Return Stacked® Academic Review

The Shrinking Merger Arbitrage Spread: Reasons and Implications

Authors

Gaurav Jetley and Xinyu Ji

Financial Analysts Journal, 2010

Link to the Article

Key Topics

return stacking, portable alpha, diversification, leverage, managed futures, trend following, carry, bonds, equities, yield, risk management, portfolio construction, capital efficiency

Analyzing the Evolution of Merger Arbitrage Spreads

Merger arbitrage, a strategy that capitalizes on price discrepancies in the stocks of companies involved in mergers and acquisitions (M&A), has traditionally offered investors attractive returns. However, the financial landscape has shifted, prompting a reevaluation of this strategy’s effectiveness. In their 2010 study published in the Financial Analysts Journal, Gaurav Jetley and Xinyu Ji investigate the significant decline in merger arbitrage spreads and explore the underlying reasons and implications for investors.

Leveraging a comprehensive dataset from the Thomson ONE Banker database, the authors examine 2,182 M&A deals involving U.S. publicly traded target companies from 1990 to 2007. The study focuses on transactions where acquirers gain majority control, calculating arbitrage spreads for cash, stock, and hybrid deals. By tracking these spreads from the day after the merger announcement to the resolution date, Jetley and Ji identify trends over nearly two decades.

