Return Stacked® Academic Review

The Best Strategies for Inflationary Times

Authors

Henry Neville, Teun Draaisma, Ben Funnell, Campbell R. Harvey, and Otto Van Hemert

The Journal of Portfolio Management

Key Topics

return stacking, portable alpha, diversification, leverage, managed futures, trend following, carry, bonds, equities, yield, risk management, portfolio construction, capital efficiency

Navigating the Challenges of Inflation on Portfolios

Inflation erodes the real value of investment returns, presenting a significant challenge for investors and necessitating a reevaluation of traditional portfolio strategies. In “The Best Strategies for Inflationary Times,” the authors analyze nearly a century of financial data from the US, UK, and Japan to identify investment approaches that have historically performed well during periods of high and rising inflation. The study focuses on both passive and active strategies, aiming to equip investors with insights to protect and grow their portfolios when inflation accelerates.

The authors define inflationary regimes as periods when year-over-year inflation rates accelerate and exceed a 5% threshold. By identifying eight such regimes in the US since 1926, they examine the performance of various assets and strategies during these times. The research spans traditional assets like equities and bonds, commodities, and dynamic strategies such as trend-following, providing a comprehensive analysis of their effectiveness in inflationary environments.

Insights from Historical Data and Strategy Performance

Performance of Traditional Assets

One of the key findings is that traditional assets often underperform during inflationary regimes. Specifically, a classic 60/40 portfolio of US equities and 10-year Treasury bonds historically delivered negative real returns when inflation was high and rising. This underscores the vulnerability of conventional portfolios in such environments and highlights the need for alternative approaches.

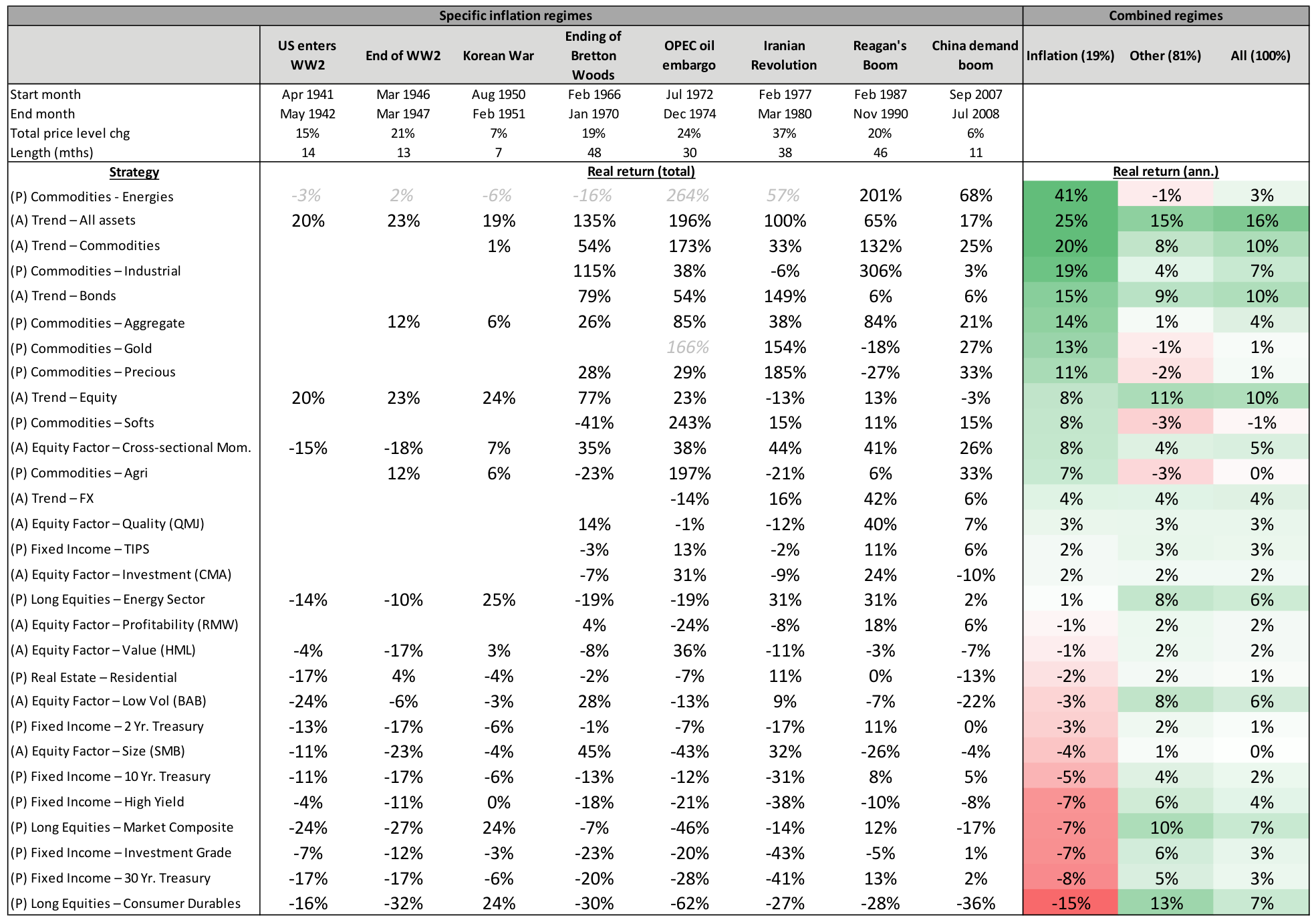

Figure 1: Summary Performance During US Inflationary Regimes (Original: Figure 2)

