Return Stacked® Academic Review

Peering Around Corners: How to Replicate Trend-Following Managed Futures

Authors

Adam Butler, Rodrigo Gordillo, Mike Philbrick

Download the full paper

Key Topics

return stacking, portable alpha, diversification, managed futures, trend following, risk management, portfolio construction, bonds, equities

Replicating Trend-Following Strategies for Enhanced Diversification

In the pursuit of improved portfolio diversification and risk-adjusted returns, investors have long been drawn to trend-following managed futures. These strategies capitalize on persistent market trends across various asset classes, offering low correlation to traditional investments like stocks and bonds. However, accessing these strategies often involves high fees and limited transparency. The paper “Peering Around Corners: How to Replicate Trend-Following Managed Futures” explores methods to replicate these strategies using liquid futures markets, potentially providing a cost-effective and transparent alternative for investors.

The authors investigate two primary replication approaches:

- Top-Down Method: Utilizing Elastic Net regression to construct a portfolio of liquid futures that closely tracks a benchmark index, such as the SG Trend Index. This method dynamically adjusts portfolio weights based on recent market movements to minimize tracking error.

- Bottom-Up Method: Employing Ridge regression to identify and combine underlying trend-following strategies across different lookback periods and asset classes. This approach provides insights into the factors driving the managed futures performance being replicated.

By replicating these strategies, investors can gain exposure to the benefits of trend-following while enjoying greater transparency and potentially lower costs.

Performance Analysis of Replication Strategies

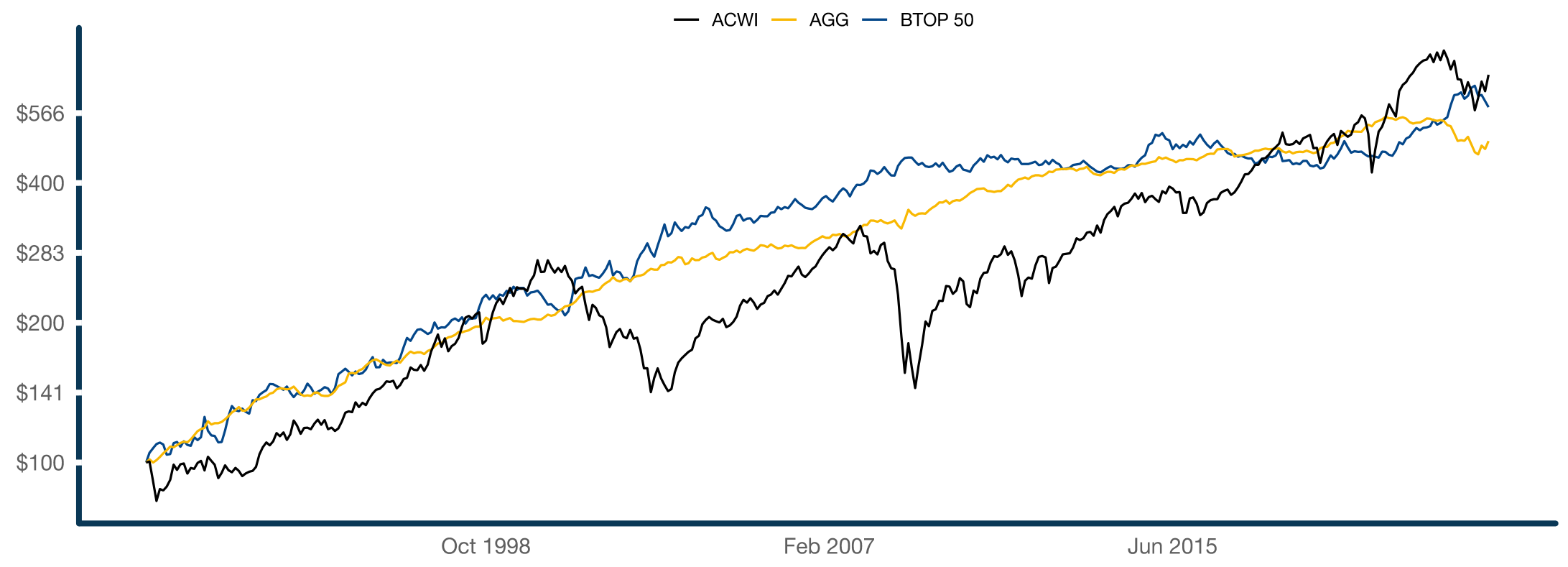

Historically, trend-following managed futures have demonstrated the ability to generate positive returns during periods when traditional asset classes experience significant drawdowns, making them valuable diversifiers. As illustrated below, the Barclay BTOP 50 Index – a proxy for trend-following managed futures – provides comparable risk-adjusted returns and low correlation to both global equities and bonds.

