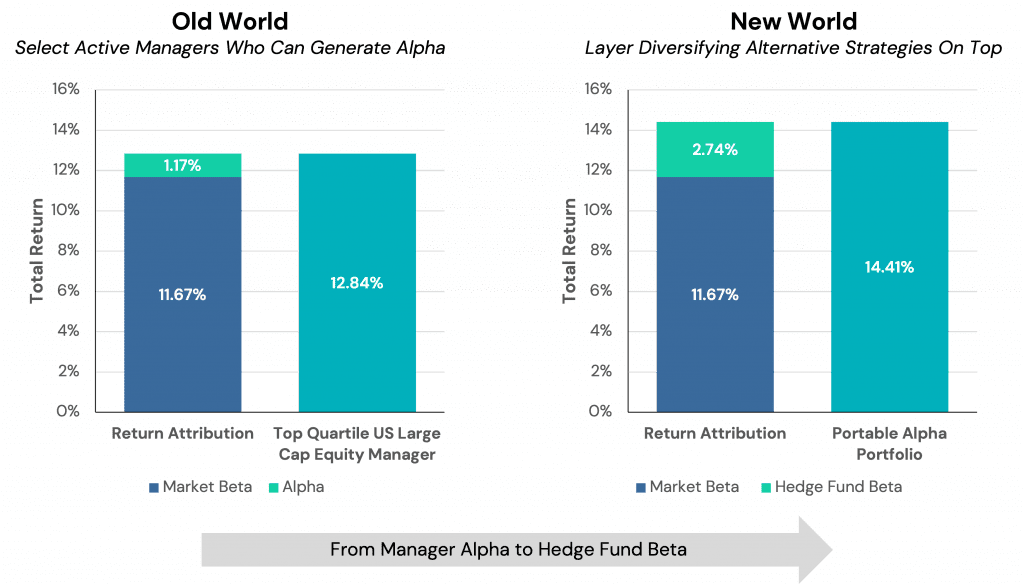

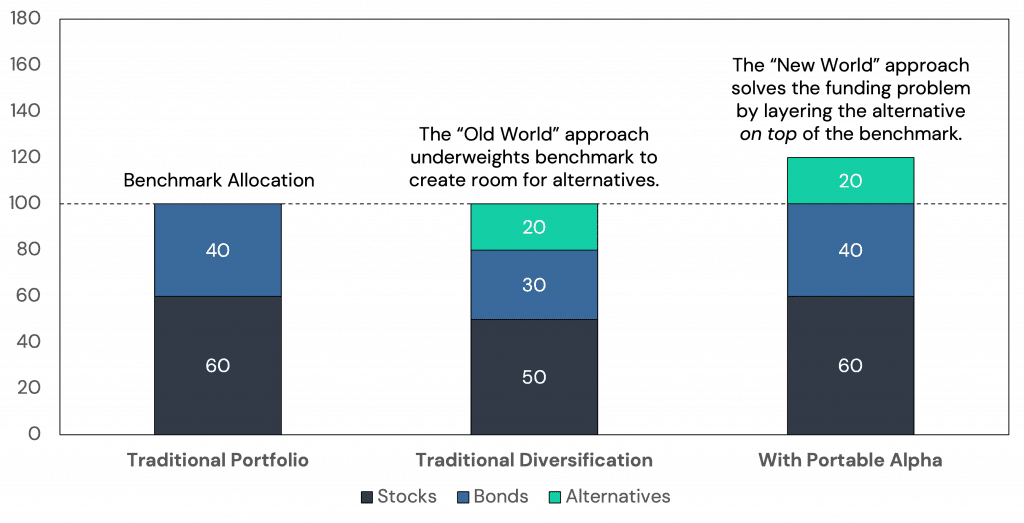

Figure 4. The old world approach is to find active managers who can beat their benchmarks while the new world approach is to buy the benchmark and overlay it with high-conviction sources of alpha (or uncorrelated beta)

Implementation, Risks, and Challenges

Implementing portable alpha requires careful planning, manager and/or strategy selection, and ongoing risk management. Key considerations include:

1. Beta exposure: Aligning beta choice with overall asset allocation and risk profile, considering the asset class, market coverage, and liquidity of the chosen instruments (e.g., S&P 500 futures, MSCI ACWI swaps, or ETFs).

