Return Stacked® Academic Review

The Fundamentals of Commodity Futures Returns

Authors

Gary B. Gorton, Fumio Hayashi, and K. Geert Rouwenhorst

NBER Working Paper No. 13249, July 2007

Key Topics

return stacking, portable alpha, diversification, carry, bonds, equities, yield, risk management, portfolio construction, capital efficiency, managed futures, trend following

Exploring the Drivers of Commodity Futures Returns

In the financial markets, commodities represent a unique asset class with returns driven by factors distinct from traditional equities and bonds. In their seminal paper, “The Fundamentals of Commodity Futures Returns,” authors Gary B. Gorton, Fumio Hayashi, and K. Geert Rouwenhorst investigate the fundamental determinants of commodity futures returns. Their research aims to provide a deeper understanding of how physical market conditions, particularly inventory levels, influence futures prices and risk premiums.

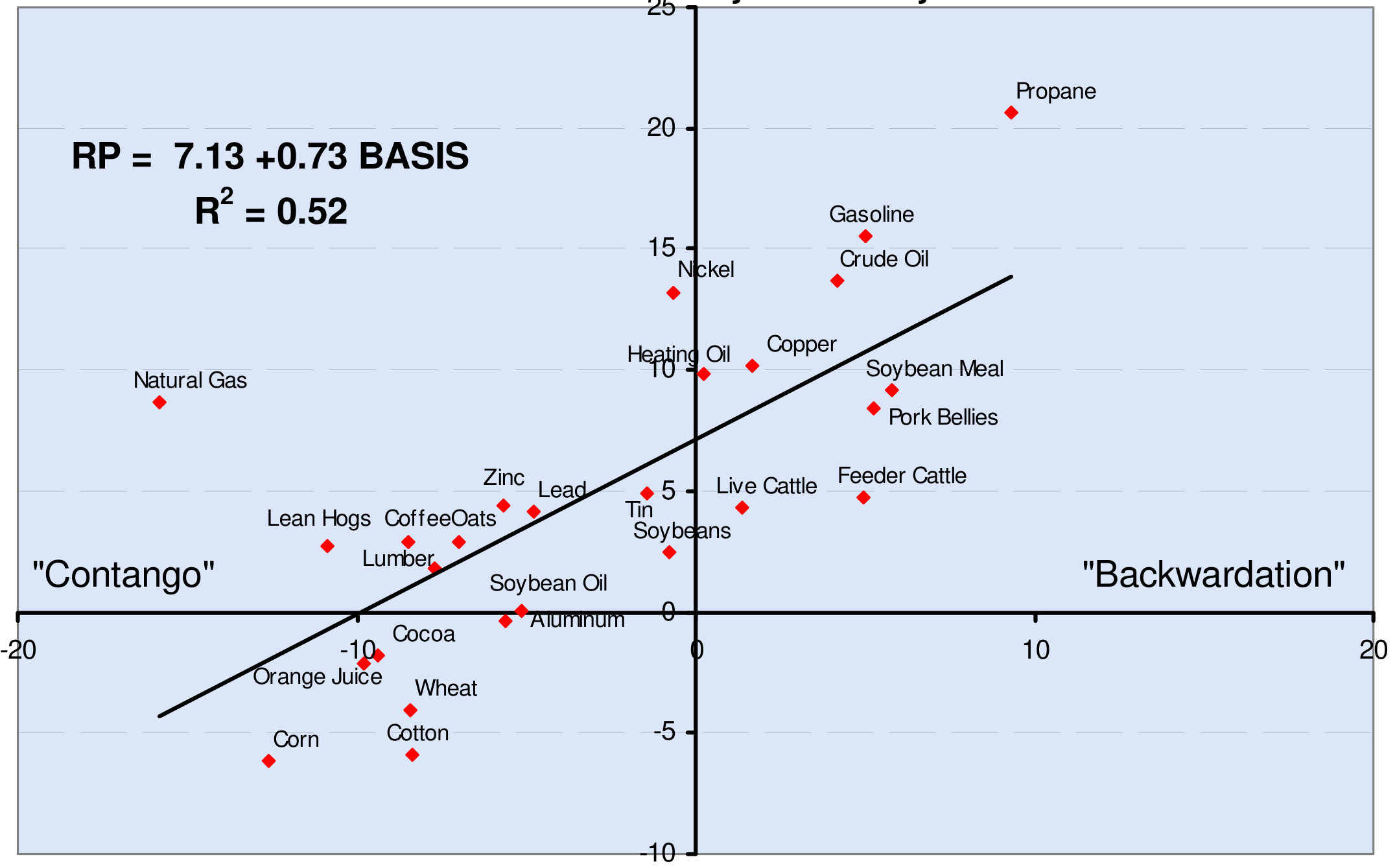

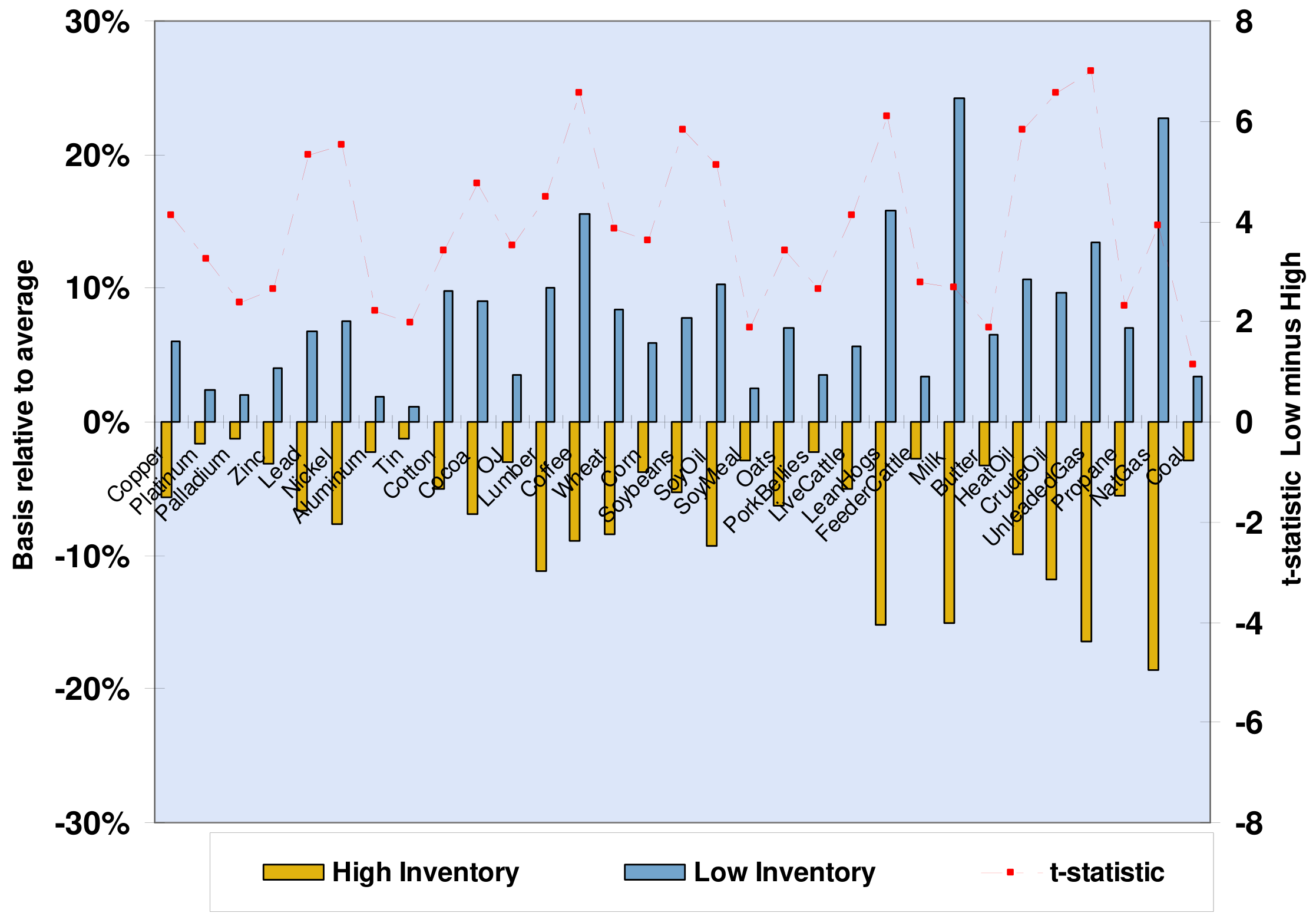

Grounded in the Theory of Storage, the authors hypothesize a direct relationship between commodity inventories and the shape of the futures curve, or basis—the difference between futures prices and spot prices. According to the theory, low inventory levels should lead to backwardation (a positive basis where futures prices are below spot prices), indicating higher expected returns for holding futures contracts. Conversely, high inventory levels should result in contango (a negative basis where futures prices are above spot prices), suggesting lower expected returns.

To empirically test this relationship, Gorton, Hayashi, and Rouwenhorst assemble a comprehensive dataset spanning 31 commodity futures and their corresponding physical inventories over a 37-year period from 1969 to 2006. This extensive dataset allows for a robust examination of the Theory of Storage across a diverse range of commodities and market conditions.

