Diversification 2.0 Redefining Risk Management with Return Stacking

Overview

In the ever-evolving landscape of investment management, effective diversification remains a cornerstone of portfolio construction. As financial markets become increasingly interconnected and traditional asset allocation strategies face limitations, return stacking (sometimes referred to as portable alpha) continues to gain traction among investors. This article explores how return stacking may redefine risk management and diversification, offering a fresh perspective on portfolio construction for investors.

Key Topics

Return Stacking, Diversification, Risk Management

Traditional Diversification vs Return Stacked Diversification

Limitations of Conventional Asset Allocation

Conventional asset allocation strategies have long relied on diversification across different asset classes to manage risk and enhance returns. However, these traditional approaches can face several limitations:

- Correlation Breakdown: During market stress, many asset classes that typically show low correlation can suddenly become highly correlated, reducing the benefits of diversification when it’s needed most.

- Opportunity Cost: Adding diversifying assets often requires reducing exposure to core holdings, potentially limiting upside potential in favorable market conditions.

- Tracking Error Concerns: For benchmark-sensitive investors, introducing alternative assets can lead to significant tracking error, as highlighted in Figure 1.

Source: Tiingo. Calculations by Newfound Research. Stocks is the SSgA S&P 500 Trust (“SPY”). Bonds is the iShares Core U.S. Bond ETF (“AGG”). Commodities is the Invesco DB Commodity Index Tracking Fund (“DBC”). Returns are gross of all fees, transaction costs, and taxes with the exception of underlying fund expense ratios. Returns assume the reinvestment of all distributions. 60/40 is 60% Stocks / 40% Bonds. 50/40/10 is 50% Stocks / 40% Bonds / 10% Commodities. 54/36/10 is 54% Stocks / 36% Bonds / 10% Commodities. 60/30/10 is 60% Stocks / 30% Bonds / 10% Commodities. Past performance is not indicative of future results.

Figure 1 illustrates how different asset allocation schemes that introduce commodities exposure by reducing stock and bond holdings can lead to underperformance relative to a traditional 60/40 portfolio, especially during periods when traditional investment assets perform well (the 2010s for example).

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

The Return Stacking Approach to Diversification

Return stacking offers an approach to potentially address these limitations by allowing investors to add diversifying exposures without necessarily reducing allocations to core holdings. This approach leverages capital-efficient instruments to achieve more than $1 of exposure for every $1 invested.

Figure 2: Active Returns of Different Asset Allocation Schemes

Source: Tiingo. Calculations by Newfound Research. Stocks is the SSgA S&P 500 Trust (“SPY”). Bonds is the iShares Core U.S. Bond ETF (“AGG”). Commodities is the Invesco DB Commodity Index Tracking Fund (“DBC”). Cash is the SSgA 1-3 Month Treasury Bill ETF (“BIL”). Returns are gross of all fees, transaction costs, and taxes with the exception of underlying fund expense ratios. Returns assume the reinvestment of all distributions. 60/40 is 60% Stocks / 40% Bonds. 50/40/10 is 50% Stocks / 40% Bonds / 10% Commodities. 54/36/10 is 54% Stocks / 36% Bonds / 10% Commodities. 60/30/10 is 60% Stocks / 30% Bonds / 10% Commodities. 60/40/10 is 60% Stocks / 40% Bonds / 10% Commodities / -10% Cash. Past performance is not indicative of future results.

Figure 2 demonstrates how return stacking may allow investors to maintain their core 60/40 allocation while adding commodities exposure (the 60/40/10 in Figure 2), potentially leading to improved performance and diversification benefits.

Key Components of Return Stacked Diversification

Leveraging Core Exposures

Return stacking utilizes capital-efficient instruments, such as futures contracts, to maintain or even increase exposure to core asset classes without fully funding these positions. This approach allows investors to free up capital for additional diversifying strategies.

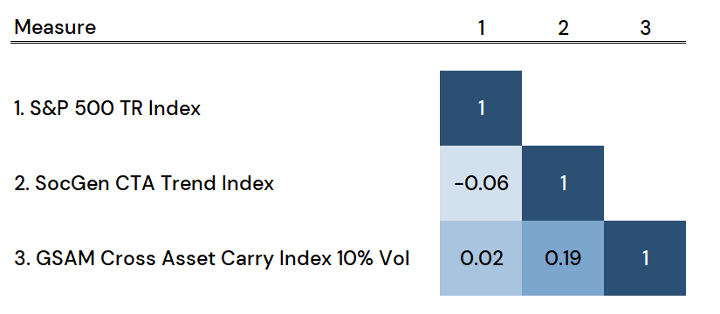

Figure 3. Correlations: S&P 500 TR Index Versus Alternative Betas

Source: Bloomberg. U.S. Stocks is the S&P 500 Index (“SPX”). Returns are gross of all fees. Alternative Beta Stack is the Société Générale Trend Index (“NEIXCTAT”) Bloomberg GSAM Cross-Asset Carry Index (Excess Return “BGSXAC”). You cannot invest in an index.

Figure 3 illustrates the historically low correlation between traditional equity markets (represented by the S&P 500) and alternative strategies like trend following and carry, highlighting the potential diversification benefits of incorporating these strategies into a portfolio.

The Return Stacking landscape is ever evolving, go deeper by connecting with a team member.

Risk Management in Return Stacked Portfolios

Implementing return stacking in investment portfolios can help mitigate drawdowns during market stress periods. By incorporating strategies that have historically performed well during equity market downturns, investors may reduce overall portfolio volatility and improve risk-adjusted returns.

