Return Stacked® Academic Review

Trend Following: Why?

Authors

Aspect Capital

Aspect Capital Insight Paper

Key Topics

return stacking, portable alpha, diversification, managed futures, trend following, carry, equities, yield, risk management, portfolio construction

Exploring the Power of Trend Following Strategies

Aspect Capital’s insight paper, “Trend Following: Why?”, delves into the enduring effectiveness of trend following strategies across various market conditions. The paper highlights how these strategies can enhance portfolio performance by providing return enhancement, drawdown reduction, and volatility mitigation.

Trend following strategies employ enhanced models to capture price trends across multiple asset classes and timeframes. By allocating to modulating strategies that utilize information beyond price alone, these programs adapt to changing market dynamics. The diversified trading universe—including liquid futures, FX forwards, and cleared OTC swaps across various sectors—allows for identification and exploitation of trending opportunities globally.

The motivation behind the paper is to showcase the practical benefits of incorporating trend following into investment portfolios. Aspect Capital emphasizes the strategies’ directional flexibility, which enables them to profit in both rising and falling markets through long and short positions. Their uncorrelated returns, exhibiting low and adaptive correlation to traditional and alternative assets, make them valuable tools for investors seeking to optimize portfolios for growth and stability.

Visualizing the Benefits of Trend Following

Figure 1: Half-Yearly Performance of Equities and Managed Futures (1980–2022) (Original: Figure 4)

Source: Aspect Capital, CISDM, SG Trend, Macrobond. Note: Aspect Diversified started trading on 15th December 1998. The returns are net of fees. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

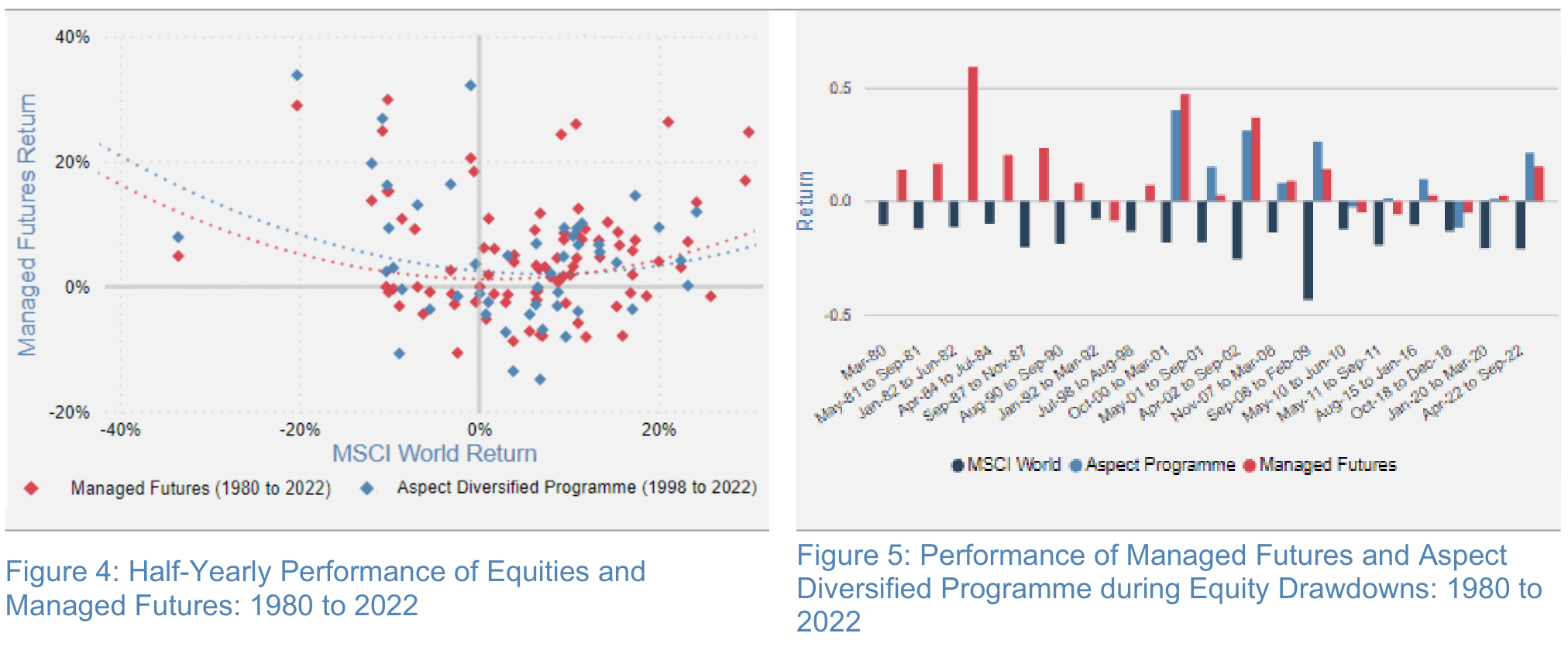

Figure 1 presents a scatter plot of half-yearly returns of managed futures versus the MSCI World Index from 1980 to 2022. It reveals a non-linear relationship, showing that trend following strategies tend to deliver substantial positive returns during both the best and worst periods for equity markets. This indicates that trend following can act as a powerful diversifier, providing significant benefits during extreme market conditions.

Figure 2 further emphasizes this point by showcasing the performance of managed futures during equity drawdown periods. The consistent positive returns of both the Aspect Diversified Programme and the broader managed futures universe during these challenging times highlight their potential to provide crisis alpha when it’s most needed. This ability to thrive in turbulent markets is a key differentiator for trend following and a compelling reason for its inclusion in a diversified portfolio.

The figures underscore how these strategies are not simply uncorrelated with equities but can offer strong positive returns when traditional assets falter. This crisis alpha potential is a key differentiator, highlighting the value of trend following in achieving portfolio resilience.

Integrating Trend Following into Return Stacked Portfolios

The insights from Aspect Capital’s paper have significant implications for return stacking strategies. Return stacking involves combining multiple, uncorrelated return streams to enhance overall portfolio performance and manage risk efficiently. Trend following, with its ability to generate returns in various market environments and low correlation to traditional assets, is well-suited for this approach.

By incorporating trend following into return stacked portfolios, investors can create more robust, all-weather strategies. The non-linear correlation with equities and capacity to provide crisis alpha make trend following a valuable component alongside traditional asset classes. This integration can lead to smoother returns and reduced portfolio volatility.

For a deeper understanding of how trend following fits into return stacking, explore our article on managed futures and trend following. Additionally, understanding the concept of portable alpha can provide insights into leveraging alternative return sources without altering the core risk profile of a portfolio.

Conclusion

Aspect Capital’s “Trend Following: Why?” makes a compelling case for including trend following strategies in modern investment portfolios. The ability of these strategies to enhance returns, reduce drawdowns, and lower volatility underscores their value in achieving diversification. Their directional flexibility and uncorrelated returns are particularly beneficial in constructing portfolios that can withstand various market conditions.

In the context of return stacking, trend following serves as a powerful tool for investors aiming to optimize performance and manage risk. By embracing these strategies, investors can enhance portfolio resilience and navigate the complexities of the evolving investment landscape with greater confidence.