Return Stacked® Academic Review

Honey, I Shrunk the Trend-Following

Authors

Yash Panjabi, Graham Robertson

Man Institute

Honey, I Shrunk the Trend-Following

Key Topics

return stacking, portable alpha, diversification, trend following, bonds, equities, risk management, portfolio construction

Rethinking Diversification in Changing Markets

In “Honey, I Shrunk the Trend-Following,” authors Yash Panjabi and Graham Robertson examine how shifts in bond-equity correlations have challenged the traditional 60/40 portfolio model. They explore the potential of incorporating trend-following strategies to enhance diversification and improve risk-adjusted returns in evolving market conditions.

Historically, the 60/40 portfolio – allocating 60% to equities and 40% to bonds—has relied on the negative correlation between these asset classes to provide a balanced risk-return profile. However, periods of positive correlation have reduced the effectiveness of this approach, prompting investors to seek alternative diversification methods.

Assessing Trend-Following as a Diversification Tool

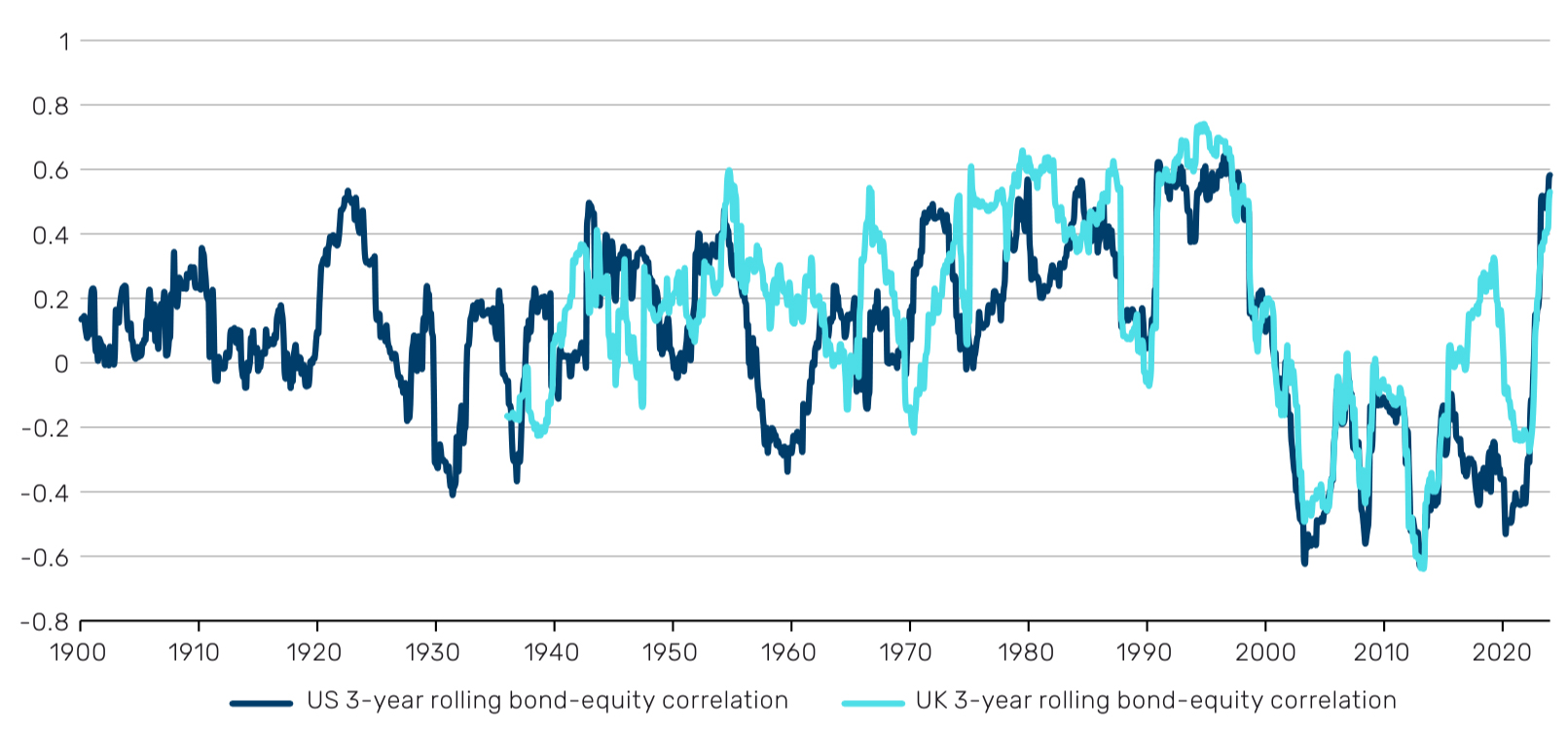

The authors analyze historical data to illustrate the fluctuating relationship between bonds and equities. They highlight the importance of recognizing these shifts and adapting portfolio strategies accordingly.

Figure 1: Rolling 3-Year Bond and Equity Correlation (Original: Figure 1)

Figure 1 shows that while bonds and equities have often maintained a negative correlation, there have been significant periods where the correlation turned positive. Such changes undermine the traditional diversification benefits of the 60/40 portfolio.

