Return Stacked® Academic Review

Trend Following: How?

Authors

Aspect Capital

Aspect Capital Insight Paper

Trend Following: How?

Key Topics

return stacking, portable alpha, diversification, leverage, managed futures, trend following, carry, bonds, equities, yield, risk management, portfolio construction, capital efficiency

Demystifying Systematic Trend Following

Systematic trend following often appears complex, but Aspect Capital’s insight paper “Trend Following: How?” seeks to clarify this investment approach by highlighting its fundamental simplicity and effectiveness. Instead of predicting market movements, trend following capitalizes on existing trends across various liquid financial markets. By going long on assets in upward trends and short on those in downward trends, this strategy leverages persistent market behaviors driven by factors like human biases and structural feedback loops.

The strategy’s strength lies in its reactive nature – responding to trends rather than forecasting them. This approach sets it apart from traditional investment strategies that typically rely on market predictions and often maintain a long-only bias. Trend following focuses on identifying momentum in market prices and positioning accordingly, all within a framework of stringent risk management.

Core Components of an Effective Trend Following Strategy

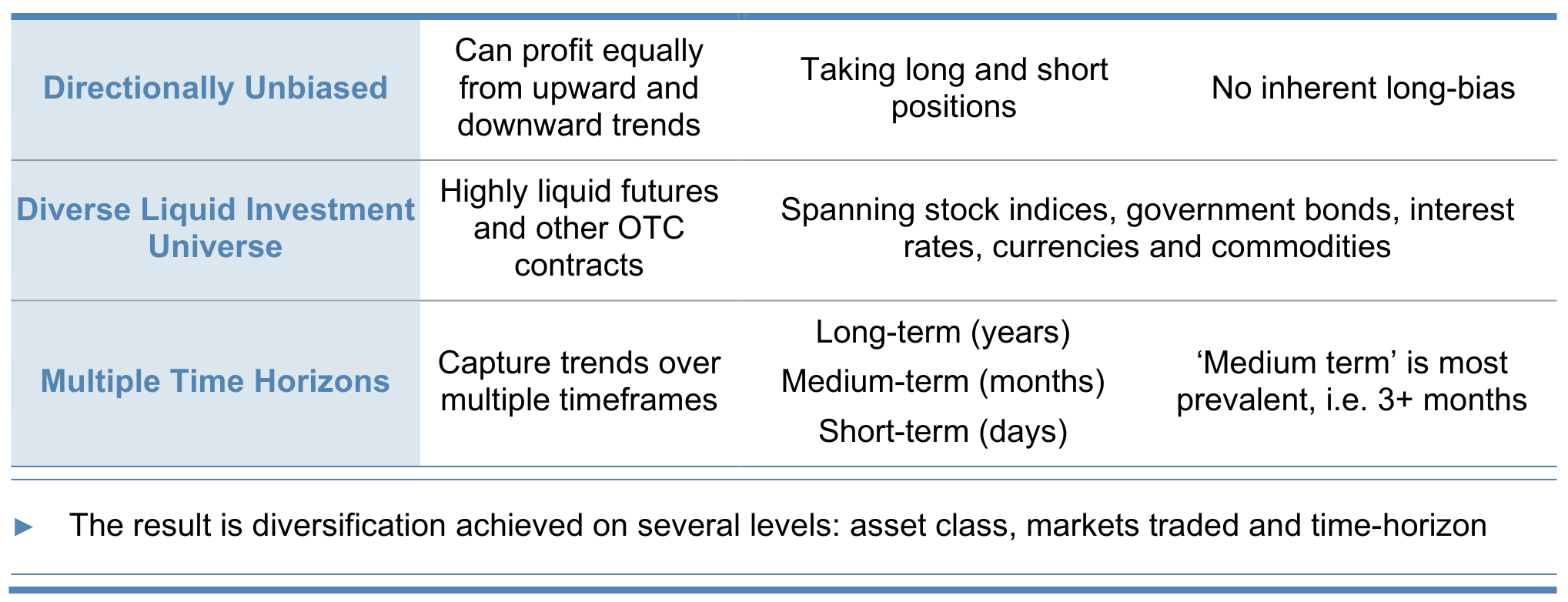

Implementing a successful trend following strategy involves several key components:

- Directional Unbiased Approach: By being neutral to market direction, the strategy can potentially profit from both rising and falling markets.

- Diversified Liquid Investment Universe: Applying the strategy across a wide range of markets—including equities, bonds, interest rates, currencies, and commodities—enhances diversification and reduces reliance on any single asset class.

- Multiple Time Horizons: Utilizing various time frames allows the strategy to capture trends over different durations, increasing flexibility and adaptability to changing market conditions.

Figure 1: Key Features of Trend Following (Original: Figure 1)

The systematic process begins with collecting and processing market price data. Statistical techniques, such as moving averages, help identify trends, which are then translated into market forecasts. Position construction considers factors like volatility scaling and sector weights to maintain a balanced and diversified portfolio. Risk management is integral, with strategies like volatility scaling adjusting position sizes based on current market volatility to stabilize portfolio risk.

