Return Stacked® Academic Review

Multi-Asset Skewness Trading Strategy

Authors

Radovan Vojtko and Marek Lievaj

Multi-Asset Skewness Trading Strategy

Leveraging Skewness Across Asset Classes

In their paper “Multi-Asset Skewness Trading Strategy,” authors Radovan Vojtko and Marek Lievaj explore how the concept of skewness in asset returns can be harnessed to enhance portfolio performance. By examining skewness across multiple asset classes – including equities, bonds, currencies, and commodities – they propose a strategy that capitalizes on behavioral biases and investor preferences to achieve better risk-adjusted returns.

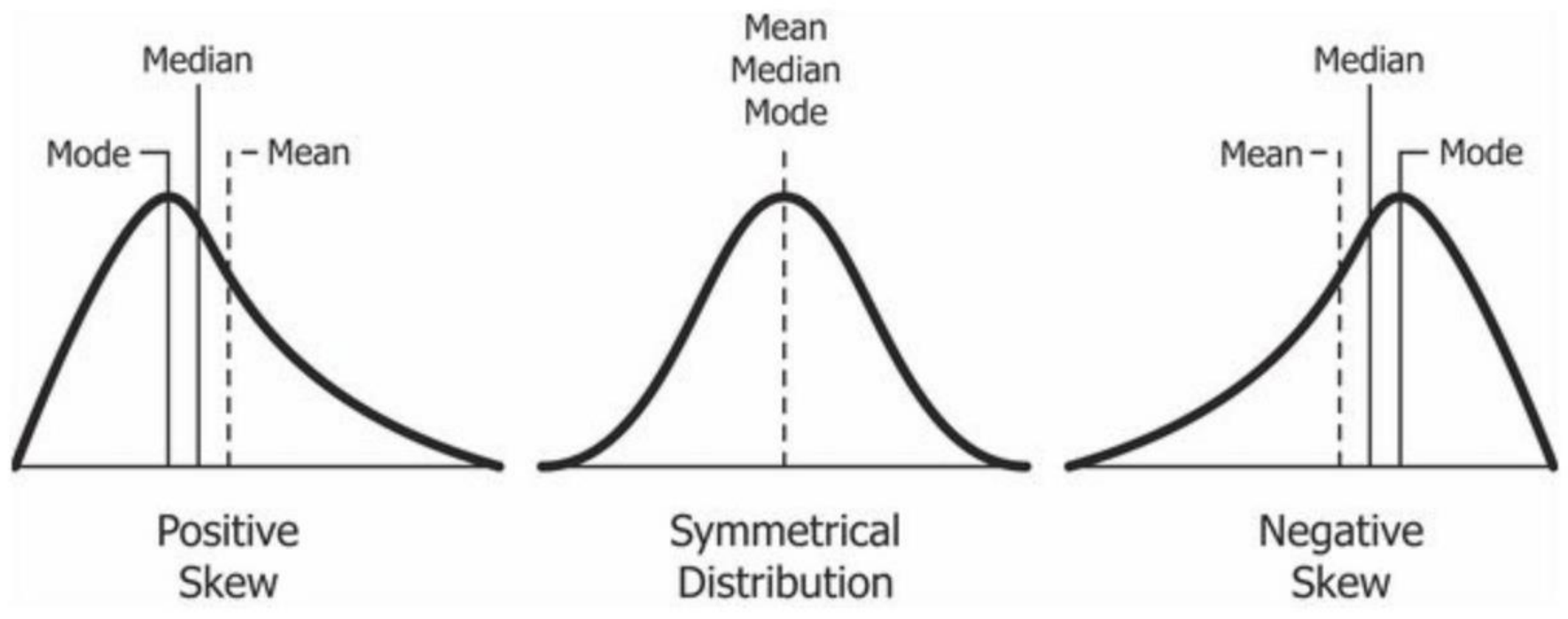

Skewness refers to the asymmetry in the distribution of asset returns. A positively skewed distribution indicates a higher probability of large positive returns, while a negatively skewed distribution suggests a greater chance of extreme negative returns. The authors argue that assets with lower historical skewness tend to outperform those with higher skewness in subsequent periods. This phenomenon can be attributed to the overpricing of positively skewed assets due to investors’ preference for lottery-like payoffs, and the underpricing of negatively skewed assets.

Vojtko and Lievaj’s strategy involves calculating the skewness of daily returns over a one-year lookback period for each asset within the different classes. They then construct long/short portfolios by going long on assets with the lowest skewness and short on those with the highest, rebalancing monthly. This approach aims to exploit the predictive power of skewness in forecasting future returns.

