Return Stacked® Academic Review

Exploring the Practicality of Merger Arbitrage

Authors

Bocconi Students Investment Club

Exploring the Practicality of Merger Arbitrage

Key Topics

return stacking, portable alpha, diversification, risk management, portfolio construction

Analyzing Merger Arbitrage Strategies

The Bocconi Students Investment Club’s paper delves into merger arbitrage, a strategy aimed at profiting from the price discrepancies during mergers and acquisitions. By examining 4,828 transactions from 1984 to 2020, the authors assess the viability of merger arbitrage as a means to generate consistent returns and enhance portfolio diversification.

The study employs advanced machine learning techniques, including logistic regression, tree-based models, and neural networks, to evaluate the factors influencing deal success. Variables such as board support, termination fees, and the transaction type (cash vs. stock) are analyzed to understand their impact on the strategy’s effectiveness.

Historical Performance and Risk Characteristics

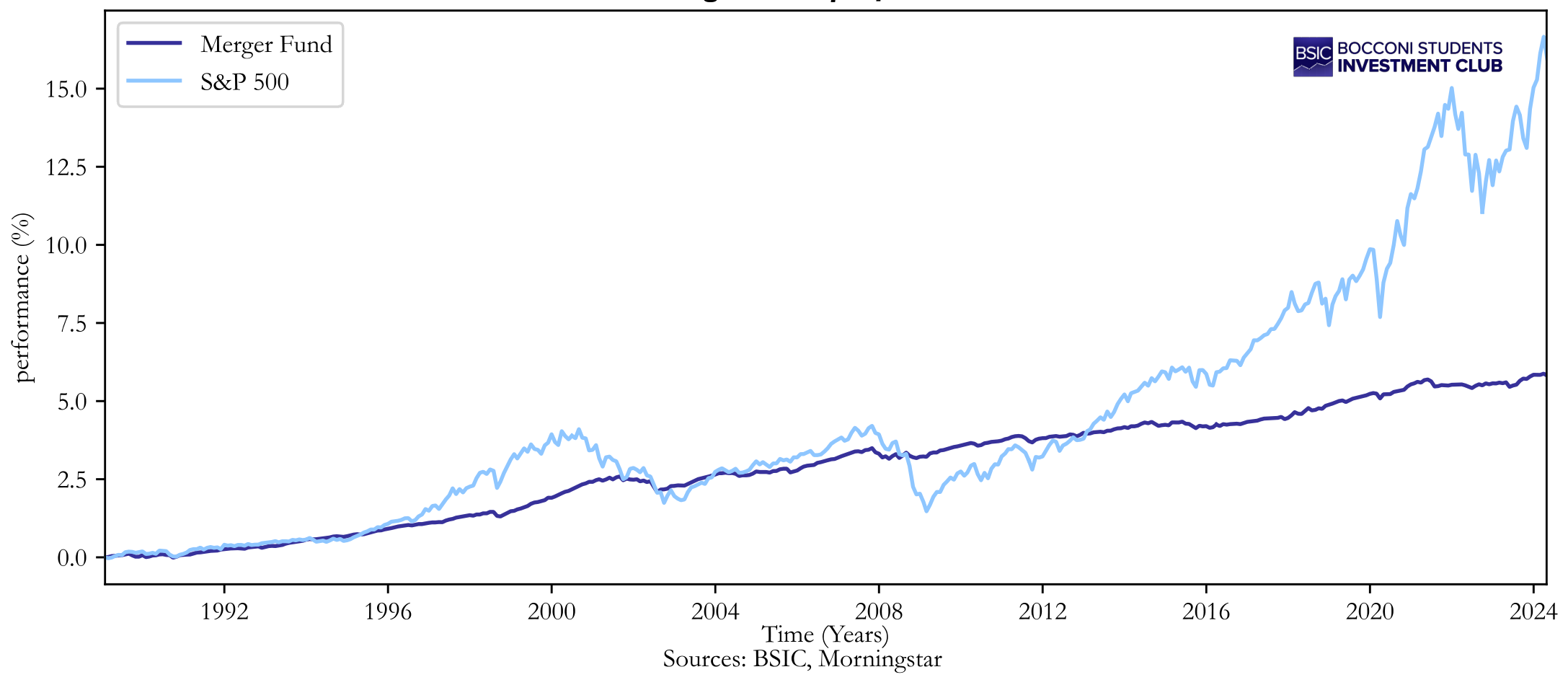

Figure 1: Merger Fund Performance vs S&P 500 (1992–2024) (Original: Figure 1)