Empirical Evidence Supporting the Theory of Storage

Figure 1: Excess Returns and Basis (Original: Figure 1)

Figure 2: Normalized Inventories and Characteristics (Original: Figure 3)

Implications for Return Stacking Strategies

During periods of low inventories, when commodities exhibit backwardation and higher expected returns, investors might consider increasing exposure to commodity futures to capture the positive carry or futures yield. This approach aligns with the principles of portable alpha, where investors seek to add uncorrelated sources of alpha to their portfolios without significantly altering their risk profiles.

Conversely, in high inventory environments characterized by contango and lower expected returns, return stacking strategies might reduce commodity exposure or focus on commodities less affected by storage dynamics. Additionally, incorporating trend following strategies can be beneficial, as they adapt to changing market conditions and can exploit momentum across various asset classes, including commodities.

By integrating these insights, investors can enhance their portfolio construction, achieving greater diversification and potentially improving risk-adjusted returns through capital-efficient allocations to commodity futures within a return stacking framework.

Conclusion: The Enduring Value of Trend Following

For investors utilizing return stacking strategies, these insights highlight the importance of monitoring commodity inventory levels and market structures. By aligning commodity futures exposures with periods of favorable carry and expected returns, and by employing strategies like portable alpha and trend following, investors can enhance portfolio diversification and capital efficiency.

Understanding the fundamental drivers of commodity returns enables more strategic allocation decisions, contributing to more robust and resilient investment portfolios.