Return Stacked® Academic Review

Capturing Unpredictability: Trend Following Alpha

Authors

Aspect Capital Insight Series, 2023

Capturing Unpredictability: Trend Following Alpha

Key Topics

trend following, portable alpha, diversification, risk management, portfolio construction, managed futures, equities, bonds

Exploring the Enduring Power of Trend Following Strategies

In their paper, “Capturing Unpredictability: Trend Following Alpha,” Aspect Capital researchers analyze trend following, a quantitative investment strategy. While often seen as a generator of “crisis alpha” during market downturns, the authors propose viewing it as a way to capture “unpredictability alpha.” This reframing highlights the strategy’s capacity to benefit from persistent market trends across different asset classes, regardless of the prevailing economic climate.

Key Insights and Performance Analysis

Trend Following Performance Across Decades

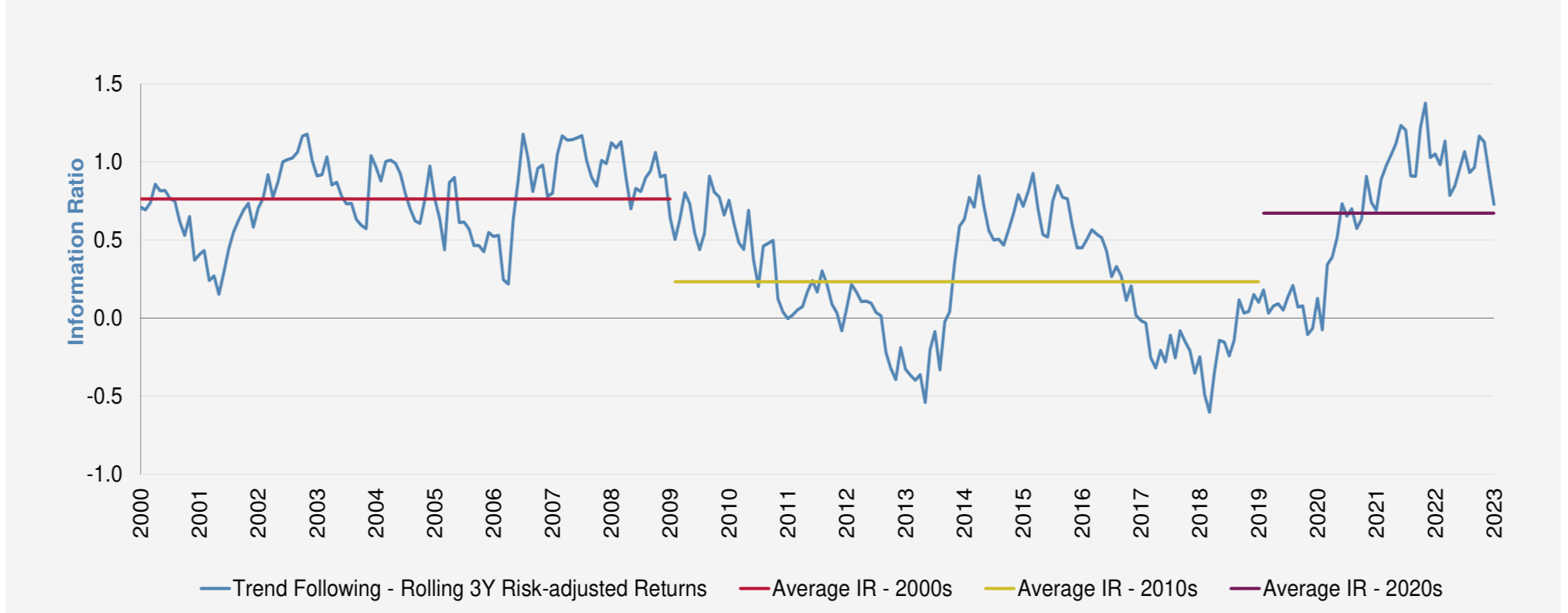

The study analyzes the historical performance of trend following strategies over multiple decades and market regimes. Utilizing indices like the SG CTA Index and the SG Trend Index as proxies, the authors compare these strategies against traditional assets such as equities and bonds, evaluating effectiveness through risk-adjusted returns (Information Ratio) and skewness.

Figure 1: Risk-Adjusted Returns for CTAs by Decade (2000–2023) (Original: Figure 1)

Source: SG CTA Index. Note: The data above with respect to various indices is shown for illustrative purposes only. Detailed descriptions of the indices used are available from Aspect upon request. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Please see relevant risk disclaimers at the end of this document.

