Return Stacked® Academic Review

Foreign Exchange Fixings and Returns Around the Clock

Authors

Ingomar Krohn, Philippe Mueller, Paul Whelan

Journal of Finance (Forthcoming)

Link to the Paper

Key Topics

return stacking, portable alpha, diversification, leverage, risk management, portfolio construction, capital efficiency

Discovering Intraday FX Return Patterns Around Currency Fixings

The foreign exchange (FX) market operates around the clock, processing immense volumes of global transactions. Traditionally perceived as highly efficient and unpredictable, this market is thought to leave little room for consistent, exploitable patterns. However, recent research by Ingomar Krohn, Philippe Mueller, and Paul Whelan challenges this view by uncovering systematic intraday patterns in currency returns associated with major currency fixings.

In their paper, “Foreign Exchange Fixings and Returns Around the Clock,” the authors examine how predetermined currency fixings in Tokyo, Frankfurt (European Central Bank), and London impact high-frequency FX market dynamics. Analyzing the G9 currency pairs—which constitute approximately 75% of daily spot FX turnover—they dissect the trading day into five specific intervals surrounding these fixings. This segmentation allows them to isolate and scrutinize the effects of the fixings on currency movements over a 21-year period from January 1999 to December 2019.

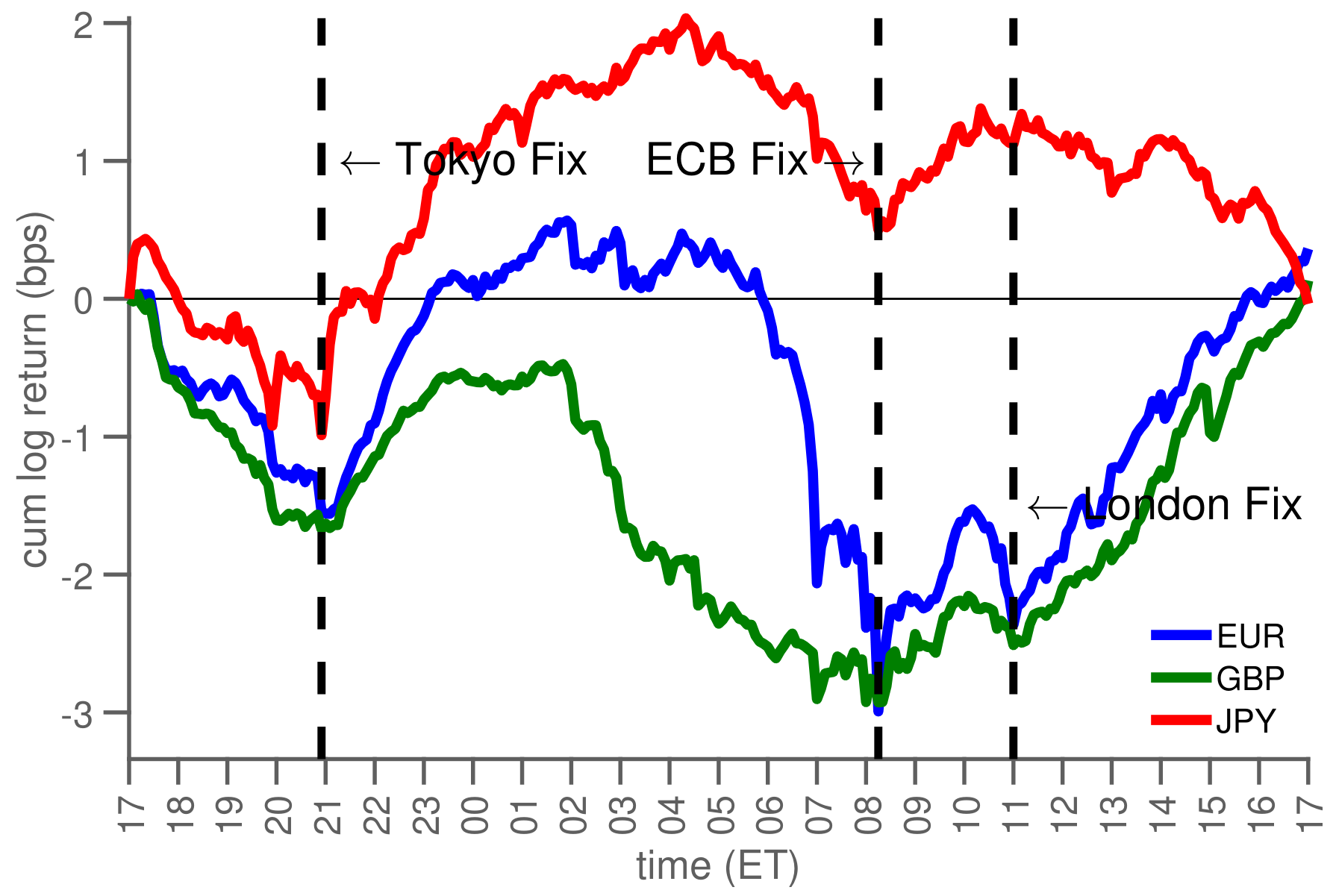

Visualizing the W-Shaped Intraday Patterns

Figure 1: Cumulative 5-minute Returns for EUR, GBP, and JPY (Original: Figure 2)

