We’re All EM Investors Now

Overview

This piece draws a provocative parallel between today’s U.S. macro environment and the structural constraints long familiar to emerging market investors—high debt, limited policy flexibility, and currency vulnerability. Instead of overhauling portfolios or making drastic tactical shifts, it advocates for return stacking as a capital-efficient way to add macro resilience. By layering exposures to heterogeneous strategies—such as gold/Bitcoin, trend-following, and multi-asset carry—on top of core allocations, investors can prepare for a range of possible macro regimes without abandoning long-term positioning. The framework emphasizes adaptability, diversification across macro drivers, and humility in the face of uncertainty.

Key Topics

In emerging markets, investors have long operated under a familiar but uncomfortable trifecta:

- Politicians with unsustainable fiscal paths,

- Central banks constrained in their ability to raise interest rates, and

- Currencies under persistent pressure to depreciate.

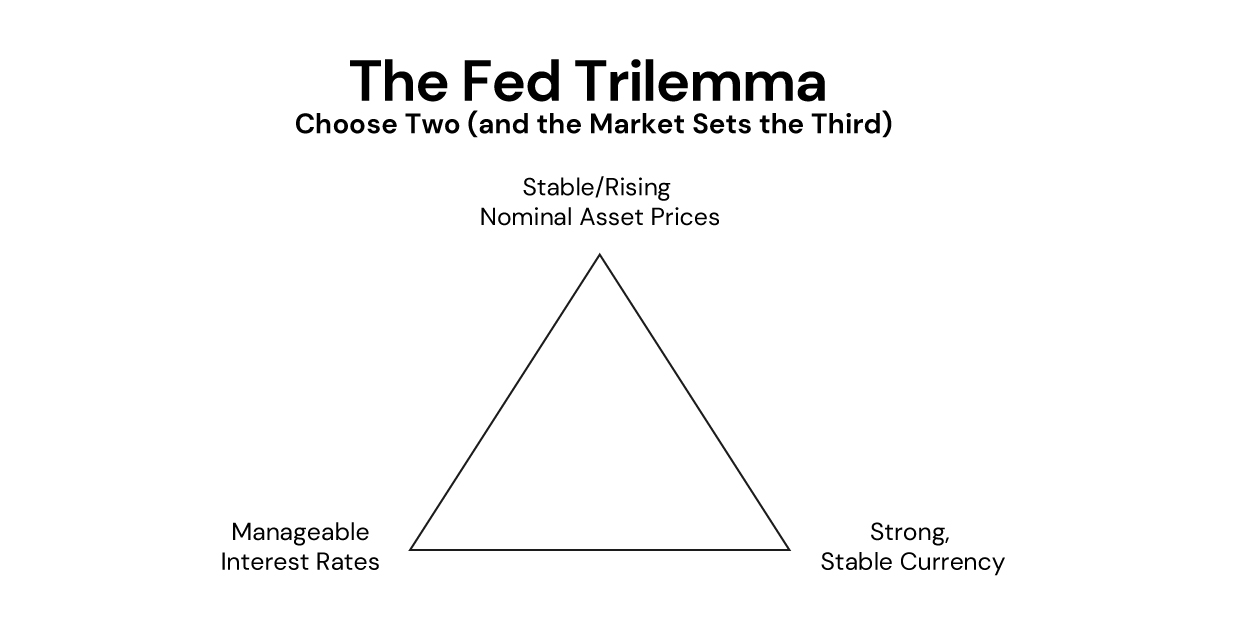

In short, EM investors know you can’t have stable asset prices, low interest rates, and a strong currency all at the same time.

That’s the provocative case made in a recent macro thesis: the United States may now be operating under the same kinds of constraints that have historically plagued emerging economies. With federal debt at historic highs, inflation still a concern, and little political appetite for fiscal reform, U.S. policymakers are increasingly boxed in.

If the Fed hikes to control inflation, it risks blowing up the Treasury’s balance sheet. If it keeps rates low to manage debt service, it risks further dollar debasement. Monetary policy no longer offers a clean path to preserving both purchasing power and asset prices.

For years, developed markets enjoyed an era of monetary dominance where central banks could stimulate growth, backstop markets, and maintain currency strength without obvious consequence. But as debt burdens rise and inflation proves stickier than expected, the playbook that worked in the 2010s may no longer apply.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

The traditional portfolio response to such macro risks is often drastic: cut exposure to risk assets, move to cash, or overweight real assets. But these moves can introduce new problems: opportunity costs, poor timing, or straying from long-term plans.

Shifting too aggressively can lead to behavioral mistakes: getting whipsawed in and out of markets, mistiming inflation hedges, or abandoning allocations right before reversals. Even moving to real assets en masse might misalign with long-term return objectives.

Return stacking offers an alternative.

Rather than selling existing assets to prepare for macro shocks, investors can layer complementary exposures on top of their current allocations. This lets them add resilience without sacrificing their core portfolio. Crucially, return stacking emphasizes capital efficiency: extracting more risk-managed utility from each dollar already deployed.

