Return Stacked® Academic Review

Portable Alpha: Finding the Right Match

Authors

Aspect Capital

Aspect Capital Insight Series

Portable Alpha: Finding the Right Match

Key Topics

return stacking, portable alpha, diversification, leverage, managed futures, trend following, carry, bonds, equities, capital efficiency

Rediscovering Portable Alpha with Managed Futures

The concept of portable alpha has re-emerged as a significant topic in portfolio construction. Aspect Capital’s study, “Portable Alpha: Finding the Right Match,” delves into how integrating a beta component, such as an equity index, with an alpha component from active management can enhance portfolio performance. The paper specifically highlights the role of managed futures as an effective source of alpha, emphasizing their potential benefits in modern investment strategies.

Addressing Historical Challenges with Capital Efficiency

Historically, portable alpha strategies have faced obstacles, especially during periods of market stress like the 2008 Global Financial Crisis. Issues such as excessive leverage, unpredictable correlations, and execution complexities have hindered their effectiveness. Aspect Capital’s research suggests that managed futures can overcome these challenges due to their resilience in turbulent markets and efficient use of margin, offering a more capital-efficient approach to alpha generation.

Visual Insights into Portable Alpha Strategies

Aspect Capital provides several illustrations to elucidate the core concepts and performance characteristics of portable alpha strategies incorporating managed futures.

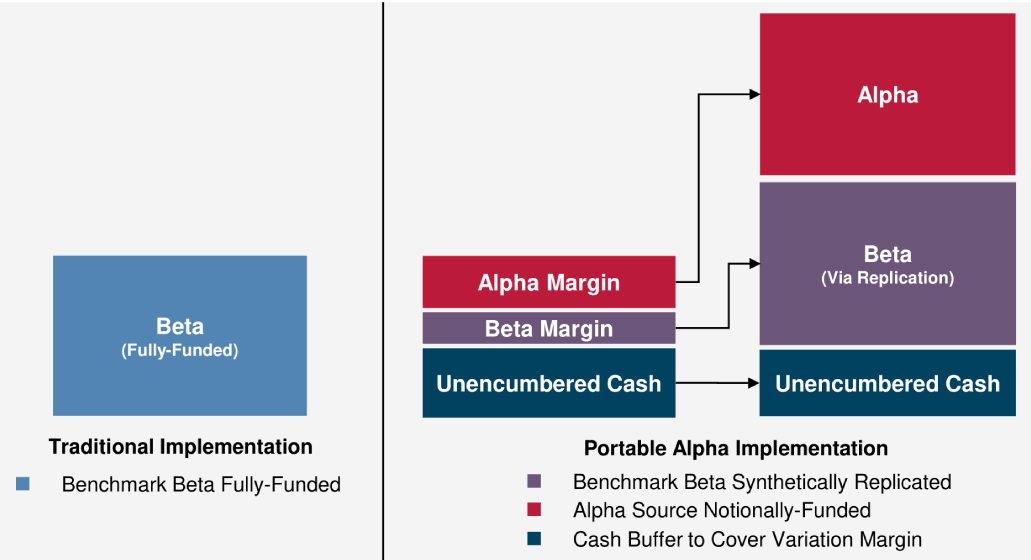

Figure 1: Potential Structure for Portable Alpha Implementation (Original: Figure 1)

Source: Aspect Capital. The data above with respect to various indices is shown for illustrative purposes only. Detailed descriptions of the indices used above are available from Aspect upon request.

This figure contrasts a traditional fully-funded beta exposure with a portable alpha structure that employs leverage. By synthetically replicating beta and combining it with a notionally-funded alpha source, investors can maintain unencumbered cash reserves. This highlights how portable alpha strategies can achieve enhanced returns without the need for full upfront funding, emphasizing capital efficiency.

