Return Stacked® Academic Review

Negative Crisis Beta and the Hidden Market Timing Ability of Trend-Following CTAs

Authors

Quantica Capital

Quantica Quarterly Insights, Q2 2024

Exploring Trend-Following CTAs for Portfolio Diversification

Quantica Capital’s research delves into trend-following Commodity Trading Advisors (CTAs) and their role in enhancing portfolio diversification. Trend-following CTAs employ systematic strategies to capitalize on market trends across various asset classes. By analyzing a 25-year performance history, the study provides insights into the risk mitigation properties and market timing capabilities of these strategies.

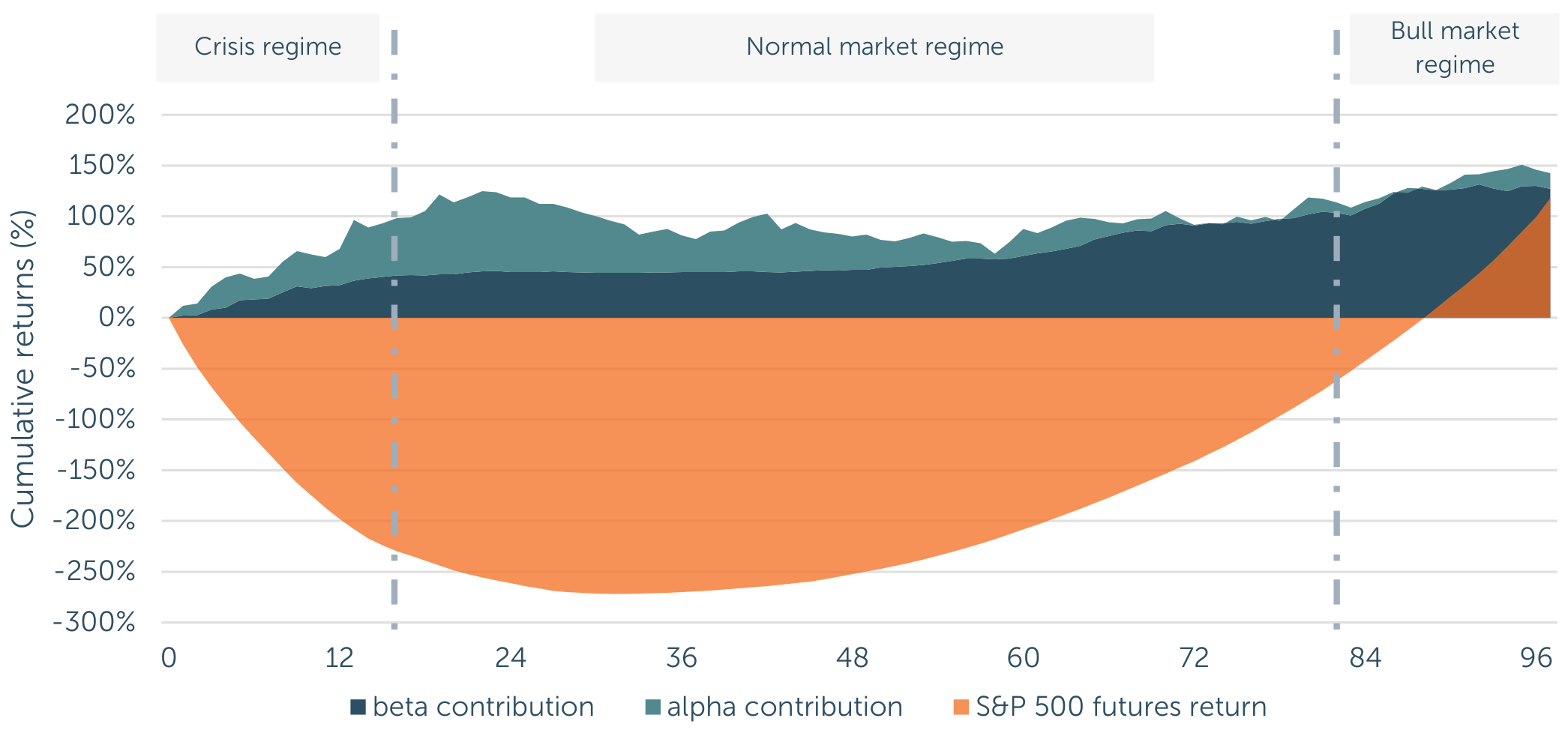

A key aspect of the research is decomposing trend-following CTA returns into two components: an alpha component, representing returns independent of equity market risk, and an equity beta component, reflecting returns correlated with equity market movements. This approach offers a nuanced understanding of how these strategies perform across different market regimes.

