Return Stacked® Academic Review

Optimising Cross-Asset Carry

Authors

Exploring Cross-Asset Carry Strategies

In “Optimising Cross-Asset Carry,” Nick Baltas extends the concept of the carry trade beyond currency markets to include commodities, equity indices, and government bonds. Carry, defined as the expected return on an asset assuming market conditions remain unchanged, varies across asset classes due to differences in underlying factors like interest rates, dividends, and yield curves. Baltas investigates how systematically capturing carry across multiple asset classes can enhance portfolio diversification and improve risk-adjusted returns.

To explore this, he constructs three portfolio strategies:

- Cross-Sectional (XS): Ranks assets by carry within each class to build balanced long-short portfolios.

- Time-Series (TS): Takes long positions in assets with positive carry and short positions in those with negative carry.

- Optimized (OPT): Combines XS and TS approaches while optimizing for the covariance structure to allocate risk more efficiently.

His empirical analysis covers 52 assets from January 1990 to January 2016, utilizing market data like spot and forward prices for currencies, futures prices for commodities and equities, and yield data for government bonds.

Key Insights from Carry Portfolio Analysis

Baltas’ findings reveal that carry strategies can generate positive excess returns across all examined asset classes. Notably, the optimized (OPT) approach delivers superior risk-adjusted performance by considering the covariance among assets, resulting in a more efficient allocation of risk and return.

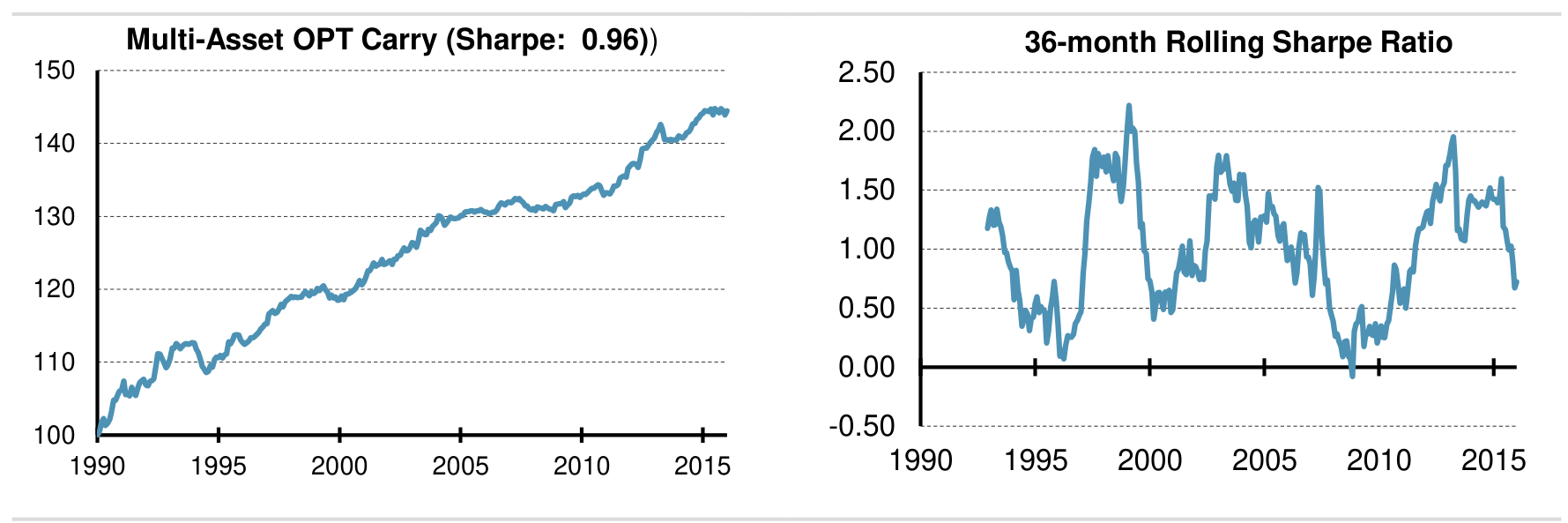

Figure 1: Multi-Asset Optimized Carry (Unlevered) (Original: Figure 7)

As shown in Figure 1, the unlevered OPT portfolio achieves a Sharpe ratio of 0.96 with low volatility of 1.48% and positive skewness. By maximizing log-weighted carry subject to a volatility target and sign constraints on weights based on carry direction, the OPT approach outperforms the simpler XS and TS strategies. The diversification benefit is further highlighted by the low correlations between carry strategies across different asset classes.

Implications for Return Stacking Strategies

The success of the optimized carry strategy has significant implications for return stacking—a method of combining uncorrelated return sources to enhance portfolio diversification and improve risk-adjusted performance. Multi-asset carry strategies align well with return stacking principles by offering distinct return drivers that can be layered onto traditional portfolios.

Incorporating such strategies can potentially enhance performance, especially when traditional assets offer limited return potential. For example, combining carry strategies with trend following or approaches that harvest a futures yield from carry can create a more robust and consistent return stream. This methodology is akin to implementing a portable alpha strategy, where alpha-generating strategies are overlaid on a core portfolio without significantly increasing risk.

For investors seeking to build resilient portfolios, integrating multi-asset carry strategies within a return stacked framework can offer enhanced diversification and improved risk-adjusted returns. More insights on how these strategies fit into modern portfolio construction can be found in our article on return stacking and the evolution of portfolio construction.