Adapting to Changing Market Conditions

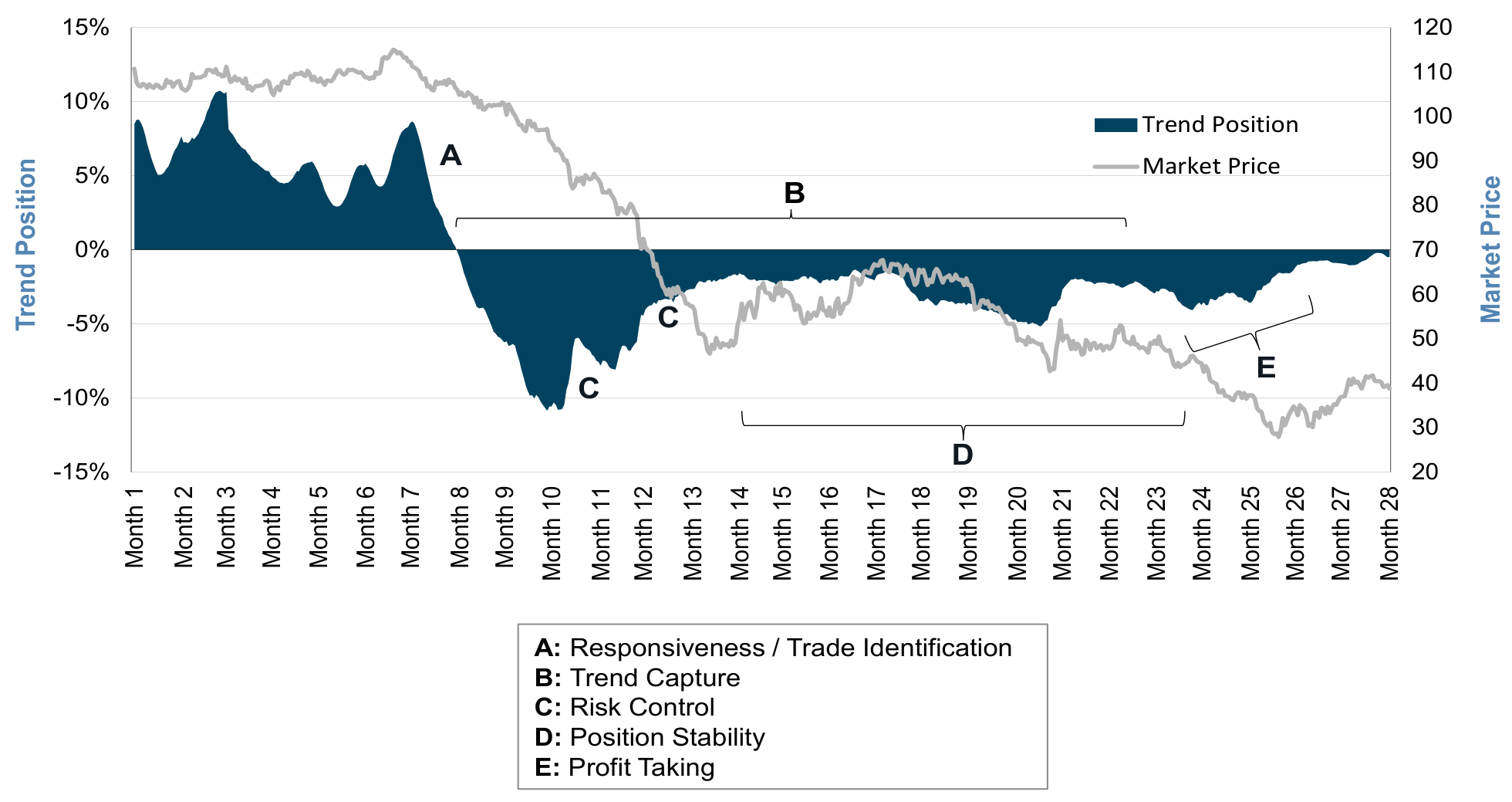

An effective trend following strategy dynamically adjusts positions in response to evolving market landscapes. The following illustration depicts how the strategy might react over time:

Figure 2: Illustrative Trend Following Position in Changing Market Conditions (Original: Figure 3)

For illustrative purposes only

Sources: https://scratch.investresolve.com/NNzC6nzN3y4faGBD8yrz49bihAQ/how_trend_following_works/how_trend_following_works.pdf_

- Region A: Reduction of a long position as a downward trend begins.

- Region B: Transition to a short position, increasing exposure as the downtrend strengthens.

- Region C: Position size reduction due to increased market volatility, emphasizing risk management.

- Region D: Maintenance of position stability during periods of market noise, avoiding overreaction.

- Region E: Gradual position reduction to lock in profits and mitigate potential impacts from trend reversals.

This approach underscores the strategy’s focus on capturing trends while diligently managing risk, reflecting net performance after accounting for fees and costs.

Integrating Trend Following into Return Stacked Portfolios

Trend following’s directionally unbiased and diversified nature makes it a suitable candidate for return stacked portfolios. It acts as a form of portable alpha, aiming to generate excess returns independent of market direction. Additionally, some trend following implementations may include carry strategies, further enhancing portfolio yield through capturing the differential in interest rates or yields across markets.

By integrating trend following, investors can potentially improve their portfolio’s resilience against market downturns and volatility, benefiting from the strategy’s adaptability and risk management focus.

Strengthening Portfolios with Trend Following

Aspect Capital’s exploration of systematic trend following provides valuable insights into how this strategy can serve as a powerful tool for diversification and risk management. By reacting to market trends across various assets and time horizons, trend following can enhance a portfolio’s ability to navigate different market environments.

Investors seeking to build more robust portfolios may find that incorporating trend following aligns well with return stacking strategies. Understanding and applying the principles of trend following can contribute to a more balanced investment approach, potentially leading to improved risk-adjusted returns and greater portfolio resilience.