Return Stacked® Academic Review

Portfolio Optimization for Efficient Stock Portfolios: Applications and Directions

Key Topics

Rethinking Traditional Portfolio Construction

Investors have long relied on market capitalization-weighted indexing as a staple in portfolio construction. However, ReSolve Asset Management’s white paper, “Portfolio Optimization for Efficient Stock Portfolios: Applications and Directions“, challenges this conventional wisdom. By analyzing data from the Center for Research in Securities Prices (CRSP) spanning 1960 to 2019—and focusing on the top 1,000 U.S. stocks by market capitalization—the study explores alternative portfolio construction methods under practical constraints like long-only positions and position limits. The goal is to provide actionable insights into more efficient portfolio design.

Debunking the Capital Asset Pricing Model

The traditional Capital Asset Pricing Model (CAPM) proposes a linear relationship between an asset’s expected return and its market beta, suggesting that higher-beta stocks should yield higher returns. However, historical data tells a different story. The study finds no significant relationship between market beta and stock returns. This revelation undermines the rationale behind market cap-weighted portfolios, which inherently allocate more capital to higher-beta stocks based solely on their market value.

Exploring Alternative Portfolio Strategies

Moving beyond traditional indexing, the research introduces a framework for various portfolio optimization techniques. These range from simple equal-weighted and inverse volatility portfolios to more sophisticated methods like equal risk contribution, hierarchical risk parity, maximum diversification, and minimum variance portfolios. Each strategy aligns with specific assumptions about risk and return, offering investors tools to tailor their portfolios according to their objectives and risk tolerance.

