Return Stacked® Academic Review

Return Signal Momentum

Authors

Fotis Papailias, Jiadong Liu, Dimitrios D. Thomakos

QMS Research Paper, No. 2019/04

Return Signal Momentum

Key Topics

return stacking, portable alpha, diversification, risk management, portfolio construction, capital efficiency, trend following

Rethinking Momentum: Emphasizing Return Consistency

Momentum investing – the practice of capitalizing on the continuation of existing market trends—has long been a cornerstone of investment strategies. Traditional momentum approaches focus on the magnitude of past returns to predict future performance. However, the paper “Return Signal Momentum” introduces a novel perspective by emphasizing the consistency of positive returns over time rather than their size. This approach leverages sign predictability, suggesting that the direction of past returns holds valuable information for forecasting future price movements.

Key Insights from Return Signal Momentum

The core innovation of Return Signal Momentum (RSM) lies in its focus on the frequency of positive returns within a specified look-back period to generate trading signals. Instead of aggregating past returns cumulatively—as is common in Time Series Momentum (TSM) strategies—RSM assesses how often an asset has posted positive returns. For example, if an asset has recorded positive returns in 8 out of the last 12 months, RSM considers this a strong positive signal regardless of the magnitude of those returns.

The authors conducted an extensive analysis on 55 of the world’s most liquid commodity and financial futures markets from January 1985 to March 2015. Their findings reveal that RSM strategies consistently outperform traditional TSM and other benchmark strategies across several performance metrics, including cumulative net profits, Sharpe ratios, and maximum drawdowns. Notably, this outperformance persists even after accounting for transaction costs, underscoring the practical viability of RSM.