Skewness and Portfolio Diversification

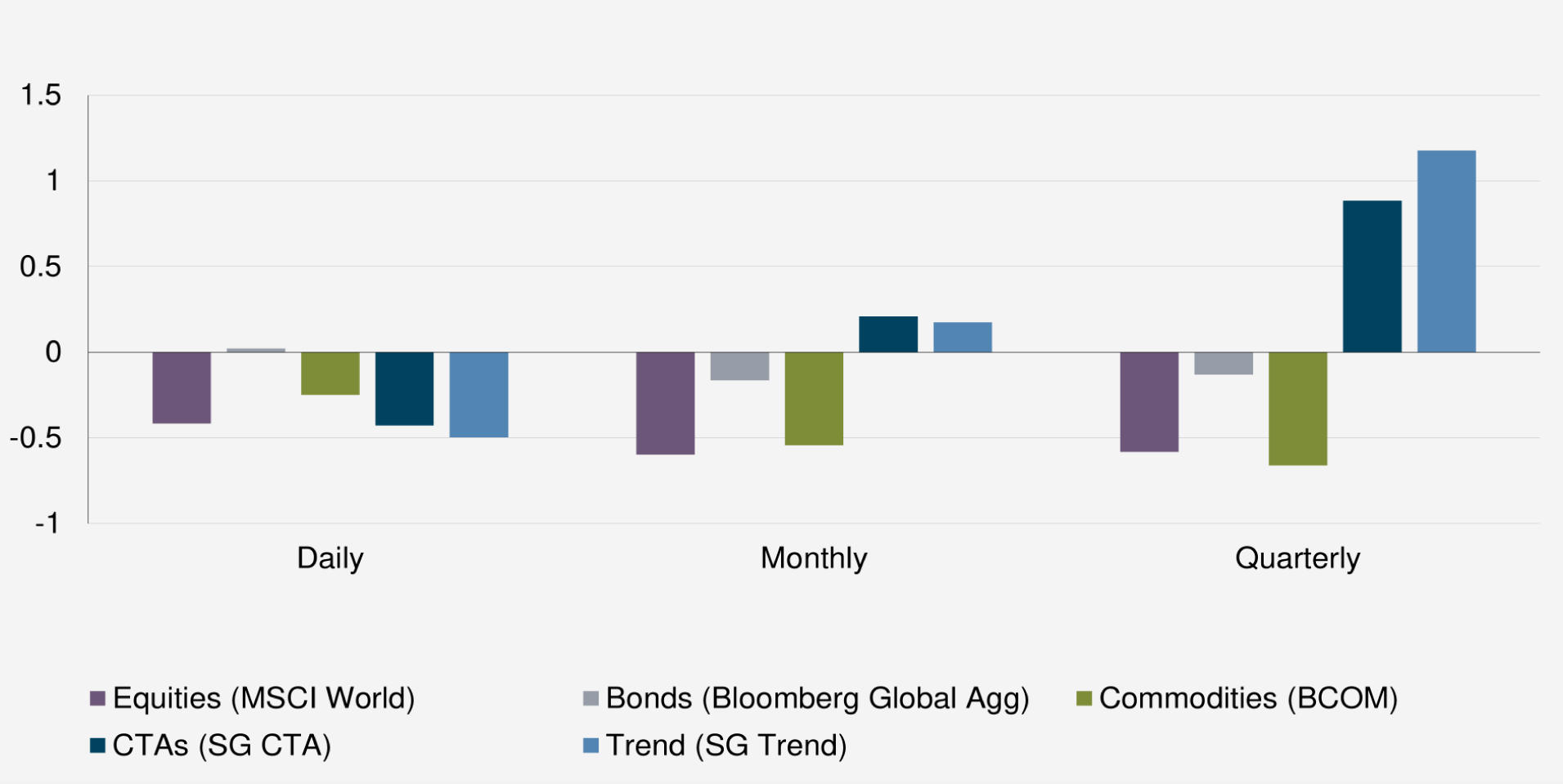

Figure 2: Skewness Profile of CTAs vs. Traditional Asset Classes (2000–2023) (Original: Figure 4)

Source: SG CTA Index, Bloomberg. The data above with respect to various indices is shown for illustrative purposes only. Detailed descriptions of the indices used are available from Aspect upon request. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Please see relevant risk disclaimers at the end of this document.

Figure 2 compares the skewness of trend following strategies with equities, bonds, and commodities across different timeframes. Trend following exhibits pronounced positive skewness, especially over monthly and quarterly periods, while traditional assets consistently show negative skewness. This positive skewness implies potential for outsized positive returns that can offset smaller losses, enhancing portfolio diversification and mitigating the impact of market downturns.

Integrating Trend Following into Return Stacking Portfolios

The insights from Aspect Capital’s research have important implications for return stacking strategies, which seek to combine multiple uncorrelated return streams to build more resilient portfolios. Incorporating trend following can enhance a portfolio’s risk-adjusted returns and reduce vulnerability to market drawdowns.

In uncertain markets where traditional correlations may break down, trend following’s ability to capitalize on sustained trends across asset classes is particularly valuable. Its adaptability allows it to perform across various market regimes, aligning with the goals of return stacking. Investors interested in integrating trend following into their strategies can explore how it complements traditional assets and other alternatives, contributing to a more robust portfolio. For further reading on this integration, consider Managed Futures in Trend Following Strategies and the concept of Portable Alpha.

Conclusion: The Enduring Value of Trends

“Capturing Unpredictability: Trend Following Alpha” provides a compelling analysis of trend following’s role in modern investment portfolios. By viewing it as a source of unpredictability alpha, the strategy’s potential to deliver positive returns across diverse market conditions is highlighted. The positive skewness and low correlation with traditional assets make trend following a valuable component for enhancing diversification and managing risk.

For investors employing return stacking strategies, incorporating trend following can contribute to building more adaptable and resilient portfolios. As unpredictability becomes a defining feature of financial markets, leveraging strategies that thrive in such environments is increasingly crucial for long-term investment success.