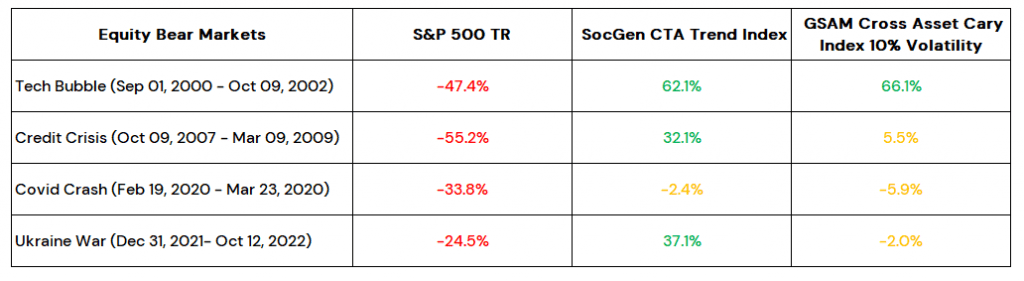

Figure 4. Worst Equity Bear Markets Since the Year 2000

Source: Bloomberg. U.S. Stocks is the S&P 500 Index (“SPX”). Returns are gross of all fees. Alternative Beta Stack is the Société Générale Trend Index (“NEIXCTAT”) Bloomberg GSAM Cross-Asset Carry Index (Excess Return “BGSXAC”). You cannot invest in an index. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Figure 4 demonstrates how alternative strategies like trend following and carry have historically provided positive returns or limited losses during significant equity market drawdowns, potentially offering diversification benefits during periods of market stress.

Case Studies: Diversification Effects in Action

Performance During Market Stress Periods

The 2008 Financial Crisis and the 2020 COVID-19 market crash provide examples of how return stacked portfolios incorporating alternative strategies could potentially outperform traditional portfolios during periods of market stress.

Long-Term Risk-Adjusted Returns Comparison

Over longer time horizons, return stacked portfolios have shown the potential to deliver superior risk-adjusted returns compared to traditional asset allocation approaches.

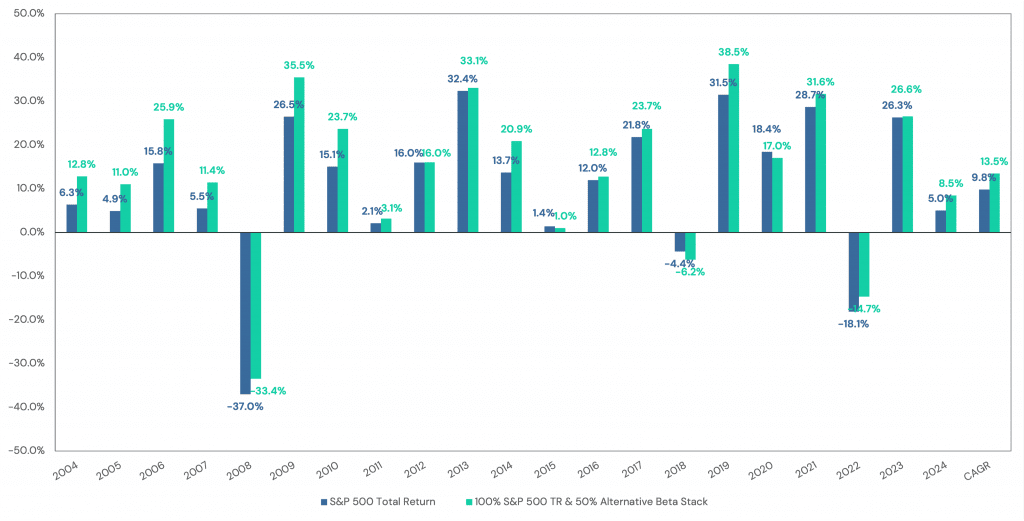

Figure 5. Annual Returns from February 14, 2004 to February 14, 2024

Source: Bloomberg. U.S. Stocks is the S&P 500 Index (“SPX”). Returns are gross of all fees. Alternative Beta Stack is 25% of CTA Trend which is the Société Générale Trend Index (“NEIXCTAT”) excess returns less 3 month T-bill using CBOE short-term interest rate index (“IRX”) and 25% of a 10% volatility scaled Bloomberg GSAM Cross-Asset Carry Index (Excess Return). You cannot invest in an index.

Figure 5 illustrates the potential for a return stacked portfolio to outperform a traditional equity-only portfolio over time, with more consistent positive returns and reduced drawdowns during market downturns.

Conclusion: The Future of Portfolio Diversification

Return stacking represents a paradigm shift in portfolio construction, offering investors a tool to potentially enhance diversification and may improve risk-adjusted returns. By leveraging capital-efficient instruments and incorporating uncorrelated alternative strategies, return stacking provides a framework for addressing many of the limitations of traditional asset allocation approaches.

As markets continue to evolve and the benefits of diversified alternatives in investing become increasingly apparent, return stacking could play a significant role in shaping the future of portfolio diversification. For RIAs and sophisticated investors seeking to optimize their portfolios for an uncertain future, exploring the potential of return stacked diversification may prove to be a valuable endeavor.

To learn more about how return stacking can enhance your portfolio diversification strategy, click here to connect with a team member and explore tailored solutions for your investment needs.

Disclaimers:

The information presented in this article is for informational purposes only and is not intended to provide investment advice. Past performance is not indicative of future results, and there are risks associated with investing, including the loss of principal. The strategies and techniques discussed involve complex investment considerations and may not be suitable for all investors. Hypothetical or simulated performance results have inherent limitations and do not reflect actual trading experiences. Before implementing any investment strategy, individuals should consult with a qualified investment adviser to ensure it aligns with their financial situation and objectives.