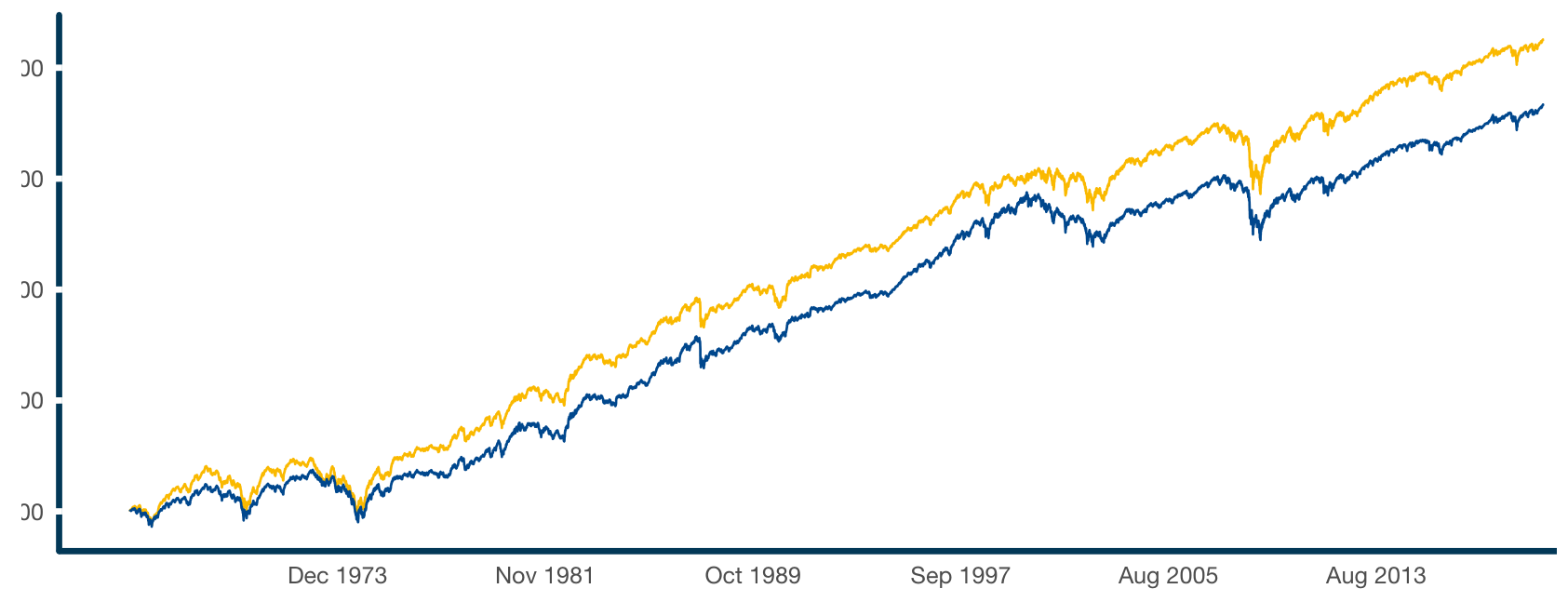

Figure 1: Market Cap vs. Equal-Weighted Large-Cap Stocks (1957-2018)

Performance Insights of Optimized Portfolios

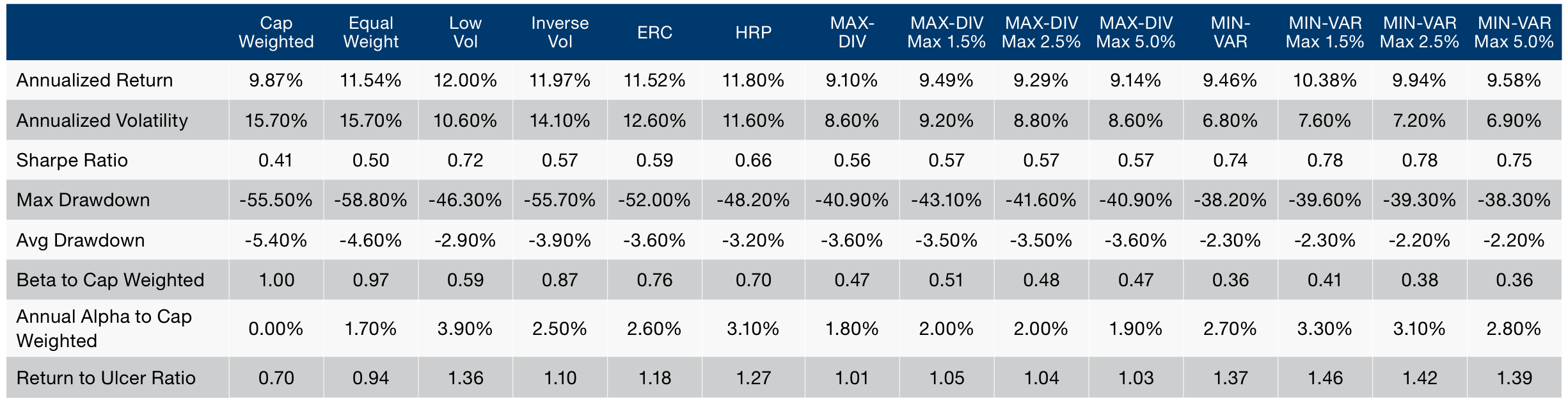

Figure 2: Performance Statistics of Various Portfolio Strategies

Implications for Return Stacking Strategies

The concept of portable alpha becomes particularly relevant. Portable alpha involves generating excess returns independent of the market’s movements. Incorporating optimized portfolios like minimum variance strategies can serve as the foundation for portable alpha, allowing investors to stack additional return streams, such as managed futures trend following or carry strategies, on top of their core holdings.

By strategically employing leverage—a key component in return stacking—investors can maintain their core asset allocations while adding exposure to uncorrelated strategies. This approach aligns with the study’s emphasis on achieving competitive returns with lower volatility, thereby enhancing overall portfolio efficiency.

Conclusion

Investors seeking to enhance their portfolios through diversification and capital efficiency can leverage these insights to optimize asset allocation. By integrating uncorrelated return streams and employing advanced optimization techniques, they can potentially achieve better risk-adjusted returns while maintaining a prudent risk profile.