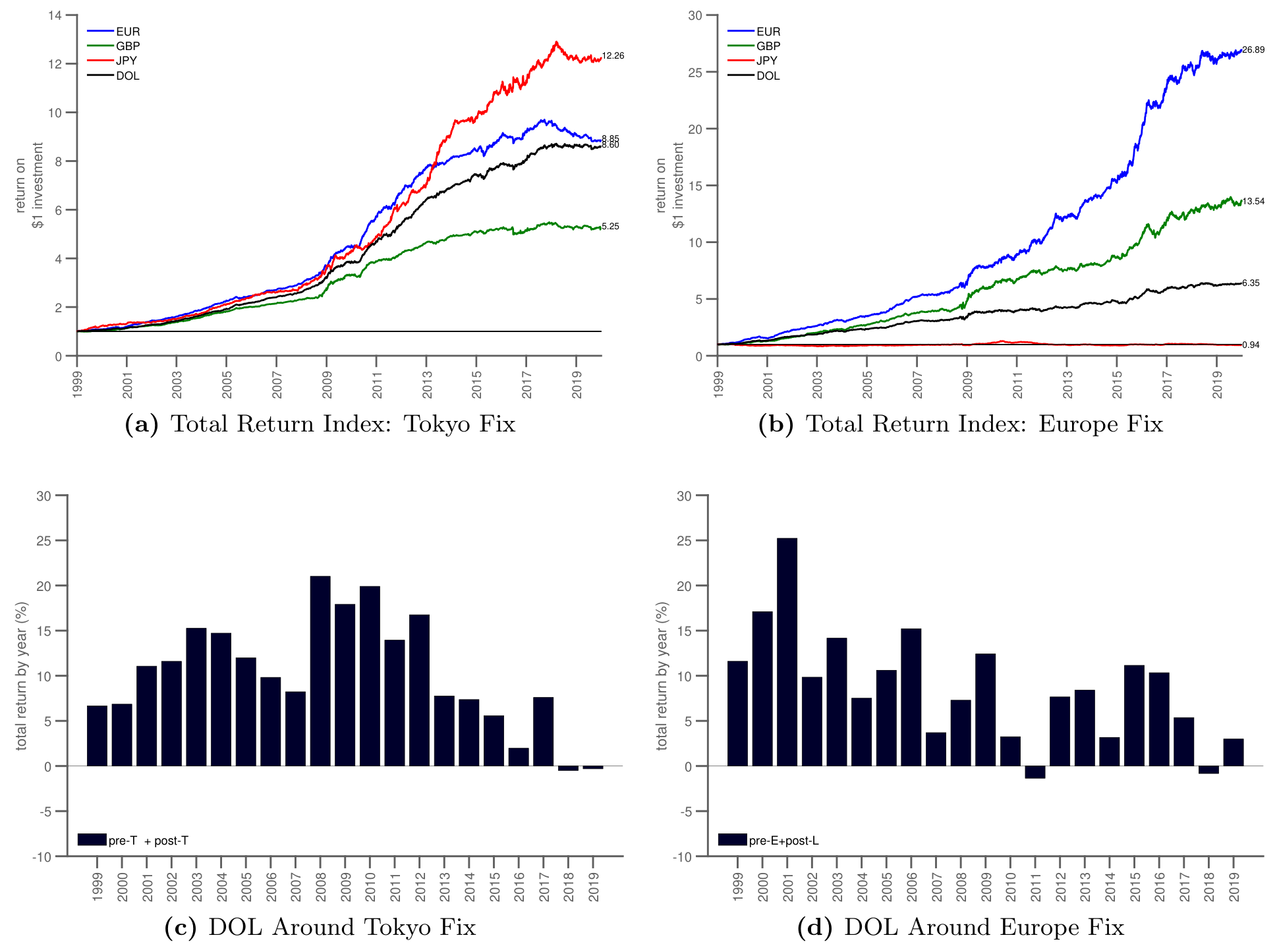

To assess the potential profitability of this pattern, the authors simulate a trading strategy that goes long USD before each fix and short USD afterward.

Figure 2: Total Return Indices and Year-by-Year Performance of Trading Strategy (Original: Figure 4)

Implications for Return Stacked Portfolio Strategies

The consistent W-shaped intraday patterns offer a potential source of portable alpha. Portable alpha refers to excess returns generated independently of traditional market exposures, which can be “ported” onto other investments. By exploiting these intraday FX movements, investors might capture additional returns that are uncorrelated with broader market trends.

Incorporating strategies that leverage these FX patterns into a return stacked portfolio could enhance diversification benefits. Since the drivers of these intraday movements—such as dealer inventory adjustments around fixings—are distinct from factors affecting traditional asset classes, they may provide uncorrelated returns. This could improve the overall risk-return profile of the portfolio and enhance capital efficiency.

Key Takeaways

For investors, these findings open avenues to enhance portfolio returns through strategic exposure to intraday FX patterns. By integrating such strategies within a return stacking framework, investors can potentially access uncorrelated sources of return, improving diversification and capital efficiency. Practical implementation would require careful consideration of transaction costs, liquidity constraints, and evolving market conditions.

This research prompts a reevaluation of conventional perspectives on FX market efficiency and encourages the exploration of innovative investment strategies. As understanding of intraday FX patterns deepens, investors can better navigate the complexities of the global currency markets and optimize their portfolios through thoughtful return stacking approaches.