Return Stacked® Academic Review

A Century of Evidence on Trend-Following Investing

Authors

Brian Hurst, Yoa Hua Ooi, and Lasse Heje Pedersen

The Journal of Portfolio Management, Volume 44, Number 1, Fall 2017

Key Topics

trend following, return stacking, diversification, leverage, managed futures, carry, bonds, equities, portfolio construction, capital efficiency, risk management

Exploring the Longevity of Trend-Following Strategies

In “A Century of Evidence on Trend-Following Investing,” authors Brian Hurst, Yao Hua Ooi, and Lasse Heje Pedersen provide an extensive analysis of trend-following strategies over more than a century of market data. The study investigates the efficacy of time-series momentum—buying assets that have performed well and selling those that have underperformed – across various asset classes and market conditions. By examining data from 1880 to 2016, the authors aim to determine whether trend-following can consistently deliver positive returns after accounting for transaction costs and fees.

The methodology involves constructing a diversified portfolio that trades futures contracts across 67 markets, including equities, bonds, commodities, and currencies. The strategy uses momentum signals based on 1-month, 3-month, and 12-month returns to determine trading positions. Positions are sized to target a constant volatility level, ensuring risk is managed consistently over time. The portfolio is rebalanced monthly and scaled to achieve a 10% annualized volatility, making it comparable to other investment strategies in terms of risk.

Crucially, the authors account for real-world considerations by incorporating historical estimates of transaction costs and simulating a typical hedge fund fee structure. This approach provides a realistic assessment of the net performance that investors might expect from implementing such a strategy.

Key Insights from Historical Performance

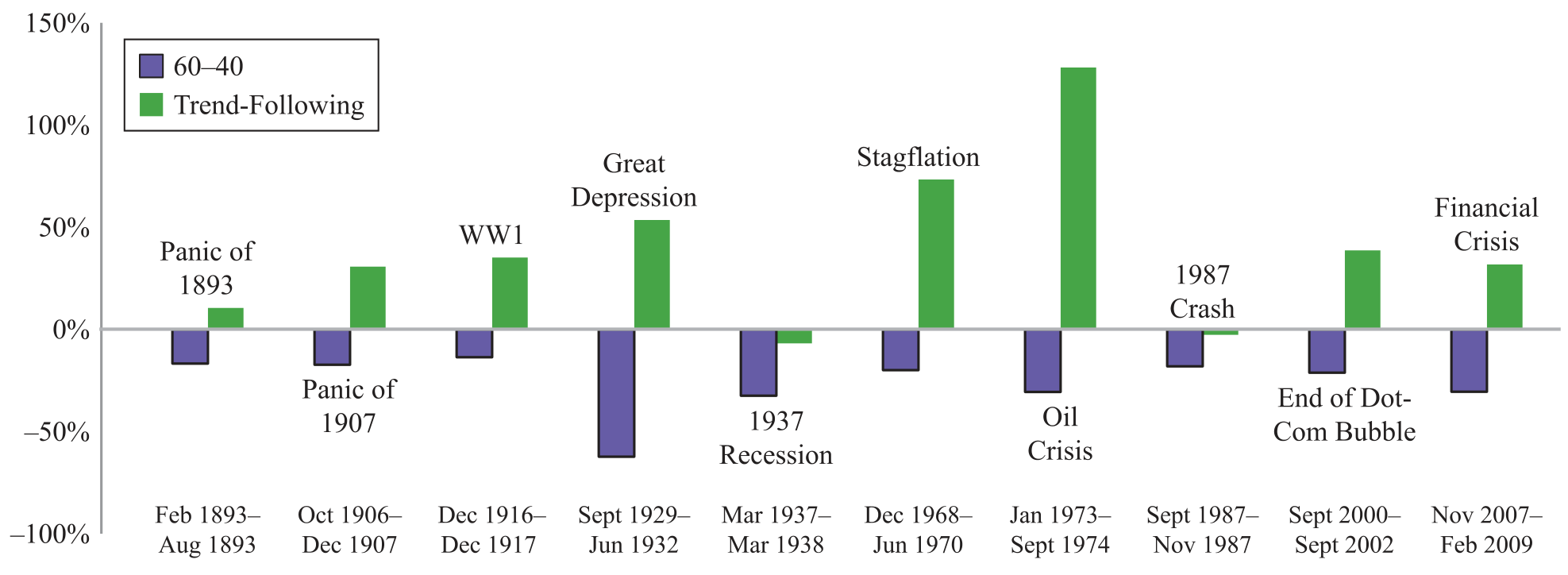

One of the study’s most compelling findings is the performance of trend-following strategies during major market drawdowns. By analyzing the ten worst periods for a traditional 60/40 portfolio (comprising 60% U.S. equities and 40% U.S. bonds), the authors highlight the potential for trend-following strategies to generate positive returns when traditional assets are under stress.

