Gold & Bitcoin: From Fringe to Foundational

Overview

As global monetary dynamics shift, some of the world’s most conservative investors – central banks – are increasingly turning to gold and Bitcoin as strategic reserve assets. Their motivations mirror those of a growing base of institutional and retail investors: hedging against currency debasement, inflation volatility, and geopolitical uncertainty. For advisors, the implications are clear. This blog explores how these once-fringe assets are moving into the mainstream and how a modern portfolio construction approach, using overlays instead of substitutions, can allow clients to incorporate gold and Bitcoin without giving up exposure to traditional return drivers.

Key Topics

Gold, Bitcoin, Macroprudential Risk

Introduction

In recent years, a quiet but profound shift has been taking place among the most conservative and risk-averse investors in the world: central banks. Once content to manage reserves through a narrow lens of sovereign debt and foreign currency, these institutions are now aggressively diversifying into real assets: most notably, gold and, increasingly, Bitcoin.

Since 2022, central banks have purchased more than 1,000 tons of gold annually, a pace not seen in over five decades. Countries such as China, India, Turkey, and Poland have led this charge, motivated by rising geopolitical tensions, the weaponization of the U.S. dollar, and a desire to reduce reliance on Western-dominated financial systems.

Gold’s appeal is long-established. It is liquid, globally recognized, and free of counterparty risk. What’s notable today is not that gold is being held, but the degree to which it is being accumulated. Gold’s share of global reserves has even surpassed the Euro in 2024 to become the second-largest reserve asset behind the U.S. dollar.

Even more striking is Bitcoin’s emergence: still volatile, still young, but increasingly viewed as a complementary store-of-value. In 2025, the U.S. formally established a Strategic Bitcoin Reserve using seized assets, signaling a shift in how policymakers view the asset’s utility. El Salvador continues to hold Bitcoin on its national balance sheet, Bhutan is mining it with hydroelectric power, and other governments are exploring how it might fit into sovereign portfolios. While Bitcoin is unlikely to replace gold, its inclusion alongside traditional reserve assets reflects growing institutional acknowledgment of a changing financial order.

For allocators, this activity sends a clear message: gold and Bitcoin are no longer fringe. They are being adopted by the same entities entrusted with preserving monetary stability and long-term purchasing power. If central banks see these assets as prudent tools for macro resilience, perhaps it’s time for allocators and wealth managers to reconsider their place in modern portfolios.

Investor sentiment increasingly mirrors the actions of central banks.

As official institutions ramp up their gold purchases, individual investors are following suit. State Street’s 2024 survey of high-net-worth individuals found that gold ownership among those with $250,000 or more in investable assets rose from 20% to 38% in just one year, with average portfolio allocations to gold increasing from 14% to 21%. Younger investors are also contributing to this trend. An eToro survey of global self-directed investors revealed that over half of Gen Z and Millennial respondents hold gold or intend to do so, citing inflation and geopolitical instability as primary concerns. These motivations align closely with those driving central banks: a desire to hedge against fiat debasement, reduce reliance on the U.S. dollar, and own a universally recognized reserve asset without counterparty risk.

The story is even more striking when it comes to Bitcoin. As the U.S. and a growing number of nations begin formalizing Bitcoin holdings in sovereign reserves, investor demand is surging in parallel. Nowhere is the investor demand for Bitcoin more apparent than the growth of the spot Bitcoin ETF category. Launched only in January 2024, this category has grown to over $125 billion in assets in only 18 months.

According to a 2024 EY survey, 67% of institutional respondents already allocate to digital assets. Among financial advisors, the Bitwise/VettaFi survey showed that crypto adoption doubled year-over-year, and 96% reported client inquiries about digital assets. Younger investors are leading the charge: a deVere Group survey found that 73% of investors aged 24 to 45 now prefer Bitcoin over gold for long-term investment. Rather than viewing Bitcoin as a speculative outlier, investors – particularly Gen Z and Millennials – are increasingly seeing it as a modern reserve asset, echoing the strategic diversification moves of central banks while embracing its potential for asymmetric upside in a digitizing economy.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

Figure 1. Demand You Can Document

Buyer Group

Central Banks & Sovereigns

Gold

Net purchases exceeded 1,000 tons in each of the last three years – the fastest pace on record. 9 of the top 10 buyers are emerging-market nations.

Bitcoin

Six sovereign entities—including the U.S. and China—collectively hold ~530k BTC (≈ 2.5% of supply) through reserves or seizures.

