Return Stacked® Academic Review

Optimal Trend-Following With Transaction Costs

Authors

Valeriy Zakamulin and Javier Giner

Available at SSRN

Link to the Paper

Key Topics

return stacking, portable alpha, diversification, leverage, managed futures, trend following, carry, transaction costs, portfolio construction, capital efficiency, risk management, yield

Accounting for Transaction Costs in Trend-Following Strategies

The authors recognize that transaction costs are an inevitable part of trading that can erode the profitability of trend-following strategies, especially those that require frequent rebalancing. To tackle this challenge, they propose a heuristic control approach that simplifies the optimization problem by restricting it to moving average crossover rules. This method avoids the complexity of stochastic optimal control theory and makes the findings more accessible and practical for investment professionals.

By assuming that financial asset returns follow an autoregressive process (AR(*p*)), the authors derive analytical solutions for expected transaction costs, expected returns, and the Sharpe ratio of trend-following strategies in the presence of transaction costs. These solutions enable the use of standard optimization techniques to determine the optimal return weights for a given trend-following indicator.

Key Findings: Moving Average Crossovers and Optimal Lookback Periods

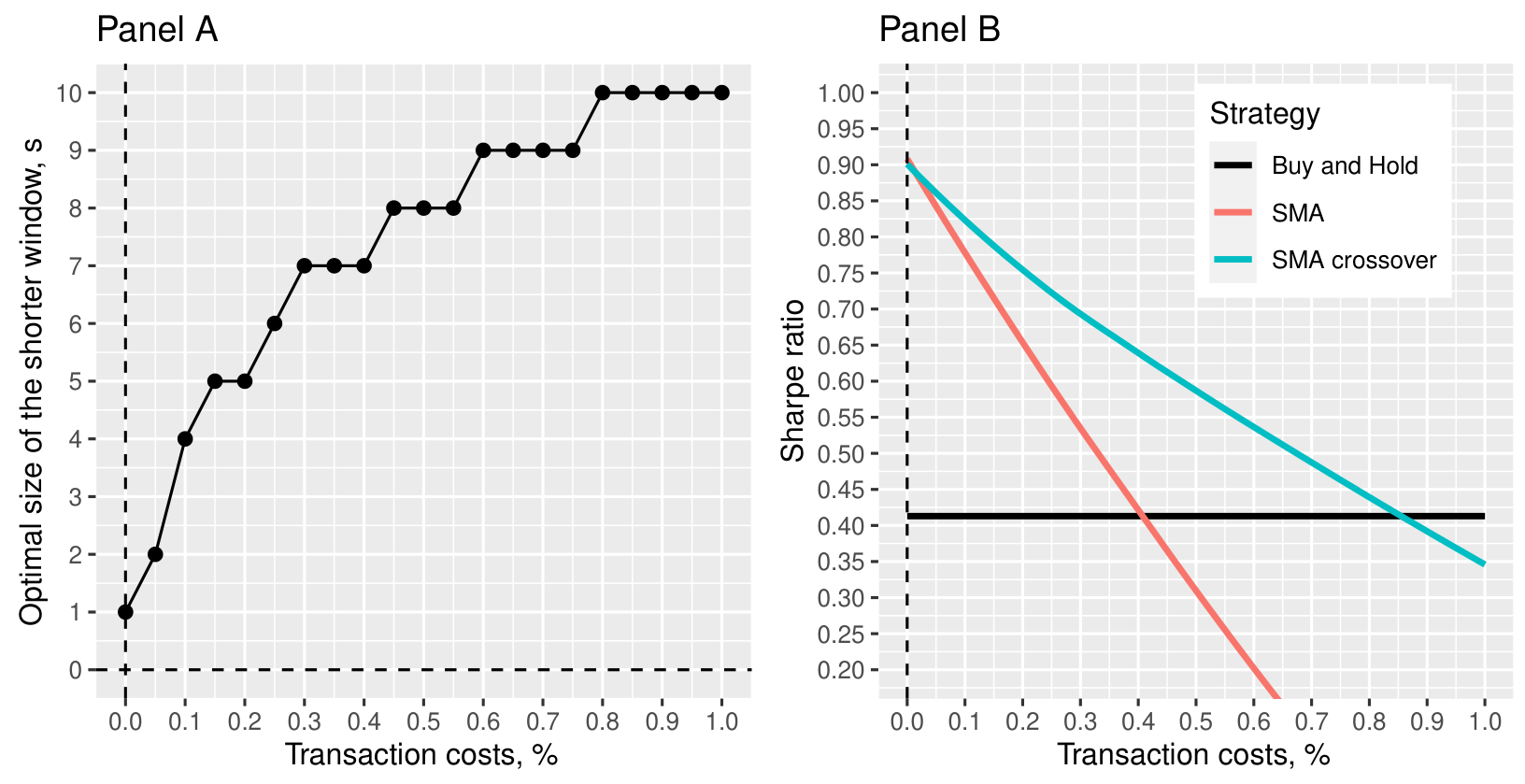

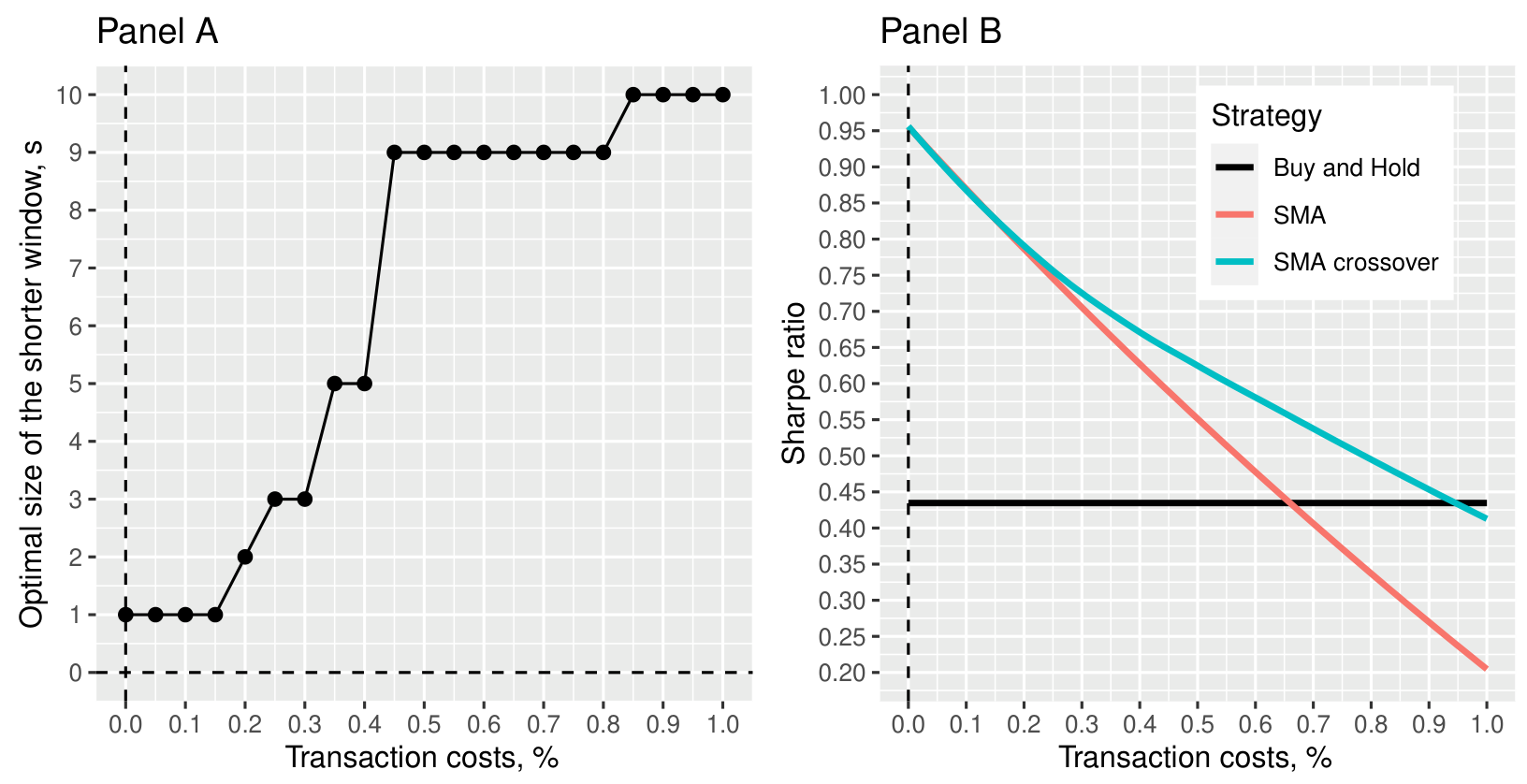

A critical insight from their analysis is the relationship between transaction costs and the optimal lookback periods of trend-following strategies. The authors find that as transaction costs increase, the optimal lookback period tends to lengthen. This finding suggests that in environments with higher transaction costs, investors should adopt a more measured approach by using longer lookback periods to reduce trading frequency and enhance capital efficiency.

