Return Stacked® Academic Review

Everything Old Is New Again: Portable Alpha in Theory and Practice

Authors

Timur Kaya Yontar

Cambridge Associates, 2015

Everything Old Is New Again: Portable Alpha in Theory and Practice

Re-examining Portable Alpha Strategies

In “Everything Old Is New Again: Portable Alpha in Theory and Practice,” Timur Kaya Yontar revisits the concept of portable alpha—a strategy that combines alpha from one investment with beta from another to enhance returns and manage risk. The article delves into the theoretical foundations and practical applications of portable alpha, drawing insights from a survey of large endowments and foundations. Yontar explores how sophisticated institutional investors employ derivatives to separate and recombine alpha and beta return streams, emphasizing the need for effective liquidity management, risk control, and the challenges associated with leverage.

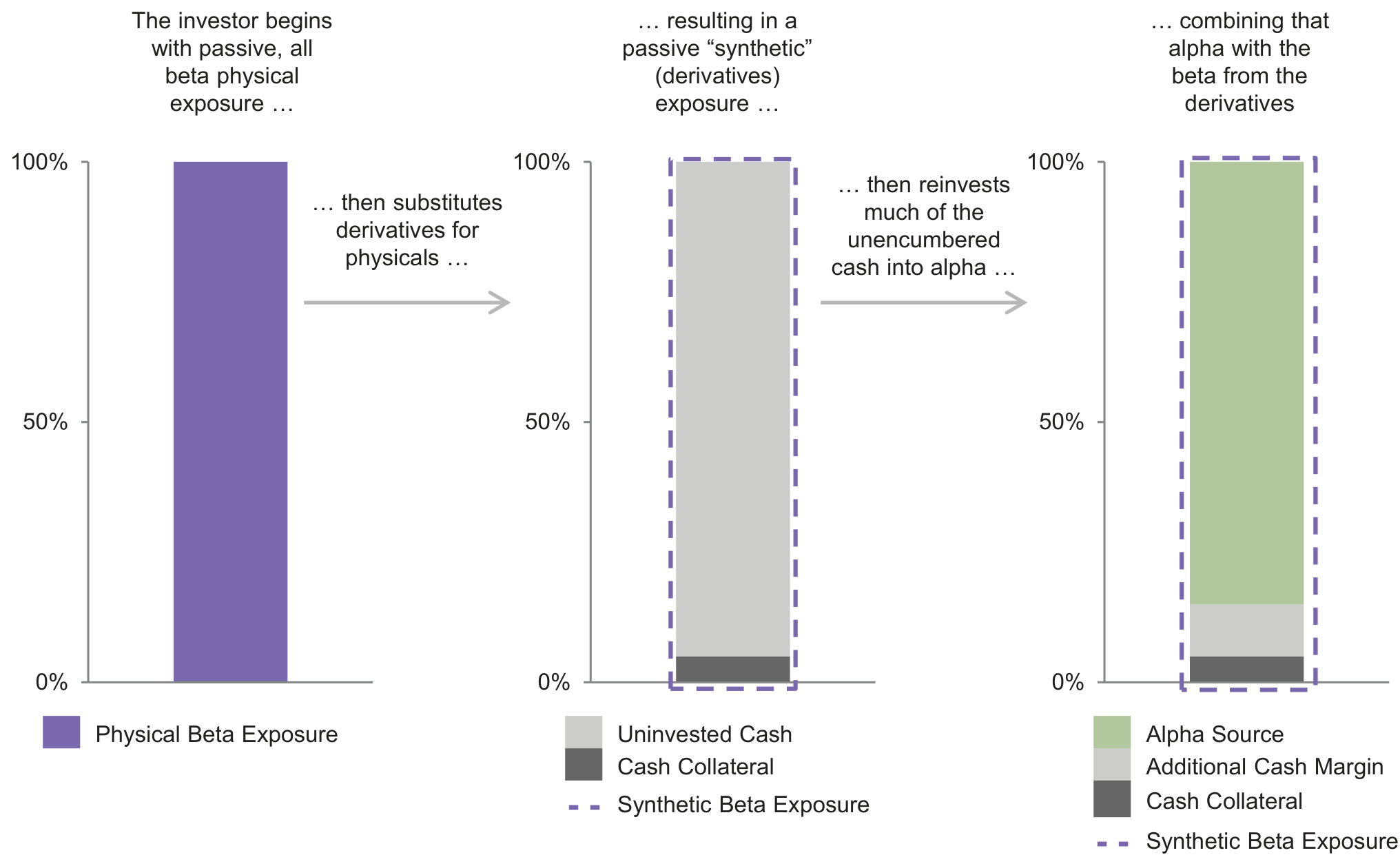

Figure 1: Portable Alpha Position: Adding Pure Alpha to Beta (Original: Figure 1)