Buyer Group

Corporate Treasuries

Gold

Anecdotal but rising demand from emerging market firms hedging fragile local currencies with bullion.

Bitcoin

Public companies holding BTC on their balance sheet have jumped from 2 in 2020 to 151 today.

Buyer Group

Institutional & Retail

Gold

Gold ETFs flipped to net inflows in late 2024, with +$14 bn YTD in 2025.

Bitcoin

U.S. spot-Bitcoin ETFs gathered $125bn in AUM within 18 months of launch—the fastest asset gathering in ETF history.

Buyer Group

Payments Infrastructure

Gold

Embedded in global financial settlement systems for centuries

Bitcoin

Stablecoins settled >$10 trillion on-chain in 2024, rivaling Visa’s payment volume.

Figure 2. Macro Catalysts Fueling the Shift

Macro Catalyst

Fiscal Dominance

Implication for Hard Assets

With global debt-to-GDP above 100%, monetary policy must remain accommodative, intentionally or not, increasing financial repression risk.

Macro Catalyst

Currency Weaponization

Implication for Hard Assets

The 2022 seizure of Russian FX reserves was a wake-up call for reserve managers that fiat assets can be “turned off.” Neutral assets become essential.

Macro Catalyst

Multipolar Trade

Implication for Hard Assets

As nations like the BRICS bloc explore non-USD settlement, gold is the lowest-friction collateral. Bitcoin is the digital, censorship-resistant alternative.

Macro Catalyst

Inflation Volatility

Implication for Hard Assets

Even as headline CPI cools, its volatility remains elevated, raising the structural value of scarce assets as long-term inflation hedges.

The concern that allocating to gold or Bitcoin requires giving up productive, income-generating assets like equities or bonds is both intuitive and legitimate. Neither gold nor Bitcoin produces dividends, interest, or cash flows, which may make these bearer assets appear less compelling. However, this view overlooks the distinctive economic roles they play and why, despite their lack of income, they may still merit a place in a well-constructed portfolio.

Gold, in particular, is often thought of as a hedge. Traditionally, hedges come with a cost: like insurance, they tend to deliver negative expected returns in exchange for protection during crises. Gold, historically, is a rare exception. Since the end of the Bretton Woods system in 1971, gold has exhibited both crisis-hedging properties and a positive real return: compounding at 7.35% annually through 2024. This paradox is resolved by recognizing that gold no longer functions as a passive store of value but now absorbs inflation, currency, and policy risk. Investors holding gold are taking on these macro risks and, as with equities or bonds, expect to be compensated for bearing them. In this way, gold behaves not as insurance, but as a risk-bearing store of value with asymmetric upside in specific economic regimes.

In addition to a risk premium, gold may also benefit from what’s known as a convenience yield: a non-cash benefit associated with holding a highly liquid, universally trusted reserve asset. During periods of market stress, currency instability, or institutional distrust, the demand for physical gold can surge, leading investors to pay a premium for ownership. Central banks, for example, have consistently accumulated gold reserves for macro-prudential reasons, reinforcing structural demand. This sovereign support – sometimes described as an “official-sector put” – can act as a source of price stability and long-run support even outside of traditional return drivers.

Bitcoin, while still in a more speculative and volatile phase of adoption, is increasingly viewed through a similar lens. Though it lacks the centuries-long track record of gold, its hard-capped supply, decentralized governance, and non-sovereign nature make it attractive as a digital analog to gold. Investors do not expect cash flows from Bitcoin, but instead value its scarcity and independence as a hedge against fiat dilution and systemic risk. Like gold, Bitcoin may command a premium for the unique role it plays, particularly among younger investors and institutions seeking uncorrelated, censorship-resistant assets in an increasingly digital economy.

While these assets may not generate income, their value arises from scarcity, liquidity, and their function as macroeconomic hedges. In that sense, gold and Bitcoin are not inferior substitutes for cash-flowing assets, but potential complements: tools that absorb different risks and provide different benefits within a diversified portfolio.

The idea that “they don’t produce cash flow” is not a disqualifier: it’s a feature. Cash-flowing assets like stocks and bonds tend to be priced off interest rates, risk premiums, and economic growth expectations. Gold and Bitcoin, in contrast, respond to different drivers: inflation, currency debasement, monetary expansion, geopolitical instability, and long-term sovereign credibility. This is precisely why return stacking – as we’ll explore in the next section – becomes so valuable: it allows investors to layer these non-cash flowing diversifiers without giving up exposure to traditional, productive assets.