Figure 1: Optimal Shorter Window Size and Sharpe Ratio vs. Transaction Costs (Original: Figure 10)

Figure 2: Empirical Validation of Optimal Window Size and Sharpe Ratios (Original: Figure 11)

Implications for Return Stacked Portfolios

In managed futures, trend-following strategies are a core component, capitalizing on persistent price movements across various asset classes. Incorporating optimized trend-following strategies that account for transaction costs is crucial for enhancing the risk-adjusted returns of return stacked portfolios. By adjusting the lookback periods in response to transaction costs, investors can reduce unnecessary trading, lower costs, and improve capital efficiency. This aligns with the principles of portable alpha, where alpha generated from one strategy (e.g., optimized trend-following) can be efficiently combined with other return sources in a portfolio.

Moreover, optimizing trend-following strategies with longer lookback periods in high transaction cost environments can enhance the yield and performance of return stacked portfolios. By improving the net performance of the managed futures component, investors can unlock additional diversification benefits and better manage risk. For more on managed futures and trend-following strategies, visit this article.

Conclusion: Enhancing Trend-Following Strategies for Cost Efficiency

These insights are particularly relevant for return stacking and managed futures strategies, where efficient use of capital and cost management are essential. By integrating optimized trend-following strategies into return stacked portfolios, investors can achieve better diversification, harness portable alpha, and improve overall portfolio construction. Accounting for transaction costs not only enhances net performance but also contributes to more robust risk management, allowing investors to unlock the full potential of trend-following strategies in a cost-effective manner.