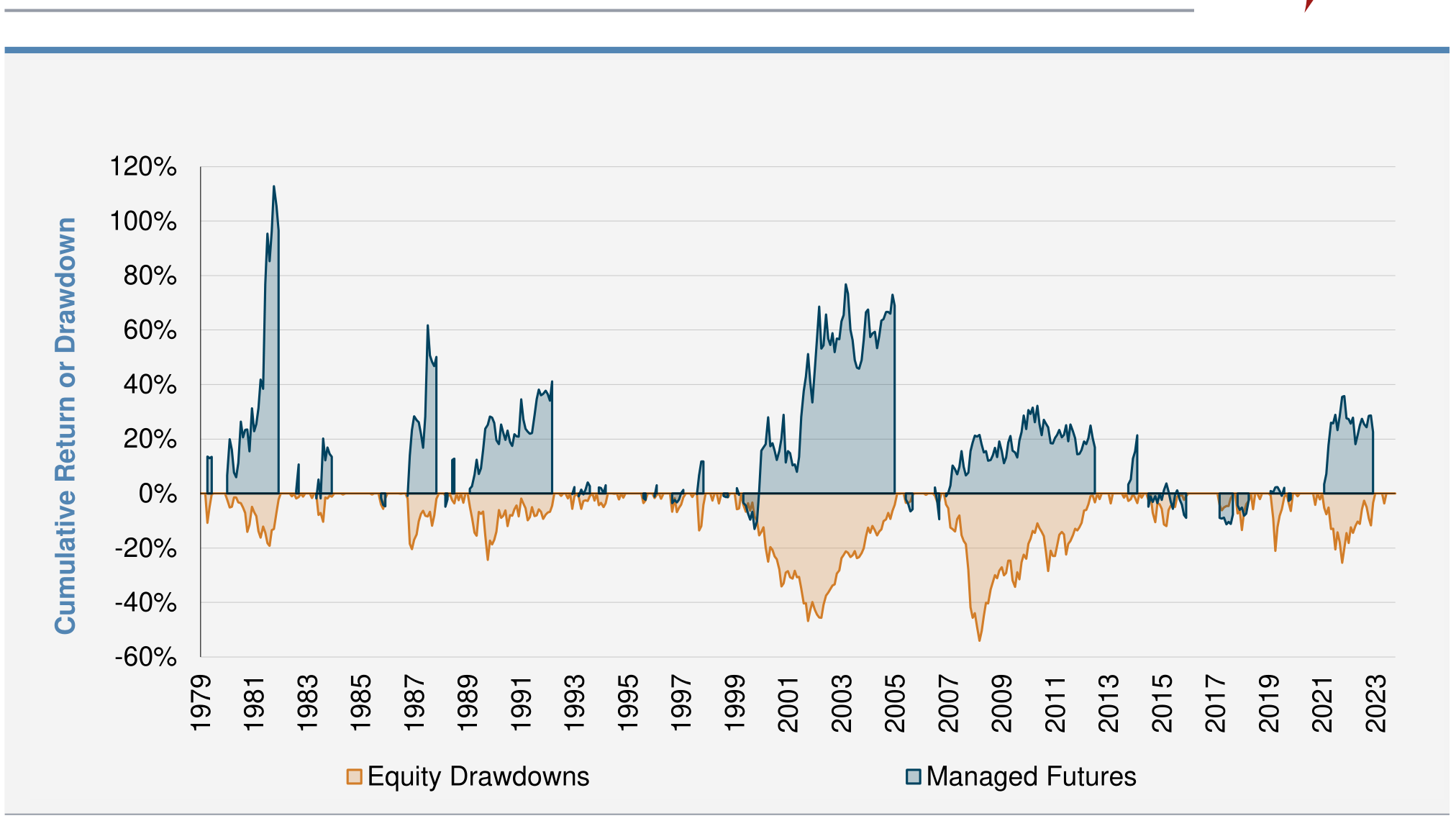

Figure 2: Managed Futures Performance During Equity Drawdowns (Jan 1980 - Sep 2024) (Original: Figure 4)

Source: CISDM, Macrobond. The data above with respect to various indices is shown for illustrative purposes only. Detailed descriptions of the indices used above are available from Aspect upon request.

This figure illustrates the cumulative returns of managed futures during significant equity market drawdowns. It underscores the diversification benefits of managed futures, showcasing their ability to generate positive returns when traditional equities experience declines. This resilience adds a valuable layer of protection within a portable alpha framework.