The real total returns of assets analyzed during the eight US inflationary regimes, as well as annualized returns during inflationary, non-inflationary, and all periods. Strategies are denoted as active (A) or passive (P). Returns for energies and gold in grey italics are spot returns due to unavailable futures data and are excluded from the combined regime calculation. Data vary by start date; further details are provided in the paper and Appendix A.

Effectiveness of Trend-Following Strategies

The study highlights the strong performance of trend-following strategies across various asset classes during inflationary periods. These strategies, which exploit persistent price trends, demonstrated an ability to generate positive real returns when inflation was both high and rising.

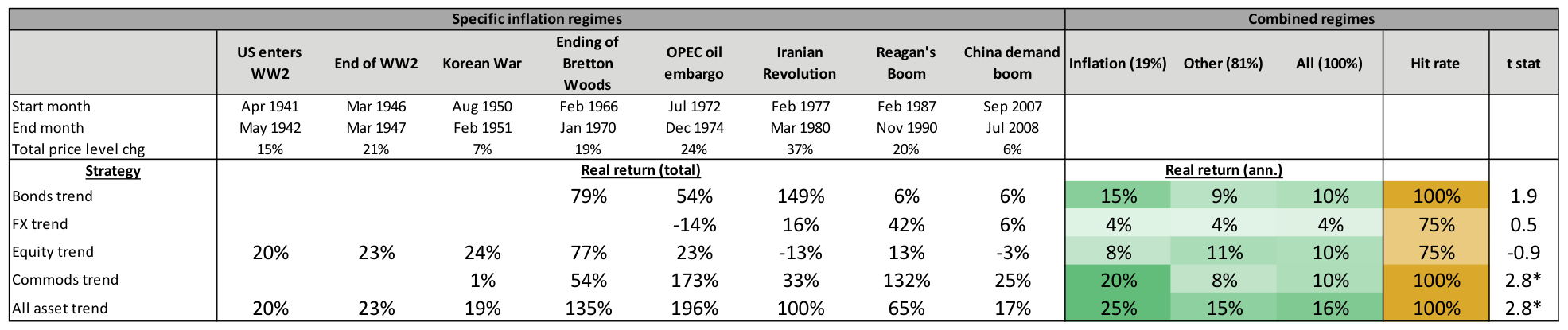

Figure 2: Trend Strategies in Inflationary Regimes (Original: Figure 14)

Total real returns of futures trend strategies by asset class and combined during the eight US inflationary regimes, as well as annualized returns during inflationary, non-inflationary, and all periods. The final columns present the hit rate (proportion of inflationary periods with positive returns) and t-statistics comparing returns during inflationary periods. Data span from 1926 to 2020; see Appendix A for details on sources and methodology.

While trend-following strategies have shown promise, the authors note practical considerations such as capacity constraints and transaction costs, which may impact scalability and net-of-fee performance for larger investors.

Integrating Findings into Return Stacked Portfolios

Trend-following strategies, as highlighted in the paper, can be a valuable addition to a return stacked portfolio. By leveraging managed futures and trend-following approaches, investors may achieve diversification benefits and potential positive returns when traditional assets falter. For a deeper understanding, refer to our primer on managed futures and trend following.

Similarly, commodities have historically served as effective hedges against inflation. Including commodity strategies, which may offer embedded yield or carry, can further strengthen a portfolio’s inflation resilience. The concept of yield and carry in managed futures is explored in our article on managed futures yield and carry.

In the context of return stacking, these strategies can be layered on top of a core portfolio of equities and bonds, serving as sources of portable alpha. This approach enhances return potential while managing risk through diversification and efficient use of capital. For more on integrating such strategies, see our discussion on portable alpha.

Conclusion: Building Resilient Portfolios in Inflationary Times

“The Best Strategies for Inflationary Times” provides valuable insights into managing investment portfolios during periods of high and rising inflation. The research underscores the challenges that inflation poses to traditional assets and highlights the potential benefits of incorporating trend-following and commodity strategies.

By strategically diversifying and efficiently combining multiple return sources—key principles of return stacking—investors can construct portfolios that are more resilient to inflationary pressures. This approach not only addresses the vulnerabilities of conventional portfolios but also leverages opportunities presented by dynamic strategies that have historically performed well during inflationary regimes.

Incorporating these insights can help investors enhance capital efficiency and achieve better risk-adjusted returns. For more on building such robust portfolios, explore our primer on return stacking and the evolution of portfolio construction.