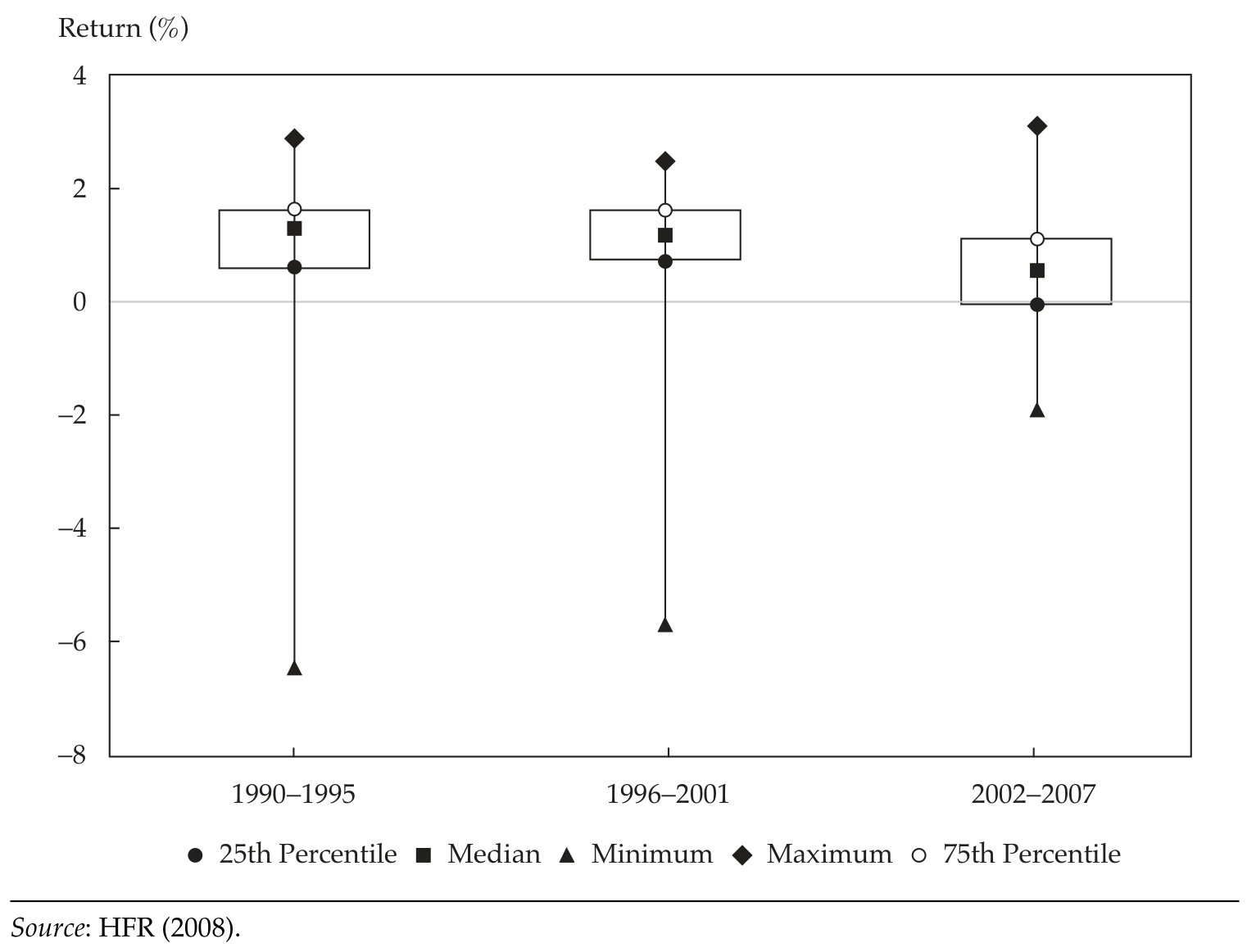

Their analysis reveals that since 2002, the merger arbitrage spread has contracted by over 400 basis points – a decline that is both economically and statistically significant. This contraction corresponds with a parallel decrease in the aggregate returns of merger arbitrage hedge funds, suggesting a structural shift in the strategy’s profitability rather than a temporary market fluctuation.

Key Figures Illustrating the Decline in Arbitrage Spreads

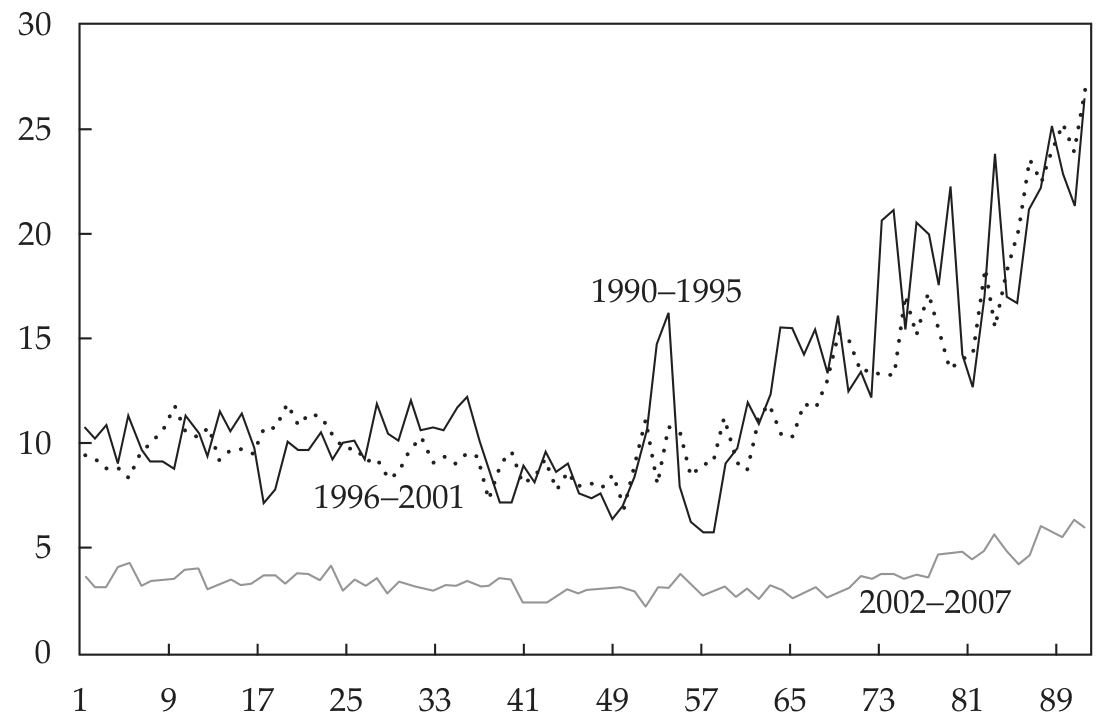

Figure 1: Median Arbitrage Spreads for M&A Deals, 1990–2007 (Original: Figure 1)

