Return Stacked® Academic Review

Limited Arbitrage in Mergers and Acquisitions

Authors

Malcolm Baker, Serkan Savasoglu

Harvard Business School, Finance Working Paper No. 06-011

Limited arbitrage in mergers and acquisitions

Key Topics

return stacking, portable alpha, diversification, risk management, portfolio construction, capital efficiency

Exploring the Dynamics of Merger Arbitrage

In the realm of mergers and acquisitions (M&A), merger arbitrage offers investors the opportunity to profit from the price discrepancies that occur during corporate takeovers. Malcolm Baker and Serkan Savasoglu’s paper, “Limited Arbitrage in Mergers and Acquisitions II,” delves into the performance of merger arbitrage strategies and the factors that influence their returns.

The authors analyze diversified portfolios of merger arbitrage positions over a 16-year period from 1981 to 1996. By constructing portfolios designed to yield fixed payoffs upon successful deal completion, they uncover persistent abnormal returns ranging from 0.6% to 0.9% per month, even after adjusting for systematic risk factors. This suggests that merger arbitrage opportunities are not fully exploited, pointing to underlying market inefficiencies.

Their theoretical model attributes these abnormal returns to practical limits on arbitrage capital and the inherent risks associated with deal completion. Factors such as selling pressure from target shareholders and the uncertainty of deal outcomes create an environment where specialized investors can capture excess returns.

Insights from Merger Activity Trends and Institutional Ownership

The study provides valuable insights into M&A trends and how they impact merger arbitrage strategies.