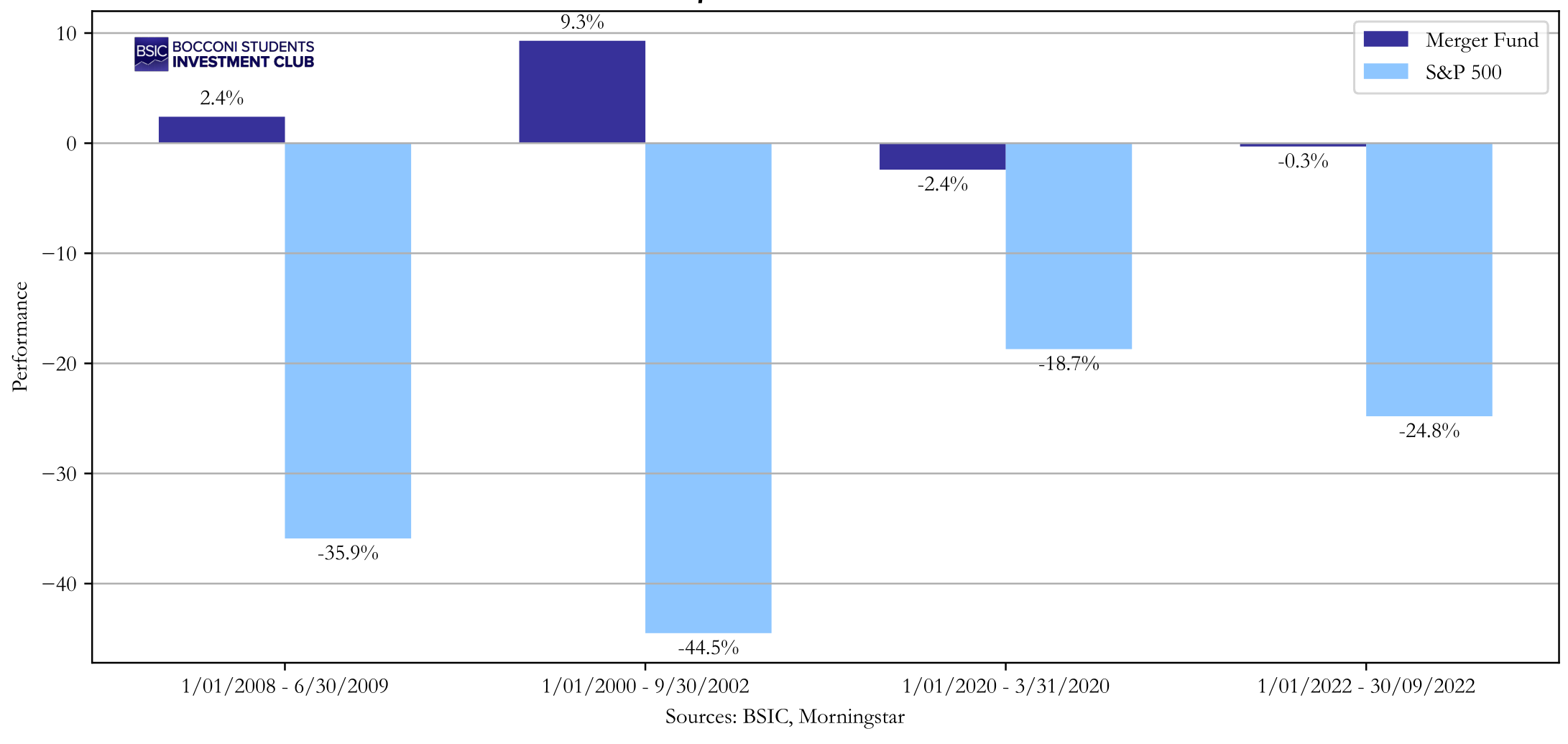

Figure 2: Performance in Bear Markets (Original: Figure 2)

Implications for Diversified Portfolio Construction

- Low Correlation with Traditional Assets: The strategy’s returns are not directly tied to stock or bond market movements, offering potential benefits in smoothing overall portfolio returns.

- Downside Protection: Historical performance during market downturns demonstrates merger arbitrage’s capacity to reduce losses, aligning with the goals of strategies like return stacking.

- Consistent Returns: While not necessarily delivering high returns during bull markets, merger arbitrage has provided steady performance over time, contributing to a more predictable return profile.

- Deal-Specific Alpha: The potential for generating returns through careful analysis of individual deals resonates with concepts like portable alpha, where returns are derived from skill-based strategies independent of market beta.

Incorporating merger arbitrage into a portfolio aligns with the principles of diversification and may enhance risk-adjusted returns. For those interested in exploring this strategy further, more insights can be found in discussions about merger arbitrage.