Historically, gold has tended to perform well during periods of negative real rates or crisis of confidence in monetary regimes. Bitcoin, although more volatile, is increasingly viewed as a hedge against monetary expansion and sovereign risk.

That said, it’s essential to acknowledge behavioral risks. These assets can be volatile and sentiment driven. Their purpose is not to predict crisis but to add resilience should confidence in fiat systems erode.

By overlaying exposure to these assets through return stacking, investors can build in potential protection against dollar weakness without having to liquidate traditional stock or bond holdings.

Stacking trend-following strategies enables portfolios to *react without reacting*—delegating the tactical response to systematic rules, while preserving long-term positioning.

This adaptability has proved valuable historically. In 2008, trend strategies shifted short as markets collapsed. In 2020, they whipsawed but re-engaged. And in 2022, as inflation shocked markets, many trend-followers leaned into commodity exposure and short bonds.

These regimes often emerge suddenly and reallocation is difficult to time. Trend overlays introduce convexity into portfolios, offering the potential for positive skew during stressful periods.

Today, as global central banks pursue increasingly varied paths – with the Bank of Japan maintaining yield curve control while the Fed tightens, or the ECB navigating inflation and fragmentation – these dislocations offer a fertile backdrop for carry strategies.

Mechanically, carry seeks to earn a premium from holding higher-yielding assets while shorting lower-yielding ones. In currencies, it means long exposure to high-rate currencies; in bonds, it means steep curve exposure; in equities and commodities, it often manifests as term or volatility risk premia.

By stacking these strategies as overlays, investors can access potential structural return premia without reallocating away from their core holdings. The exposures are additive, not competitive.

Inflationary periods, stagflation, disinflation, and outright crisis each reward different asset behaviors. Relying solely on static asset mixes (like 60/40) assumes regime stability that history doesn’t always deliver.

Stacking overlays like trend, carry, or gold adds what we might call regime insurance: optionality that pays off when conventional assumptions break. You don’t need to guess the next regime—you prepare for multiple outcomes simultaneously.

This makes return stacking more than a potential return enhancer. It’s a potential resilience enhancer.

| Concern | Traditional Reaction | Return Stacking Response |

| Currency debasement | Sell bonds, buy gold/BTC | Overlay gold/BTC exposure |

| Inflation / macro volatility | Shift to real assets or cash | Add trend-following overlay |

| Policy divergence / dislocation | Tilt away from 60/40 | Overlay multi-asset carry strategy |

While Gold/Bitcoin, Trend Following, and Carry strategies all serve to diversify portfolios and hedge different macro regimes, they operate on entirely different planes of the investment universe.

Trend following is typically implemented using a broad basket of global futures across equity indices, fixed income, currencies, and commodities. Exposure rotates based on price trends, so the portfolio can be long or short across dozens of local macro markets at any time.

Carry strategies, by contrast, tap into structural premia by buying higher-yielding assets and shorting lower-yielding ones. This might involve currency pairs, bond yield differentials, or volatility spreads. The edge lies in harvesting persistent pricing inefficiencies rooted in policy divergence and capital imbalances.

Gold and Bitcoin, meanwhile, are directional exposures to non-sovereign monetary assets – uncorrelated with traditional policy tools and sovereign debt. Their relevance tends to increase during periods of currency debasement, monetary disorder, or skepticism in fiat systems.

Put simply, stacking these strategies doesn’t just layer different return streams: it layers fundamentally different assets and exposures. That distinction matters as it helps avoid overlapping risks, supports more robust diversification across macro drivers, and increases the likelihood that one leg of the portfolio is working when others aren’t. In a world of regime uncertainty, building a stack from heterogeneous exposures may be just as important as selecting the right strategies.

And secular disinflationary forces—like demographics, globalization, or digital deflation—could reassert themselves. Macro forecasting is hard. Portfolio humility is essential.

That’s exactly why return stacking is so powerful.

It allows investors to prepare for multiple macro paths without needing to bet the farm on any single narrative. It offers resilience through capital efficiency, enabling optionality rather than committing to a single macro outcome.

Stacking is not a forecast. It’s a framework.

If the U.S. is entering a regime that increasingly mirrors the constraints of emerging markets, investors can’t afford complacency. But nor should they panic.

Return stacking offers a measured, capital-efficient way to build macro resilience:

- Hedge against dollar debasement without selling your bonds.

- Prepare for regime shifts without tactical market timing.

- Access structural return premia like carry and trend without displacing long-term allocations.

Advisors and investors can implement return stacking through a variety of methods: direct overlays via futures or swaps, managed accounts that embed the exposures, or packaged solutions designed for capital efficiency.

Operational considerations matter—leverage constraints, rebalancing protocols, and alignment with investment policy statements. But conceptually, the approach enables a dual mandate: maintain discipline and add adaptability.

In a world where macro risks rise but investment discipline still matters, return stacking bridges the gap. It’s not about doubling down on fear. It’s about layering in durability.

If your portfolio needs to evolve with the times, stacking may be the smartest way to prepare—without overreacting.