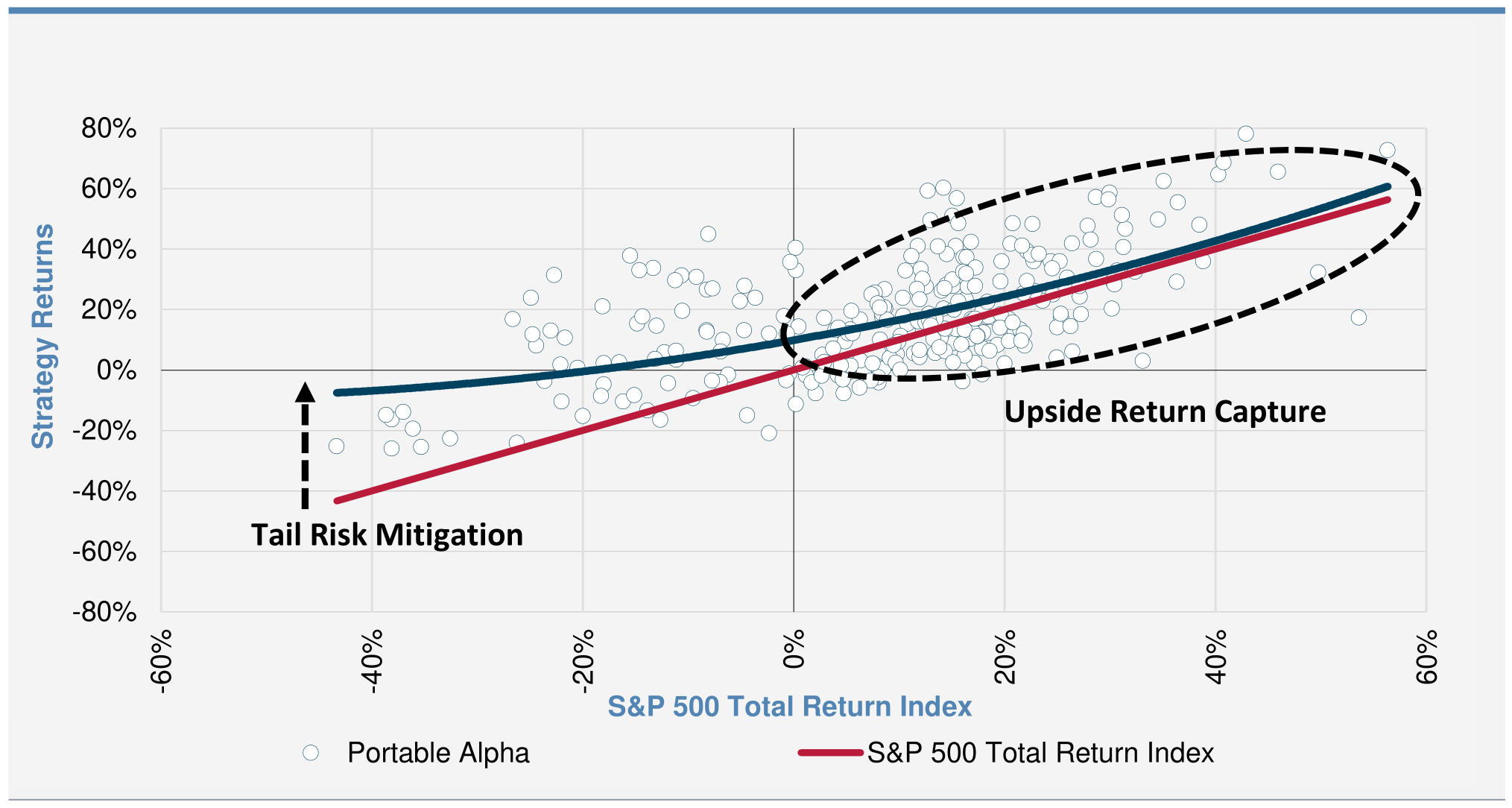

Figure 3: Rolling 12-Month Returns of E-Mini and Managed Futures Blend (2000 - 2024) (Original: Figure 8)

Source: Macrobond.

The data above with respect to various indices is shown for illustrative purposes only. Detailed descriptions of the indices used above are available from Aspect upon request. THESE RESULTS ARE BASED ON SIMULATED OR HYPOTHETICAL RESULTS THAT HAVE CERTAIN LIMITATIONS. UNLIKE THE RESULTS SHOWN IN AN ACTUAL PERFORMANCE RECORD, THESE RESULTS DO NOT REFLECT ACHIEVED RESULTS AS THE RETURNS HAVE BEEN ADJUSTED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

This scatter plot analyzes the rolling annualized returns of a portfolio blending E-Mini S&P 500 futures with managed futures. The combination aims to capture equity market upside while mitigating downside risks, highlighting the effectiveness of diversification. The quantitative analysis supports the paper’s thesis on enhancing returns and reducing volatility through strategic asset allocation.

Integrating Managed Futures into Return Stacking Strategies

The findings from Aspect Capital’s paper are particularly pertinent to return stacking strategies, which involve layering different return streams to optimize portfolio performance without a proportional increase in risk. Managed futures align with return stacking principles by offering an overlay of alpha onto core equity exposures. This approach can lead to improved risk-adjusted returns, better diversification, and efficient liquidity management, essential elements in robust portfolio construction.

By incorporating managed futures, return stacking strategies can navigate market volatility more effectively. The resilience of managed futures during downturns, as highlighted in the paper, demonstrates their capacity to mitigate equity market drawdowns while still participating in upswings. This aligns with the goal of achieving a smoother return profile, a key advantage of return stacking. For a deeper understanding of return stacking and its role in modern portfolio construction, refer to Diversification 2.0: Understanding Return Stacking and the Evolution of Portfolio Construction.

Additionally, managed futures strategies like trend following and carry can serve as potential diversifiers to traditional bonds and equities within a return stacking framework.

Enhancing Portfolio Resilience with Portable Alpha

Aspect Capital’s research underscores the importance of portable alpha strategies in achieving portfolio resilience and capital efficiency. By leveraging the strengths of managed futures, investors can enhance diversification, reduce volatility, and improve overall risk-adjusted returns. The study provides valuable insights and practical guidance for those seeking to construct more robust and efficient portfolios through the integration of managed futures and return stacking techniques.