2. Alpha sources: Identifying managers or strategies with proven track records of consistent, risk-adjusted returns, minimally correlated with the chosen beta.

3. Risk management: Implementing robust risk guidelines, including leverage limits, diversification requirements, and drawdown expectations. Regular monitoring and portfolio rebalancing are essential to manage leverage risks, complexity, potential volatility, and the criticality of thorough manager due diligence. Investors must understand the strategies and underlying exposures, have realistic return expectations, and ensure alignment with overall investment objectives and risk tolerance. Additional risks include counterparty risk from derivatives, liquidity risk in alternatives, and potentially higher fees compared to traditional investments.

4. Portfolio construction: Optimizing beta and alpha allocations and managing overall risk exposure using techniques like risk budgeting, scenario analysis, and stress testing to build resilient portfolios. Operational and legal requirements, including trading and custody arrangements, and regulatory compliance, are also crucial. Partnering with specialized consultants or investment managers can assist in navigating implementation complexities.

Case Studies and Real-World Applications

Real world examples help illustrate the potential benefits and challenges. The Missouri State Employees’ Retirement System (MOSERS) has successfully implemented portable alpha for over 15 years, influencing other pension plans in the state.5 Delta Airlines’ pension fund, under CIO Jon Glidden, utilized a hybrid portable alpha approach post-bankruptcy, partnering with consultants like UBS and Goldman Sachs for manager selection and advice. This strategy contributed significantly to restoring the fund’s health.1 A 2015 Cambridge Associates survey revealed that nine out of eleven large U.S. institutions utilized portable alpha, some since the 1990s. However, some abandoned the strategy after the financial crisis due to poor results, highlighting the risks of over-allocation at the wrong time.6 These cases emphasize the importance of robust risk management, manager selection, and understanding downside risks.

The Impact of Interest Rates on Portable Alpha

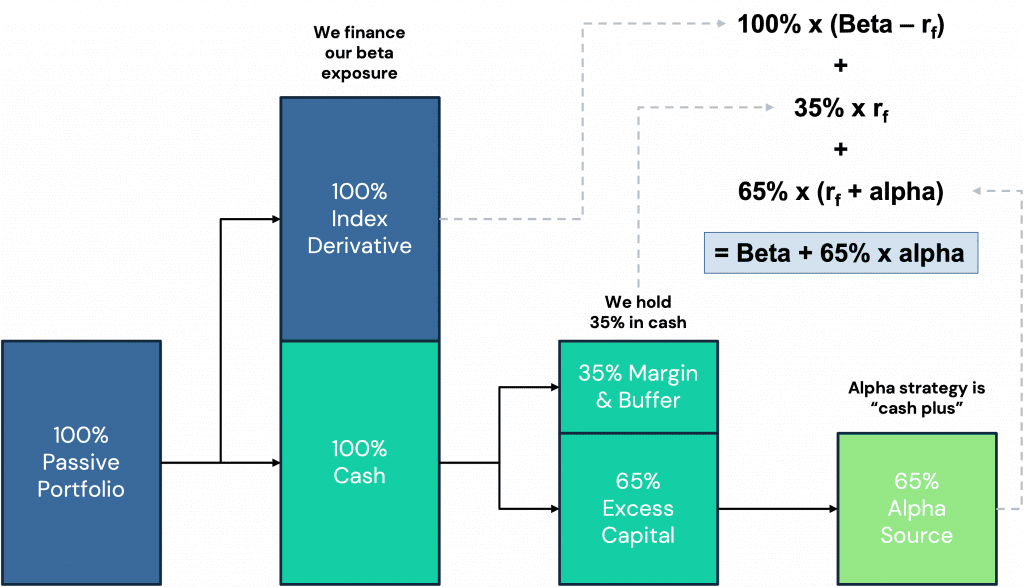

Interest rates influence portable alpha implementation and performance. As the strategy often involves derivatives and leverage, rate changes impact financing costs and return potential. Low rates can make portable alpha attractive, potentially allowing for greater alpha allocation. However, the relationship is complex, as rates also affect market returns from beta and alpha sources. From a financing perspective, if derivative financing rates approximate the risk-free rate, the overlay becomes largely rate-agnostic. In a “cash plus” alpha strategy, efficient derivative financing costs are offset by cash interest, leaving the portfolio with beta and alpha exposure.