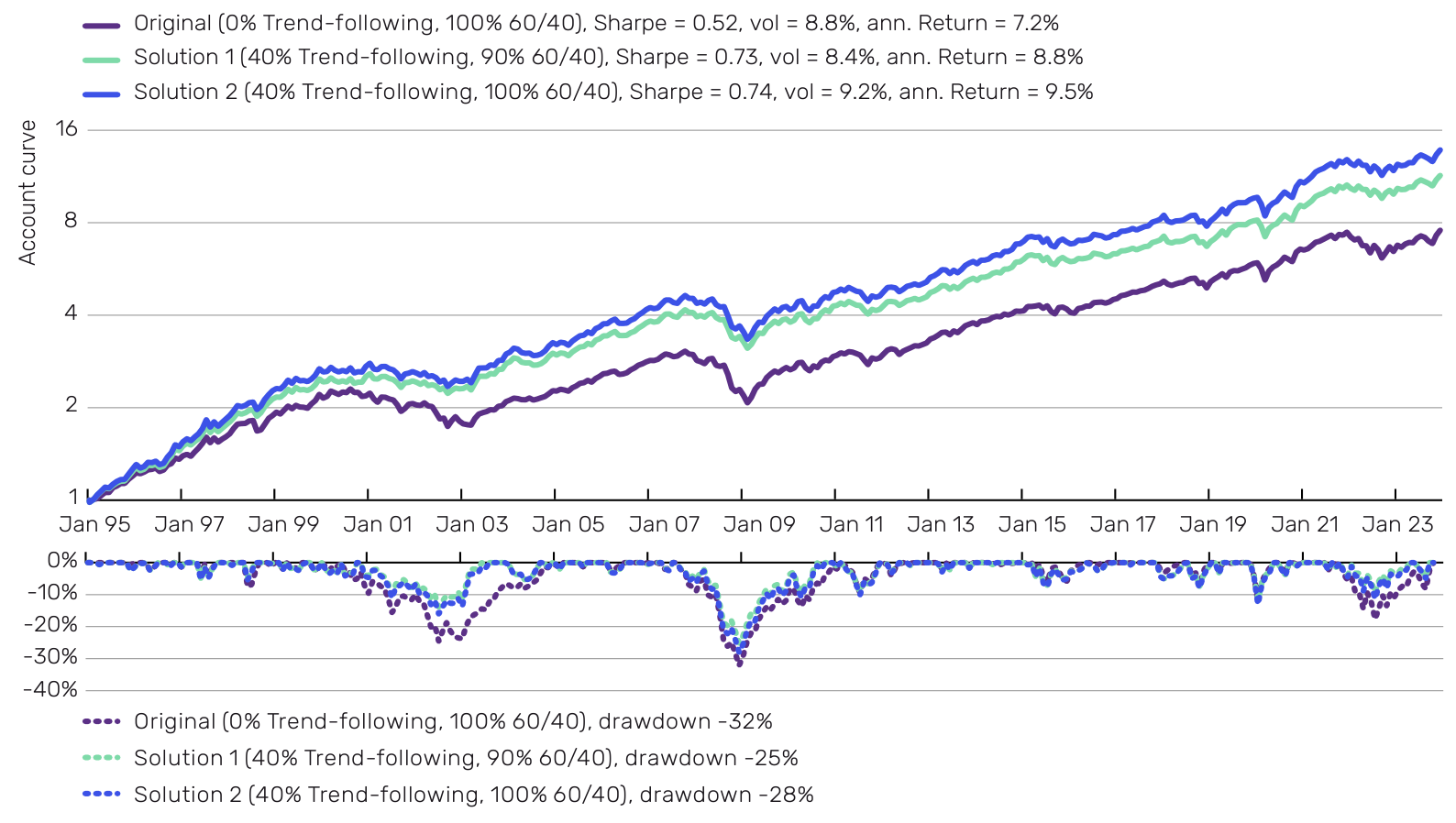

To quantify the impact of incorporating trend-following strategies, Panjabi and Robertson conduct optimization analyses using data from 1995 to 2023. They evaluate how different allocations to trend-following, represented by the BTOP50 Index, affect portfolio performance alongside a traditional 60/40 mix.

Figure 2: Account Curves of Portfolio Solutions (Original: Figure 6)

Source: Bloomberg, Backstop Solutions Group, LLC – BarclayHedge (www.barclayhedge.com), Man Group. Trend-following represented by BTOP50. Date range: 1 January 1995 to 31 December 2023.

Figure 2 compares the performance of the original 60/40 portfolio with portfolios that include trend-following strategies. The analyses reveal that allocating a portion of the portfolio to trend-following can enhance the Sharpe ratio and reduce maximum drawdowns, indicating improved risk-adjusted performance.

Integrating Trend-Following into Return Stacked Portfolios

The study’s findings align closely with the principles of return stacking, where multiple uncorrelated return streams are combined to achieve better diversification and potentially higher returns. Trend-following strategies, known for their low correlation to traditional assets, are prime candidates for such integration.

Trend-following, as detailed in Managed Futures and Trend Following, capitalizes on sustained market trends across various asset classes. Its use of futures and derivatives makes it a cash-efficient strategy, allowing investors to add it to their portfolios without displacing existing investments.

By adding trend-following to a portfolio, investors can create a form of portable alpha, overlaying alpha-generating strategies on top of traditional beta exposures. This approach can enhance returns and provide better risk management, particularly during periods when traditional assets face headwinds.

Conclusion: Adapting Portfolios for Enhanced Performance

Panjabi and Robertson’s analysis underscores the necessity of adapting investment strategies in response to changing market dynamics. Incorporating trend-following strategies offers a viable path to enhance diversification and improve risk-adjusted returns, especially when traditional correlations no longer hold.

The integration of trend-following aligns with innovative portfolio construction methods like return stacking, providing investors with tools to navigate complex market environments. Embracing such strategies can lead to more resilient portfolios capable of achieving long-term investment success despite evolving challenges.