Unveiling the Skewness Effect

Figure 1: Types of Skewness in Statistical Distributions (Original: Figure 1)

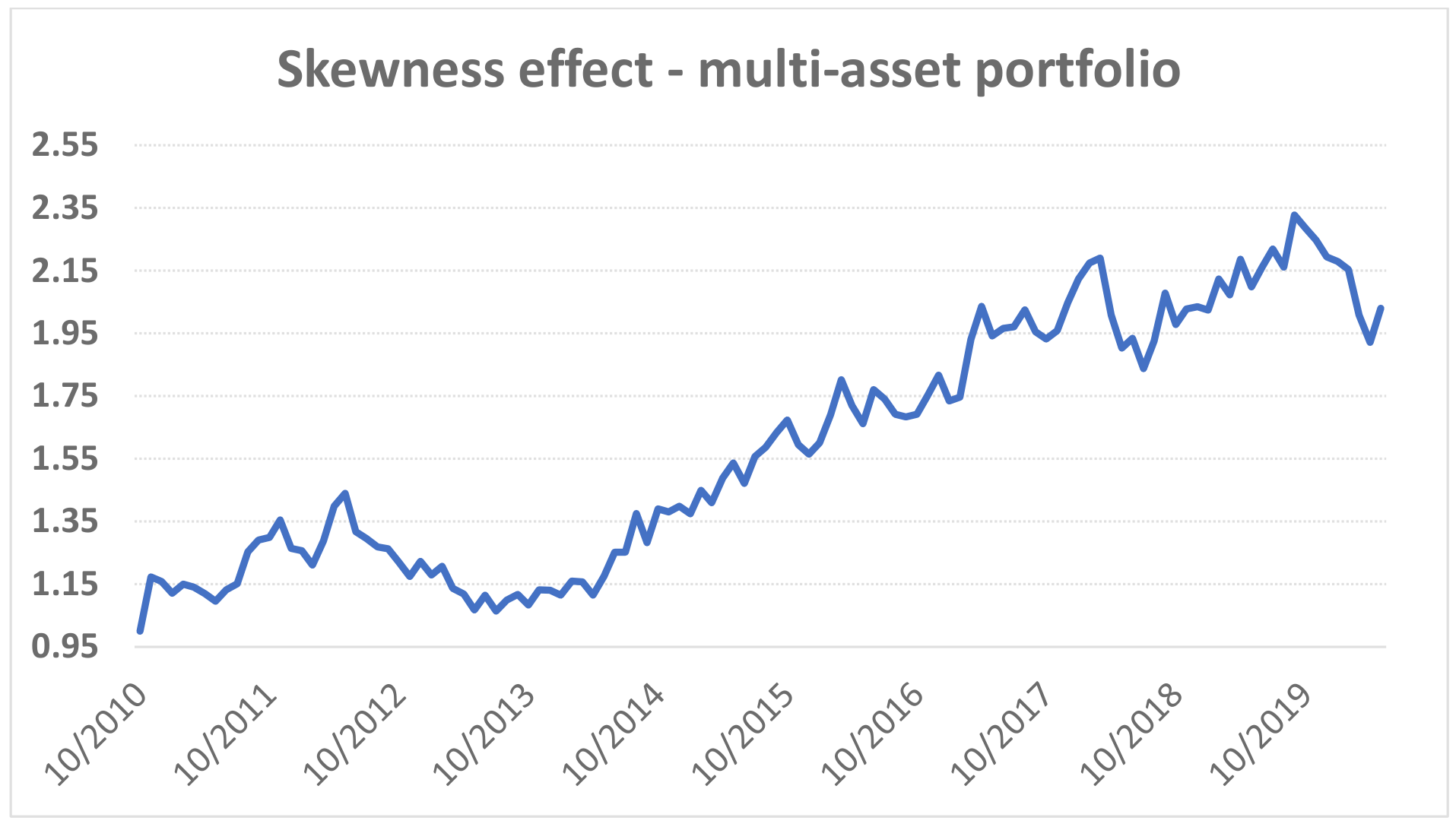

The authors also demonstrate that a multi-asset skewness strategy, when properly weighted and volatility-targeted, can produce consistent and attractive performance over time.

Figure 2: Performance of the Multi-Asset Skewness Strategy with 15% Volatility Target (Original: Figure 2)

Integrating Skewness Strategies into Return Stacking

Incorporating a multi-asset skewness strategy into a return-stacked portfolio can provide additional diversification benefits. The low correlations between skewness effects in different asset classes mean that such a strategy can improve portfolio resilience across varying market conditions.

Furthermore, the use of volatility targeting and inverse volatility weighting in the skewness strategy is akin to the risk management techniques employed in portable alpha strategies. Portable alpha seeks to separate alpha generation from beta exposure, allowing investors to overlay uncorrelated strategies and potentially boost returns without significantly increasing risk.

By combining the multi-asset skewness approach with other strategies like trend following, investors can further diversify their portfolios. Trend following strategies, which capitalize on momentum across markets, offer additional uncorrelated return streams that can complement the skewness strategy.

Conclusion

The study underscores the importance of diversification and risk management in portfolio construction. Combining uncorrelated strategies, such as skewness trading and trend following, within a return-stacked framework can lead to greater capital efficiency and more robust investment outcomes.

For portfolio managers and investors seeking to optimize their strategies, integrating skewness-based approaches offers a valuable avenue for enhancing returns while managing risk. The research highlights the potential of alternative strategies to contribute meaningfully to a well-diversified, return-stacked portfolio.