Figure 7. Do interest rates impact the efficacy of portable alpha?

The overall impact depends on factors like specific exposures, leverage, and the market environment. Diversifying alpha sources across asset classes with varying interest rate sensitivities is one mitigation approach. Investors must remain adaptable, reassessing and adjusting strategies in changing market conditions.

Portable Alpha in Modern Portfolio Management

Portable alpha is increasingly integrated into modern portfolio management, particularly by institutional investors leveraging risk-based allocation frameworks. These frameworks allocate capital based on risk contributions, potentially improving risk-adjusted returns. Strategy innovation, the availability of quantitative index solutions from banks, and democratization of previously niche strategies are also contributing to wider adoption. Aaccessibility is also growing among individual investors and advisors, facilitated by low-cost beta instruments like ETFs and index futures. However, the complexity and risks necessitate expertise and robust risk management.

The future of portable alpha seems promising, driven by new alpha sources and strategies, evolving regulations, and broader industry shifts. The rise of liquid alternatives and related investment avenues has simplified operations and reduced liquidity mismatches. Regulations, such as the SEC 18f-4 rule, impact strategy feasibility and necessitate adaptation. Portable alpha’s potential for customized solutions aligns with growing investor demand, while its role in active management may increase alongside the rise of passive investing.

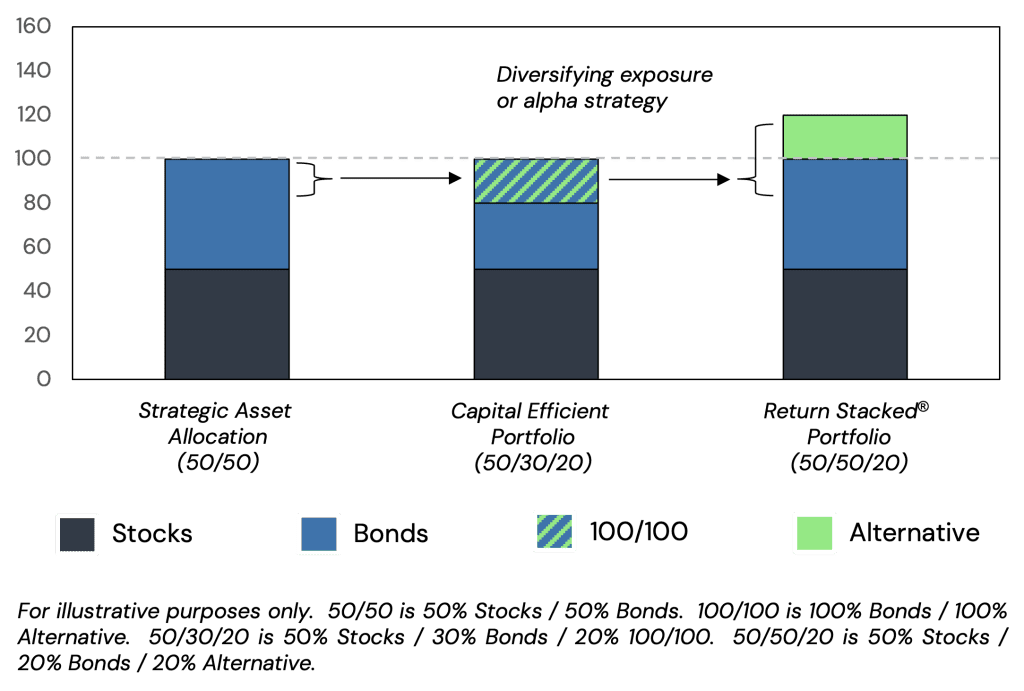

Portable Alpha and the Emergence of Return Stacking

Figure 8. An animated demonstration of how return stacking can layer new exposures on top of an existing portfolio

Conclusion

Portable alpha empowers investors to enhance returns, diversify, and achieve long-term objectives. By separating beta and alpha, it offers flexibility, efficiency, and potential for enhanced risk-adjusted performance. Return stacking represents a significant advancement in democratizing diversification, making portable alpha more accessible and sustainable. With ongoing innovation and evolving regulations, portable alpha is poised to remain a valuable investment tool, contributing to greater certainty and confidence in achieving financial goals.