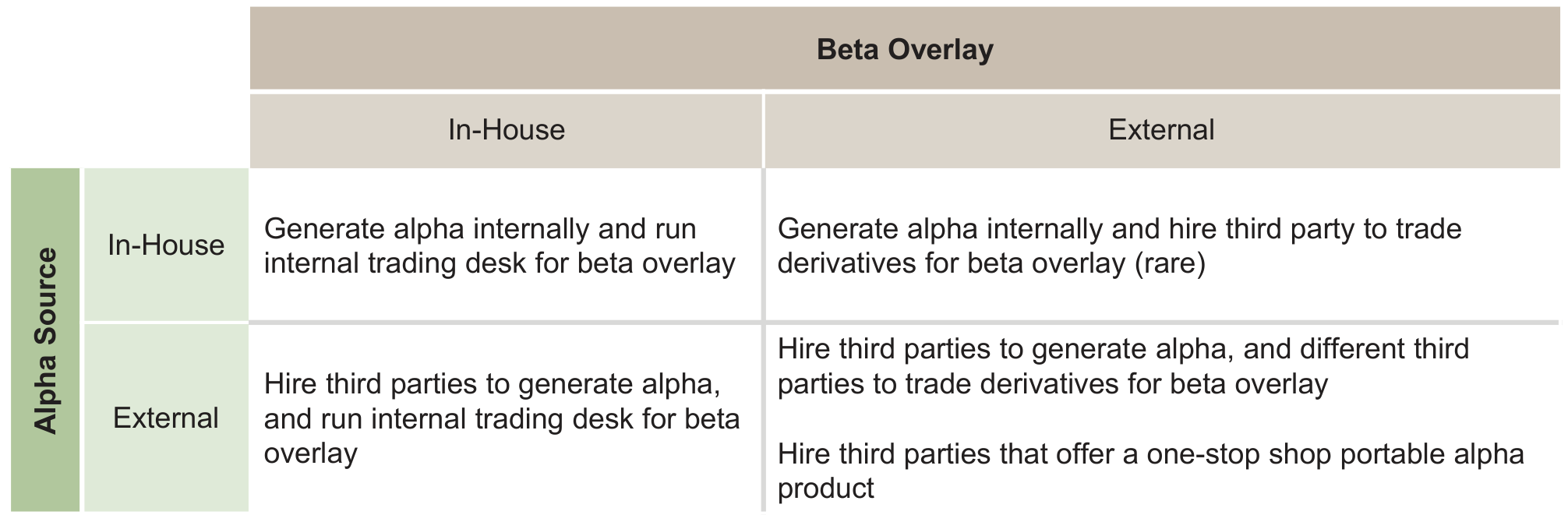

Figure 2: Portable Alpha Spectrum of Implementation: Five Choices (Original: Figure 4)

Implications for Return Stacking Strategies

The article’s emphasis on liquidity management, risk control, and the judicious use of leverage aligns with the principles of return stacking. Managing the complexities of layered exposures requires a deep understanding of the underlying strategies and their interactions. Investors interested in exploring these concepts further can refer to discussions on portable alpha and how it underpins evolving approaches to portfolio construction.

Conclusion

“Everything Old Is New Again: Portable Alpha in Theory and Practice” provides a comprehensive examination of portable alpha strategies, offering both theoretical insights and practical guidance. Yontar underscores the potential benefits of separating and recombining alpha and beta while highlighting challenges associated with leverage, liquidity, and risk management. The article’s findings are significant for investors seeking to enhance returns through sophisticated strategies like portable alpha and return stacking. By understanding the mechanics and implementation options, investors can better navigate the complexities of modern portfolio construction and tailor approaches that align with their objectives and resources.