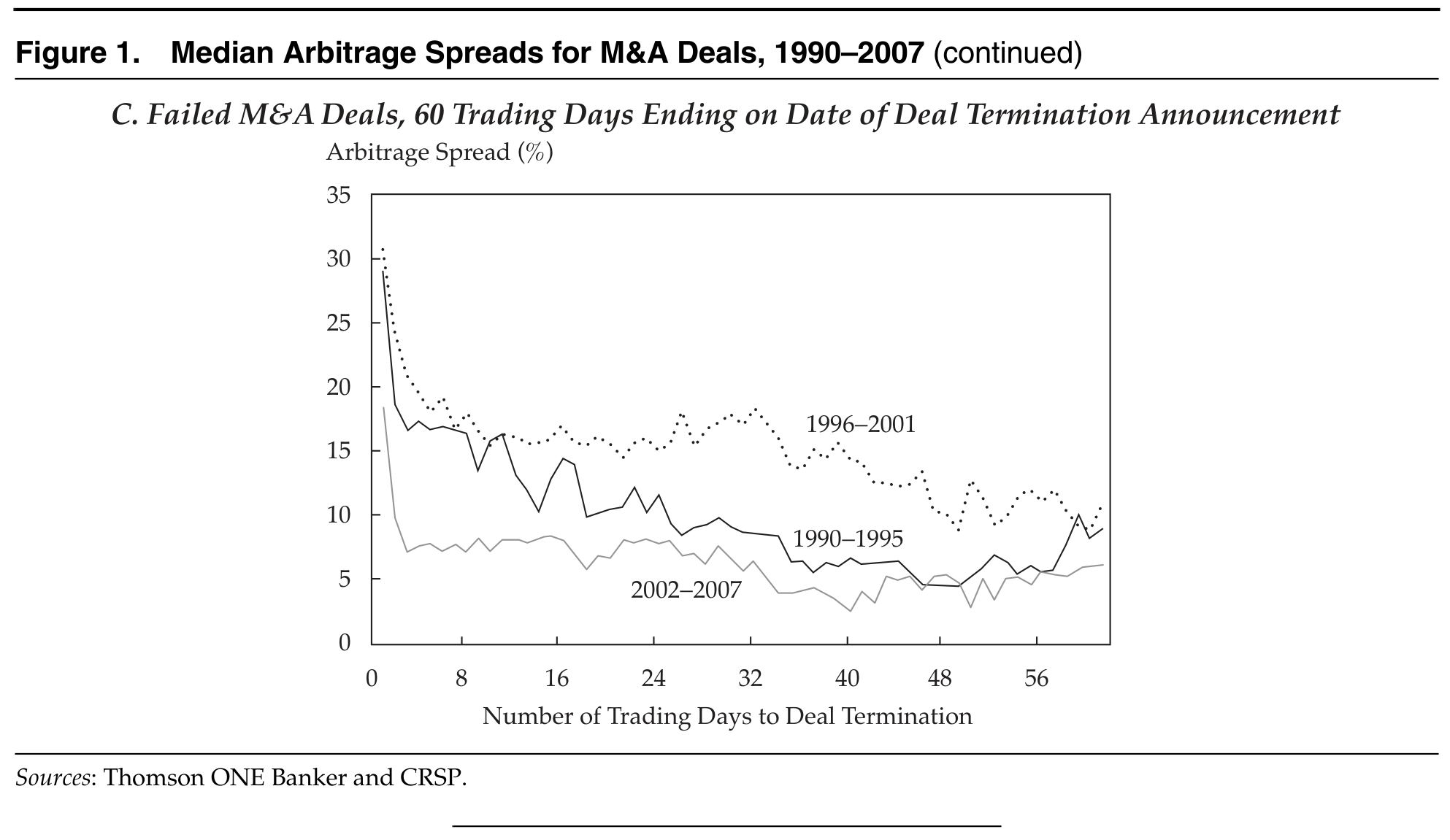

Figure 2: Median Arbitrage Spreads for M&A Deals (Continued), 1990–2007 (Original: Figure 1)

Panel B shows that for failed deals, spreads in the earlier periods fluctuated around 10% before rising sharply. In contrast, during 2002–2007, the median daily arbitrage spread for failed deals remained relatively low, between 3% and 5%. This indicates that even when deals did not go through, the potential losses for arbitrageurs were smaller in the most recent period.

Figure 3: Merger Arbitrage Hedge Fund Monthly Returns, 1990–2007 (Original: Figure 2)

Implications for Return Stacked Portfolios

The shrinking merger arbitrage spreads have profound implications for investors employing alternative investment strategies, particularly those utilizing return stacking. Return stacking aims to enhance portfolio returns by combining multiple, diversifying alternative strategies, allowing for greater capital efficiency and the potential generation of portable alpha. Read more about portable alpha here.

The study underscores the challenges posed by capacity constraints in popular strategies like merger arbitrage. As more capital flows into a strategy, increased trading activity can diminish the potential for outsized profits by narrowing spreads. This phenomenon highlights the importance of diversification across multiple strategies to mitigate the risk associated with capacity constraints.

For investors employing return stacked portfolios, incorporating a variety of uncorrelated strategies—such as merger arbitrage, trend following, and carry trades—can enhance diversification and potentially improve risk-adjusted returns. By understanding the structural shifts in individual strategies, investors can make informed decisions about strategy allocation within a return stacked framework. Learn more about how merger arbitrage can be integrated into a diversified, return stacked portfolio.

Conclusion: Navigating Market Dynamics Through Diversification

These findings emphasize the importance of diversification and adaptability in investment strategies. For those employing return stacking, a well-constructed, diversified portfolio that combines multiple strategies can potentially offer more stable and sustainable returns, even as individual strategies face capacity constraints and changing market conditions.

By staying attuned to the underlying drivers of strategy returns and embracing diversification, investors can better navigate the complexities of the financial markets and enhance their portfolios’ resilience.