Dynamic Equity Beta and Risk Management

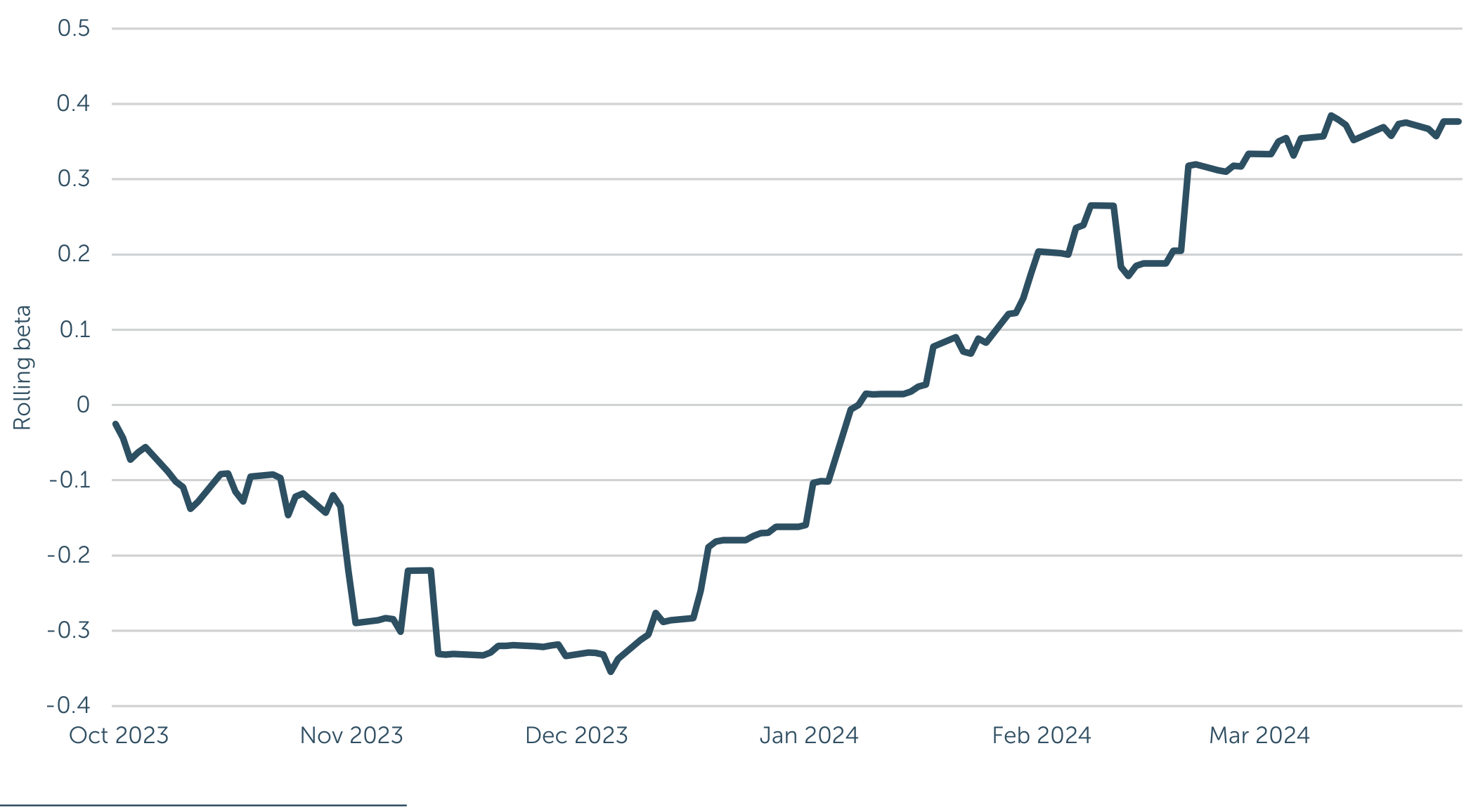

Figure 1: Rolling Equity Beta of the SG Trend Index Against S&P 500 Futures (Original: Figure 1)

Figure 1 illustrates how trend-following strategies dynamically adjust their equity beta. The chart shows that during periods of positive market trends, these strategies may increase their exposure, while reducing it during volatility spikes. This dynamic beta management enhances their ability to mitigate risk and capitalize on evolving market conditions.

Alpha and Beta Contributions to Trend-Following Returns

The research also examines trend-following CTAs’ performance during significant equity market downturns. By analyzing the 16 worst calendar quarters for the S&P 500 since 2000, the study reveals that these strategies have historically generated positive returns during most crisis periods. This is attributed to both a strategically negative beta and the alpha component.

Figure 2: Cumulative Equity Alpha & Beta Contribution of Trend-Following CTA Returns vs. Cumulative Equity Returns

Integrating Trend-Following CTAs with Return Stacking Strategies

Trend-following CTAs, with their dynamic equity beta and ability to generate positive returns during market downturns, can serve as valuable components in return stacked portfolios. Their unique combination of crisis protection and upside participation can enhance the overall risk-return profile. This aligns with the principles of portable alpha, where uncorrelated alpha streams are combined with beta exposures to improve portfolio efficiency.

Furthermore, integrating trend-following strategies complements other approaches like managed futures, providing diversification benefits and potential for improved returns. By carefully selecting and combining strategies with different alpha and beta profiles, investors can construct portfolios that are better equipped to navigate volatile markets.

Conclusion

Quantica Capital’s study highlights the ability of trend-following CTAs to adapt to changing market conditions and provide valuable diversification benefits. Their dynamic equity beta allows for risk mitigation during downturns and participation in upward trends. The research challenges traditional views on equity exposure constraints and emphasizes the importance of considering such strategies within a broader investment framework.

For investors seeking to build resilient portfolios, integrating trend-following CTAs within return stacking strategies offers a compelling approach. By combining crisis protection with growth opportunities, trend-following strategies contribute to a more balanced and efficient portfolio capable of weathering market storms while capturing long-term gains.