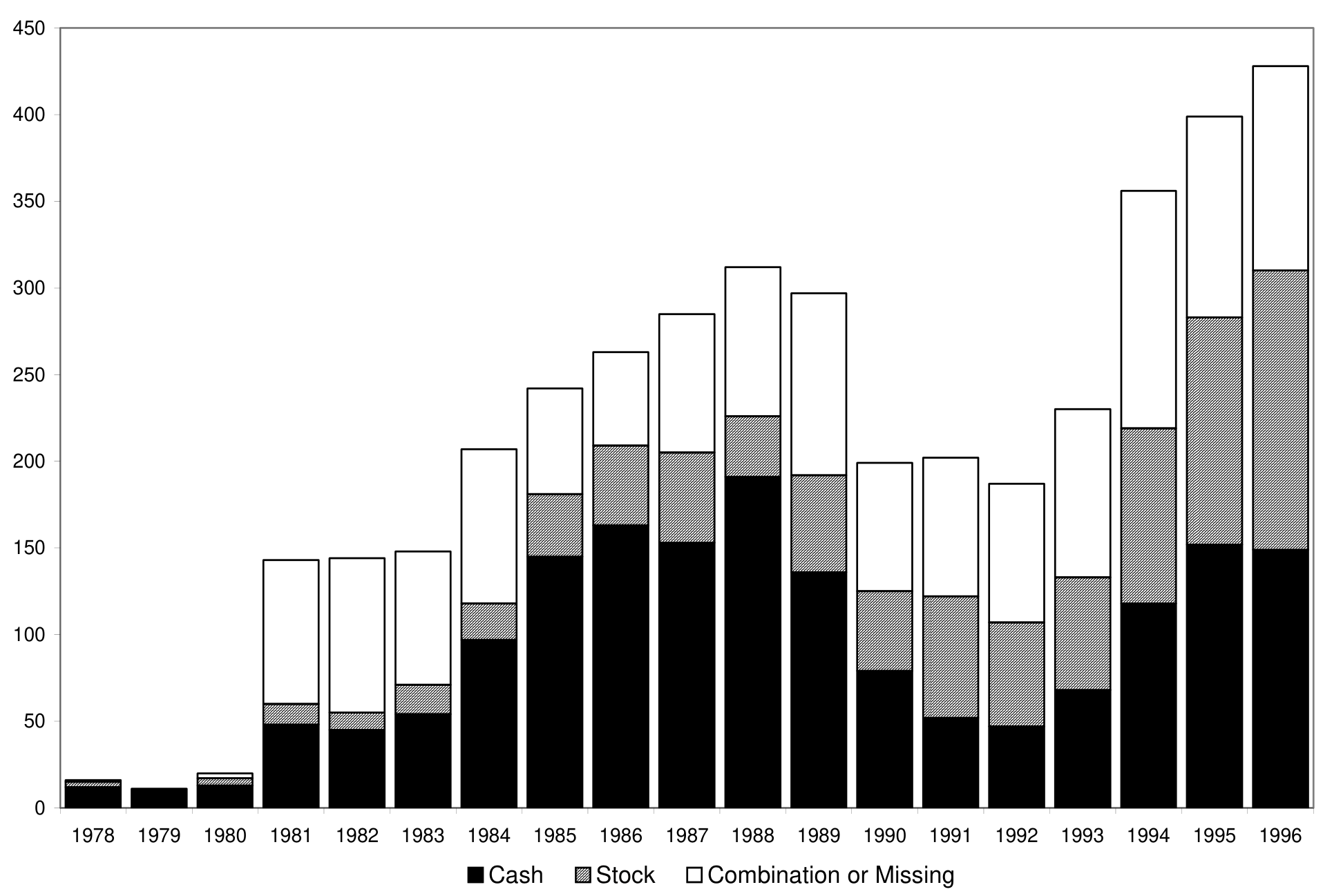

Figure 1: Mergers and Acquisitions, 1981 to 1996 (Original: Figure 1)

Annual mergers and acquisitions announced between 1981 and 1996 and recorded by Securities Data Company (SDC). The sample contains only deals where the target firm was listed by the Center for Research on Security Prices (CRSP) and the acquirer firm was a public company. We use the SDC description of the consideration to identify deals that are pure cash offers or pure stock offers.

The figure illustrates the ebb and flow of M&A activity, highlighting a growing number of transactions over the studied period. This expanding opportunity set enhances the potential for merger arbitrage strategies within a return stacking framework.

Further insights are drawn from the examination of institutional ownership changes around deal announcements.