Figure 1: Cumulative Monthly Total Returns for MSCI All-Cap World Index, Barclays Aggregate Bond Index, and Barclay BTOP 50 Managed Futures Index (August 1990 – January 2023) (Original: Figure 1)

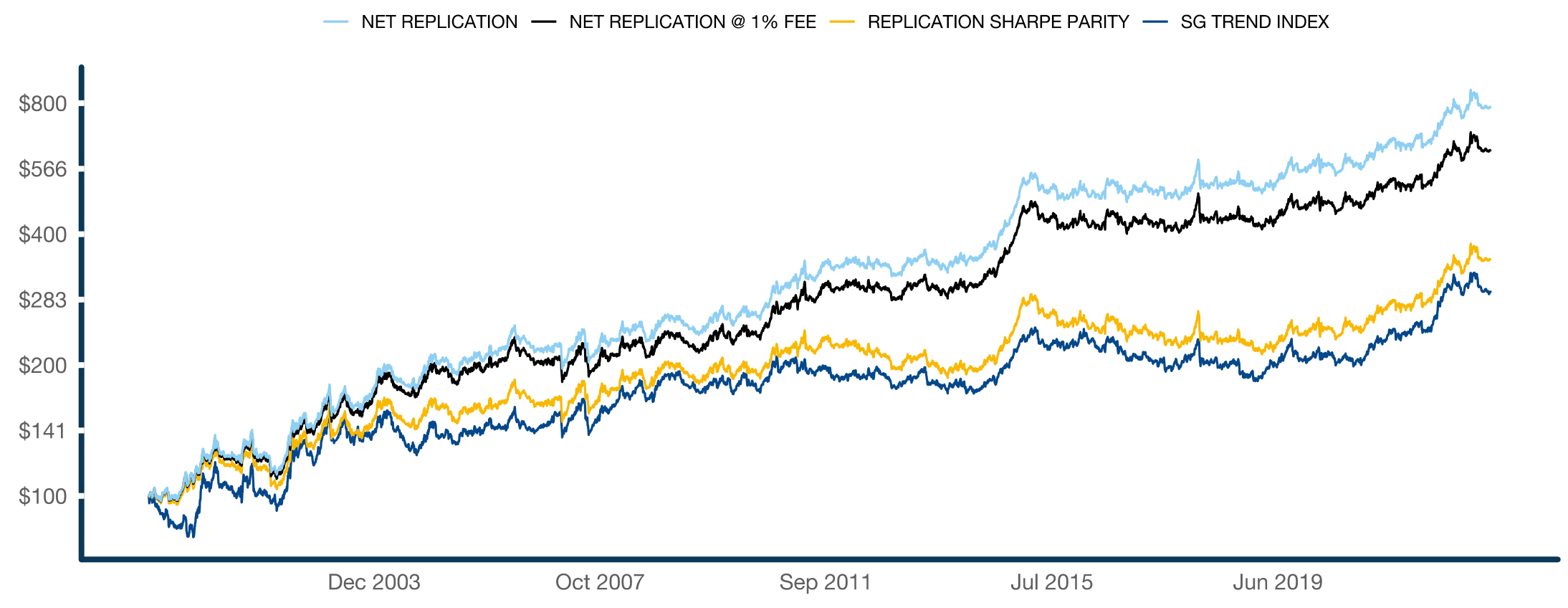

Figure 2: Cumulative Equity of Excess Returns for Replication Strategies vs. SG Trend Index (January 2000 – January 2023) (Original: Figure 8)

These results are based on simulated or hypothetical performance and should not be considered indicative of actual or future performance.

*Source: Futures data from Refinitiv. Simulation returns are total returns including roll yield, in excess of the funding rate. Replication strategies are net of estimated trade slippage and commissions, with the “Net Replication @ 1% Fee” including a 1% annual fee charged daily. SG Trend Index returns are net of all transaction costs and fees, and in excess of the 3-month US Treasury bill yield.*

Integrating Replicated Managed Futures into Return Stacking

The ability to replicate trend-following strategies using liquid futures has significant implications for return stacking, an approach that seeks to enhance portfolio efficiency by layering diversifying strategies on top of traditional asset class exposures. By integrating replicated managed futures into return stacked portfolios, investors can achieve greater diversification and potentially improve risk-adjusted returns.

Trend-following strategies, in particular, have historically provided diversification benefits due to their low correlation with traditional assets. Incorporating these strategies into a return stacked framework allows investors to “stack” the returns of managed futures on top of their core holdings, effectively seeking additional sources of return without significantly altering the risk profile of their portfolio. For more on how trend-following can be integrated into portfolios, see “Managed Futures and Trend Following”.

Moreover, the transparency and customization afforded by replication methodologies enable investors to tailor their exposure based on specific risk management preferences and return objectives. This aligns with the principles of portable alpha, where investors aim to separate alpha generation from beta exposure, layering uncorrelated strategies to enhance overall portfolio performance.

Conclusion: Accessing Trend-Following Benefits Through Replication

“Peering Around Corners: How to Replicate Trend-Following Managed Futures” provides valuable insights into how investors can access the benefits of trend-following strategies more efficiently. By utilizing replication methods, investors can achieve similar performance to traditional managed futures funds with greater transparency and potentially lower fees. This approach not only enhances portfolio diversification but also aligns with innovative investment strategies like return stacking, enabling investors to navigate market uncertainties with increased confidence.

As the financial landscape continues to evolve, the replication of managed futures strategies represents a practical means of incorporating diversification and improving portfolio efficiency. Investors seeking to enhance their portfolios may consider the integration of replicated trend-following strategies within a return stacked framework, leveraging the benefits of low correlation and favorable risk-adjusted returns.

Disclaimer: The information provided is for educational purposes and should not be considered investment advice. Past performance is not indicative of future results.