Performance Evaluation and Risk Management

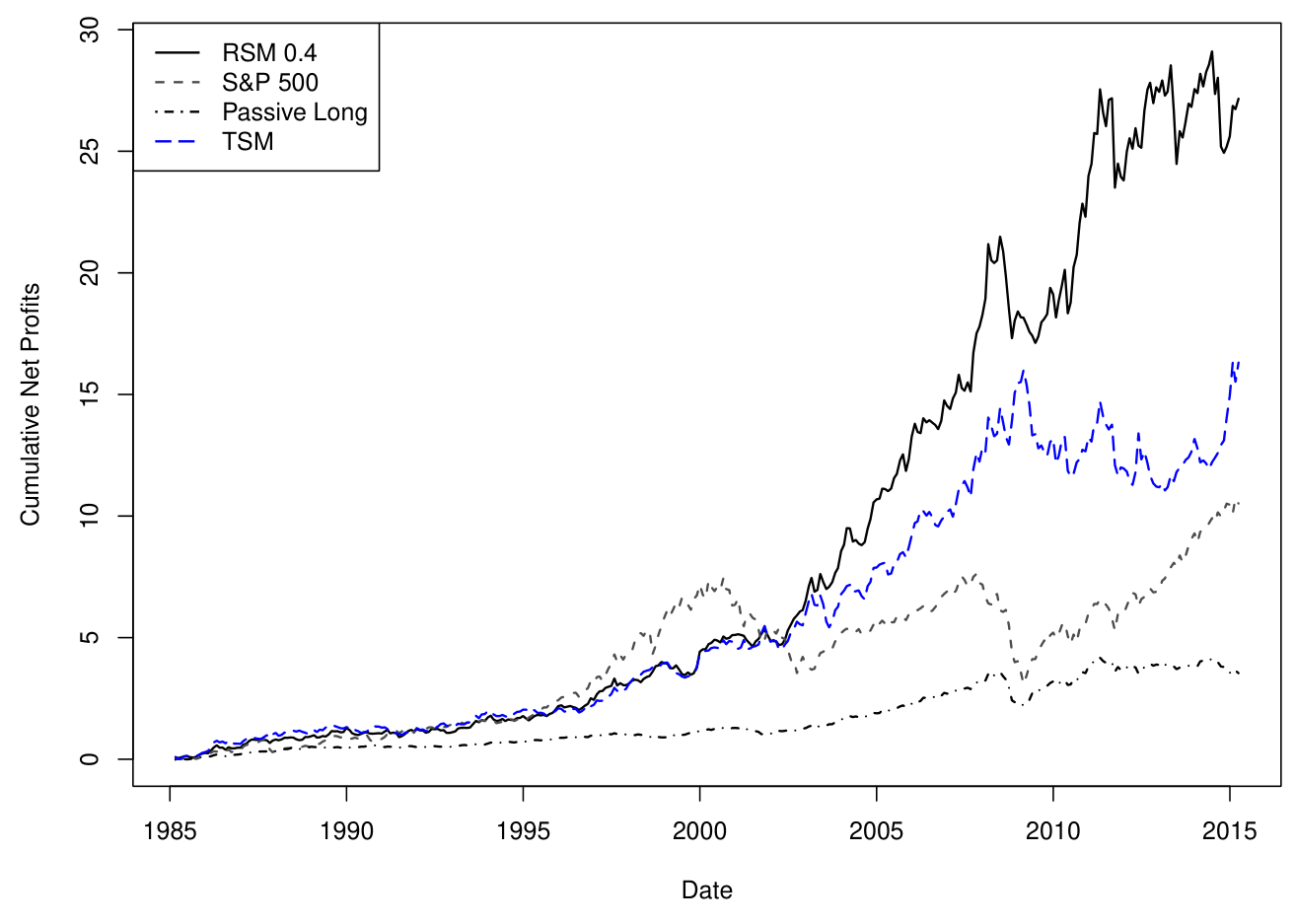

Figure 1: Cumulative Net Profits of RSM Strategy vs. Benchmarks (1985–2015) (Original: Figure 6)

Figure 1 illustrates the cumulative net profits generated by the RSM strategy with a fixed probability threshold of 0.4 (RSM0.4) compared to three benchmarks: the S&P 500 index, a passive long (equal-weighted) strategy, and a traditional TSM strategy. Over the 30-year period, the RSM0.4 strategy exhibits a significant upward trajectory, outperforming all benchmarks. Notably, the cumulative net profits of RSM0.4 nearly double those of the TSM strategy, highlighting the substantial performance advantage of focusing on return consistency.