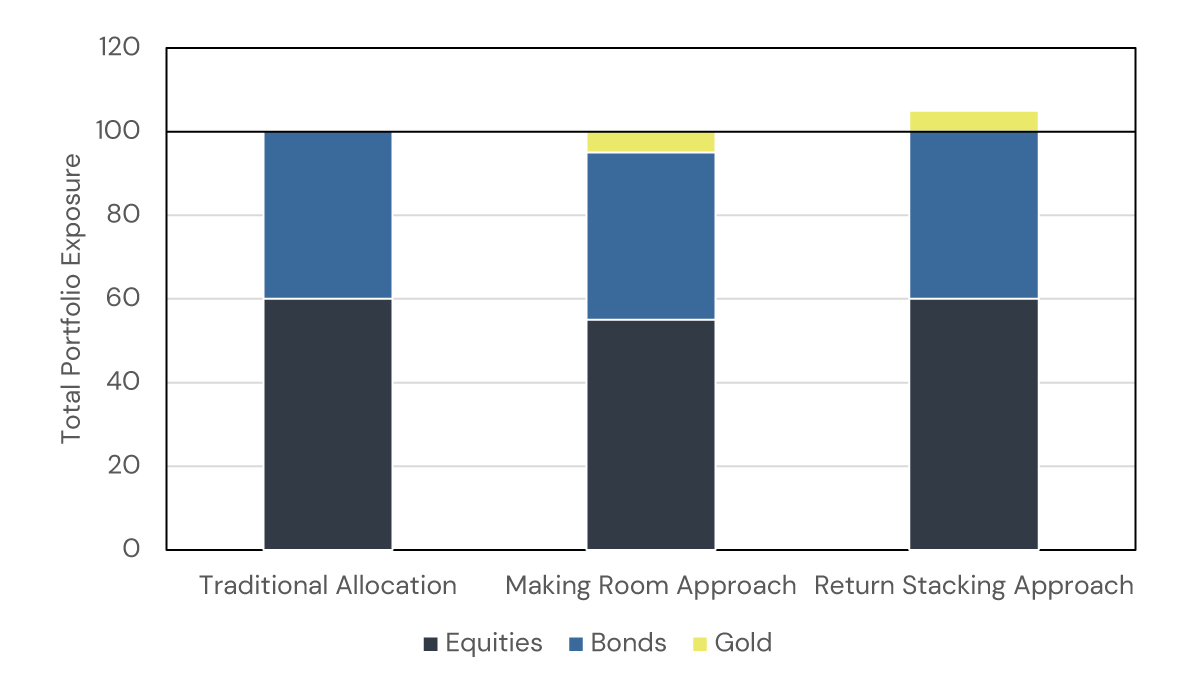

Figure 3. Two Approaches to Diversification: “Making Room” versus “Return Stacking”

For illustrative purposes only. Traditional Allocation is a 60% Equity / 40% Bond Portfolio. The Making Room Approach is a 55% Equity / 40% Bond / 5% Gold portfolio. The Return Stacking Approach shows a 60% Equity / 40% Bond / 5% Gold portfolio.

Viewed this way, the overlay becomes a re-denomination mechanism. It’s not about betting that gold or Bitcoin will outperform, but rather recognizing that diversification also extends to currency regimes. By adding exposure to bearer assets that are not tied to the fiscal or monetary credibility of any single government, investors can construct portfolios that are more resilient across a broader set of macroeconomic environments.

In a world where currency debasement and financial repression are more than theoretical risks, the ability to partially denominate a portfolio in hard assets like gold and Bitcoin – without sacrificing core holdings – offers a compelling evolution in portfolio design. Overlaying these exposures acknowledges their potential role not only as tactical diversifiers, but as structural components in the architecture of long-term wealth preservation.

Conclusion

Gold and Bitcoin are no longer fringe curiosities: they are increasingly being embraced by central banks, institutional investors, and a new generation of asset allocators for their unique role in navigating an evolving macroeconomic landscape. While neither asset generates cash flow, both offer scarce, non-sovereign stores of value that can hedge against currency debasement, inflation shocks, and systemic risk.

Importantly, investors no longer need to choose between owning these assets and maintaining exposure to traditional equities and bonds. By shifting from substitution to overlay, gold and Bitcoin can serve as complements rather than replacements—effectively re-denominating a portion of the portfolio in alternative monetary assets without sacrificing core return drivers.

In doing so, investors may achieve deeper diversification—not just across asset classes, but across monetary regimes—positioning portfolios to better withstand a range of future economic outcomes.