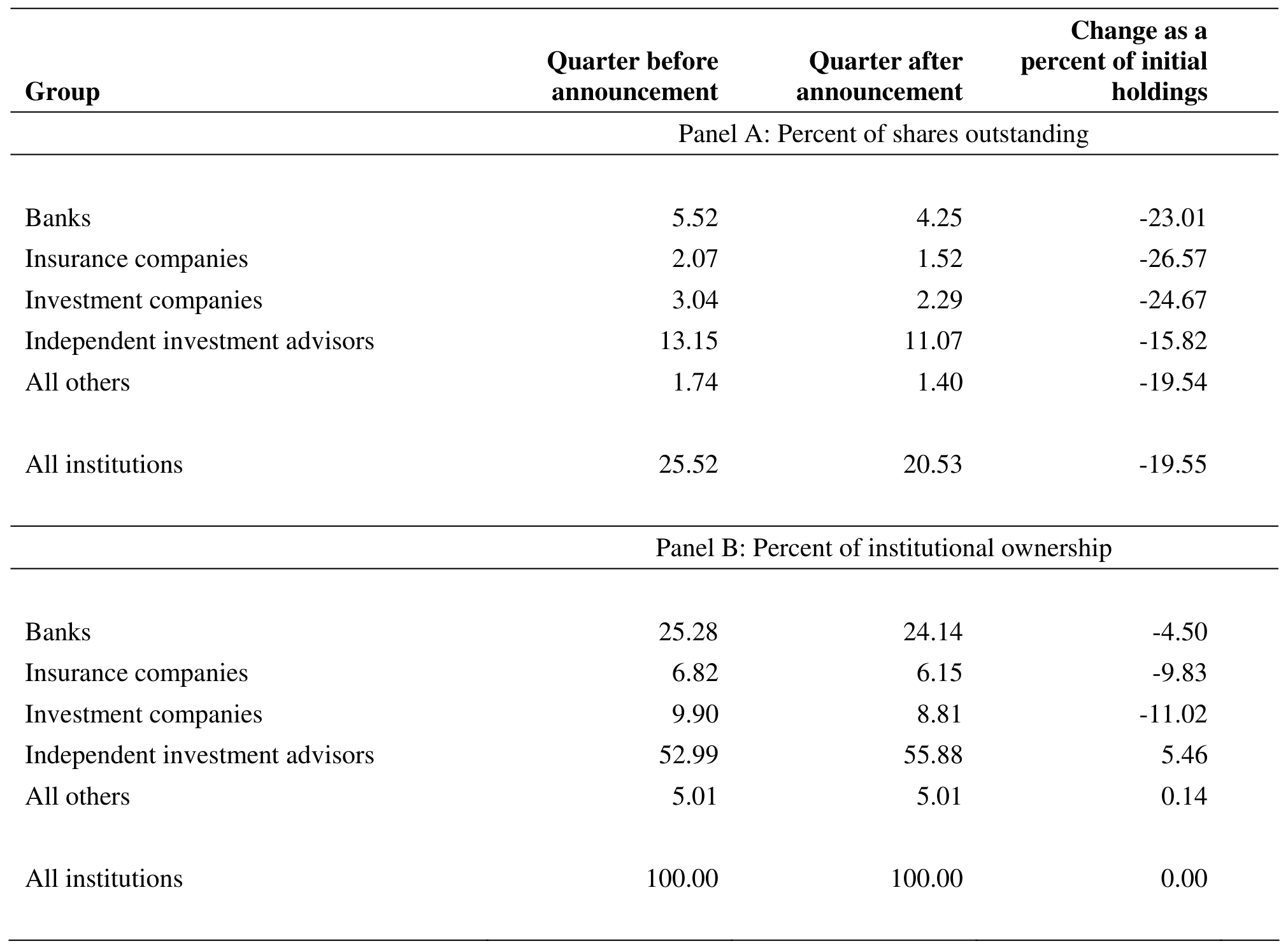

Figure 2: Institutional Ownership Before and After Takeover Announcements (Original: Table 4)

This table shows institutional ownership before and after a takeover announcement. The first column shows ownership for the quarter ending prior to announcement, the second column shows ownership for the quarter ending after announcement, and the third column reports the difference between the first two. Panel A shows ownership as a fraction of shares outstanding for five types of asset managers. Panel B shows ownership as a fraction of total institutional ownership.

The table reveals a significant reduction in institutional ownership following takeover announcements. This suggests that certain investors may be reluctant to bear the risks associated with deal completion, highlighting the limits on arbitrage capital and the opportunities for investors adept at managing these risks.

Integrating Merger Arbitrage into Return Stacked Portfolios

The findings have meaningful implications for constructing return stacked portfolios, which combine multiple, non-correlated return streams to enhance diversification and capital efficiency. As demonstrated in the study, merger arbitrage offers a distinct return profile driven by deal-specific factors rather than broad market movements.

Incorporating merger arbitrage into a portfolio alongside other non-correlated strategies, such as trend following and portable alpha, can potentially improve risk-adjusted returns. By stacking these returns, investors may achieve greater diversification and shield their portfolios from systemic market risks.

However, it’s important to consider the practical challenges highlighted by the authors. Factors like transaction costs, deal completion risks, and variability across different market environments can impact the net performance of merger arbitrage strategies. Effective risk management and a thorough understanding of these factors are essential when integrating merger arbitrage into a return stacked approach.

Implications for Portfolio Diversification and Risk Management

“Limited Arbitrage in Mergers and Acquisitions II” sheds light on how limits to arbitrage capital and deal-specific risks contribute to persistent abnormal returns in merger arbitrage. For investors seeking to enhance portfolio diversification and capitalize on non-correlated return streams, the study underscores the value of including merger arbitrage in a broader investment strategy.

By acknowledging the challenges associated with merger arbitrage, such as deal completion uncertainty and market volatility, investors can better manage risks through diversification and informed strategy selection. The research emphasizes the importance of balancing potential returns with the inherent risks, aligning well with the principles of return stacking methodologies.