Figure 1: Trend-Following Performance During the 10 Worst 60/40 Drawdowns (Original: Figure 6)

Note: Returns of time-series momentum (net of cost, gross of fee) and the 60/40 portfolio during its largest drawdowns.

As shown in Figure 1, the trend-following strategy produced positive returns in eight out of the ten worst drawdowns for the 60/40 portfolio. This suggests that trend-following can serve as a valuable hedge, offering a potential source of “crisis alpha” when traditional portfolios suffer significant losses.

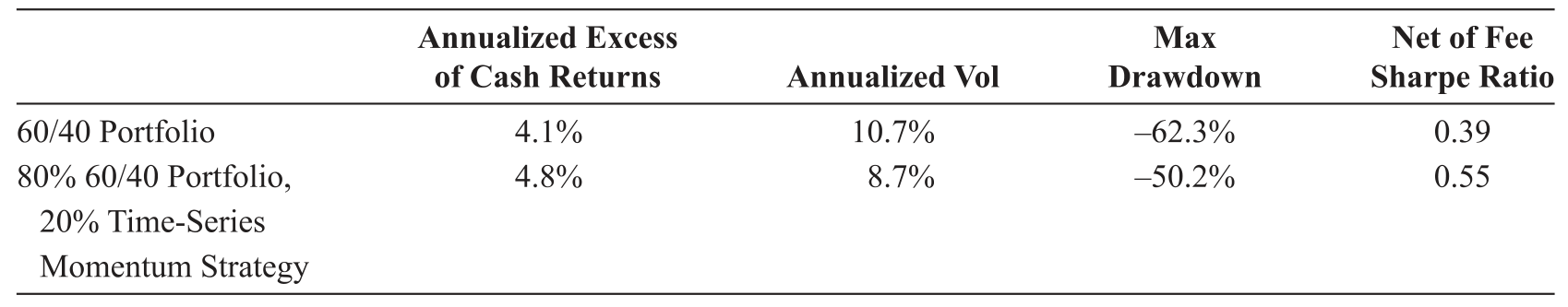

Another key insight is the improved risk-adjusted returns when incorporating trend-following into a traditional portfolio. The study demonstrates that allocating a portion of a traditional portfolio to trend-following can reduce volatility and drawdowns while enhancing overall returns.

Figure 2: Impact of Adding Trend-Following to a Traditional Portfolio (1880–2016) (Original: Figure 7)

Note: Performance characteristics of a 60/40 portfolio and a portfolio with 80% in 60/40 and 20% in time-series momentum (net of fees and costs).

Figure 2 illustrates that a portfolio with 20% allocated to the trend-following strategy not only achieved higher returns but also experienced lower volatility and drawdowns compared to the standalone 60/40 portfolio. This enhancement in the Sharpe ratio underscores the diversification benefits of adding uncorrelated return streams to traditional investments.

Integrating Trend Following into Return Stacked Portfolios

The findings of this study have significant implications for return stacking strategies, which aim to layer multiple uncorrelated return streams onto a traditional portfolio to enhance returns and improve capital efficiency. Trend-following strategies, due to their low correlation with traditional assets and ability to perform well during market downturns, are ideal candidates for return stacking.

For instance, investors can consider incorporating managed futures trend-following strategies into their portfolios. By doing so, they effectively add an uncorrelated source of returns that can potentially offset losses during equity market downturns. This approach aligns with the principles of return stacking, where the goal is to build more resilient portfolios capable of navigating various market environments.

Moreover, combining trend-following with other alternative strategies, such as a carry strategy, can further enhance diversification. The carry strategy focuses on capturing the yield or “carry” of assets, providing a different source of returns. By layering both strategies, investors may achieve a more balanced exposure to different risk premiums.

The strategic use of leverage in trend-following also plays a role in return stacking. By employing leverage judiciously, investors can increase their exposure to trend-following strategies without displacing their existing allocations, thereby improving capital efficiency. However, it’s crucial to manage leverage carefully to ensure that the overall risk remains within acceptable levels.

Conclusion: The Enduring Value of Trend Following

“A Century of Evidence on Trend-Following Investing” offers robust evidence that trend-following strategies have consistently delivered positive returns across different markets and time periods. The study’s comprehensive analysis, accounting for transaction costs and fees, demonstrates that trend-following not only enhances returns but also reduces portfolio risk when combined with traditional assets.

The ability of trend-following strategies to generate positive performance during market crises makes them a valuable addition to portfolios, particularly within a return stacking framework. By integrating trend-following, investors can potentially achieve better risk-adjusted returns, mitigate drawdowns, and build more resilient portfolios.

While no investment strategy is without limitations, and trend-following may underperform during certain market conditions, its historical track record suggests it can play a significant role in modern portfolio construction. Investors seeking to navigate the complexities of today’s markets may find that incorporating trend-following into their strategies offers meaningful benefits over the long term.