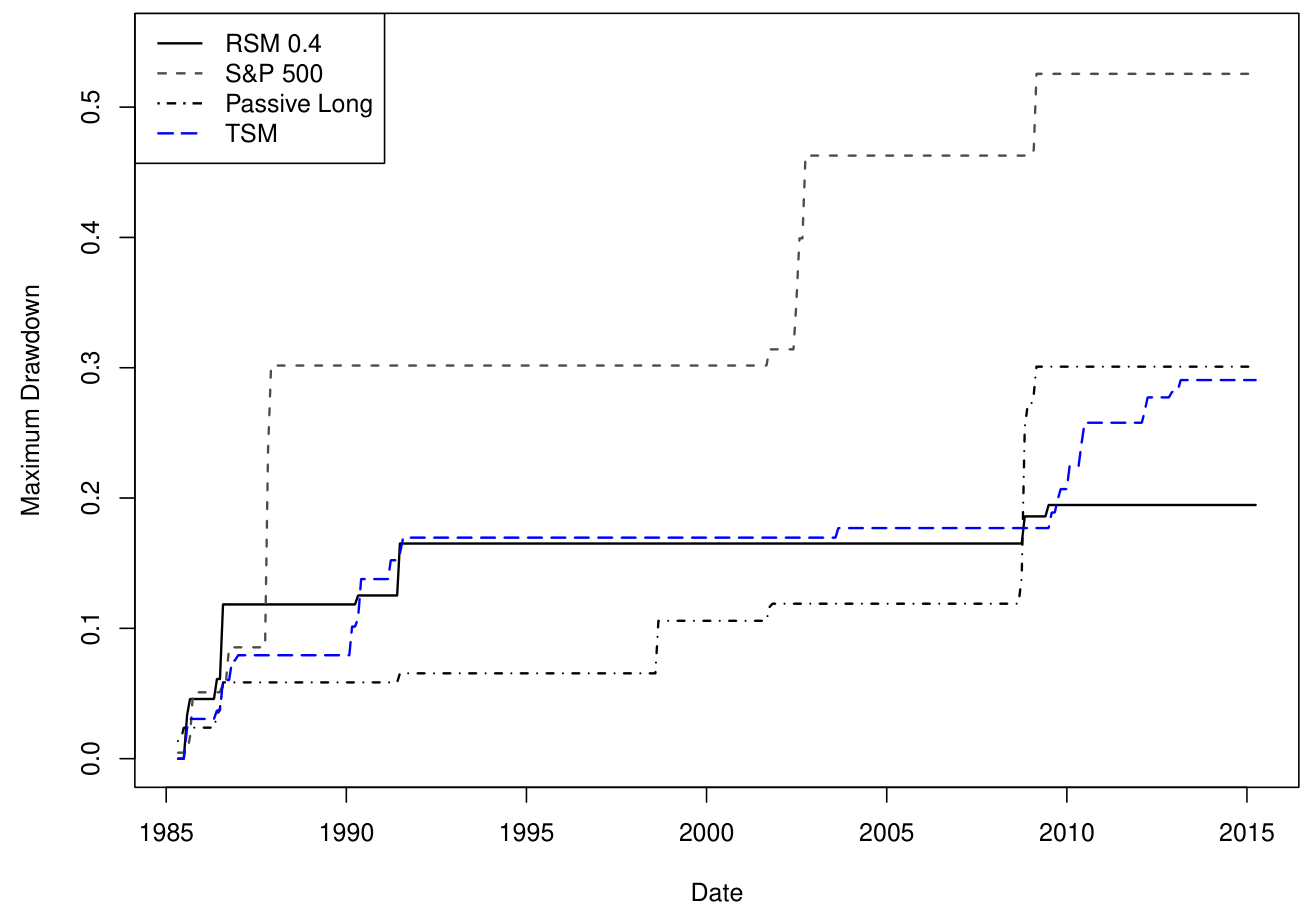

Risk management is a critical aspect of any investment strategy, and RSM demonstrates superior performance in this area as well.

Figure 2: Maximum Drawdown of RSM Strategy vs. Benchmarks (1985–2015) (Original: Figure 7)

Integrating RSM into Return Stacked Portfolios

The unique attributes of RSM make it an attractive candidate for inclusion in return stacked portfolios. Return stacking involves combining multiple uncorrelated strategies to enhance diversification and improve risk-adjusted returns, all while maintaining capital efficiency. By focusing on the sign predictability of returns, RSM provides a source of returns that is potentially uncorrelated with traditional strategies based on return magnitude.

Incorporating RSM into a return stacked portfolio can enhance overall performance through increased cumulative net profits and reduced maximum drawdowns. Its emphasis on the frequency of positive returns aligns with strategies like trend following, which capitalizes on persistent market movements. However, RSM’s distinct approach—centering on return consistency rather than trend magnitude—may offer additional diversification benefits.

For investors looking to optimize their portfolios through return stacking, understanding the interplay between different strategies is crucial. Our articles on Trend Following and Portable Alpha provide deeper insights into how combining strategies like RSM can lead to improved portfolio construction and performance.

Conclusion: Harnessing Return Consistency for Enhanced Portfolio Performance

“Return Signal Momentum” offers a fresh perspective on momentum investing by shifting the focus from the size of past returns to their consistency. The empirical evidence presented in the paper demonstrates that RSM strategies can deliver superior performance compared to traditional benchmarks, both in terms of returns and risk management.

For investors and portfolio managers, integrating RSM into investment strategies provides an opportunity to enhance diversification and achieve better risk-adjusted returns. Its compatibility with return stacking principles and potential to contribute uncorrelated returns make RSM a valuable tool in the evolution of portfolio construction. As markets continue to evolve, strategies like RSM that offer innovative approaches to capturing returns while managing risk are essential for achieving long-term investment success.