Return Stacked® Academic Review

Multi-Asset Seasonality and Trend-Following Strategies

Authors

Nick Baltas

Forthcoming at Special Issue on Hedge Funds for Bankers Markets & Investors, 2016

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2710334

Exploring Seasonality's Role in Trend-Following Strategies

In the quest for profitable trading strategies, identifying patterns like seasonality can be pivotal. Nick Baltas’s study, “Multi-Asset Seasonality and Trend-Following Strategies,” delves into how predictable seasonal variations in asset returns can be leveraged, particularly within commodities and equity indices. By analyzing patterns across multiple assets over time, Baltas aims to identify significant seasonality effects that could enhance investment outcomes.

The research is grounded in the observation that certain assets exhibit recurring patterns tied to specific times of the year—such as heating oil prices fluctuating between winter and summer or agricultural commodities varying around harvest seasons. To test whether these patterns can be exploited for profit, the study constructs long-short portfolios that buy assets with historically high average returns in a given month and sell those with low returns. The findings reveal significant seasonality effects in commodities and, to a lesser extent, in equity indices, but not in government bonds or FX rates.

However, directly trading on these seasonal patterns presents practical challenges. The high turnover required leads to substantial transaction costs, which can erode the theoretical profits. This highlights a common gap between academic findings and real-world implementation in quantitative finance.

Enhancing Trend-Following with Seasonality Signals

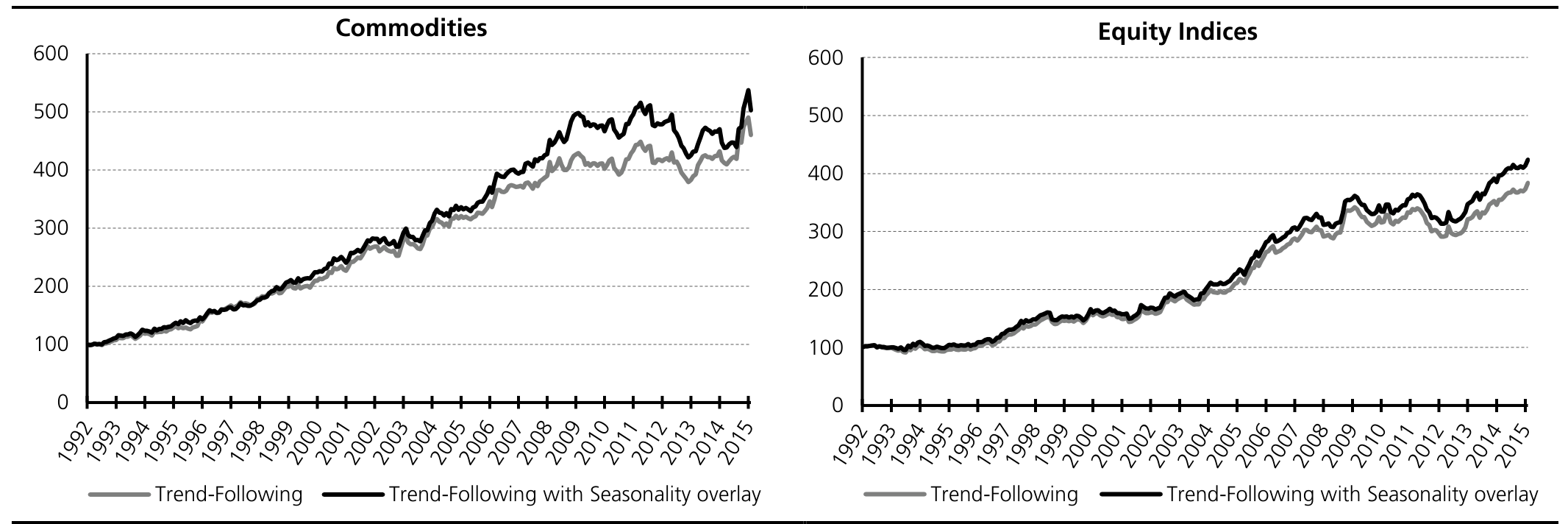

This combined approach shows promising results. The cumulative returns of the seasonality-adjusted trend-following strategy outperform the standard trend-following strategy, indicating that seasonality provides valuable information for timing and selecting trades.

Figure 1: Incorporating Seasonality Signals in Trend-Following Strategies (Volatility Target at 7%) (Original: Figure 6)

The integration of seasonality into trend-following not only enhances returns but also improves risk-adjusted performance. The Sharpe ratio increases when seasonality is incorporated, demonstrating a more efficient use of risk.

Enhancing Trend-Following with Seasonality Signals

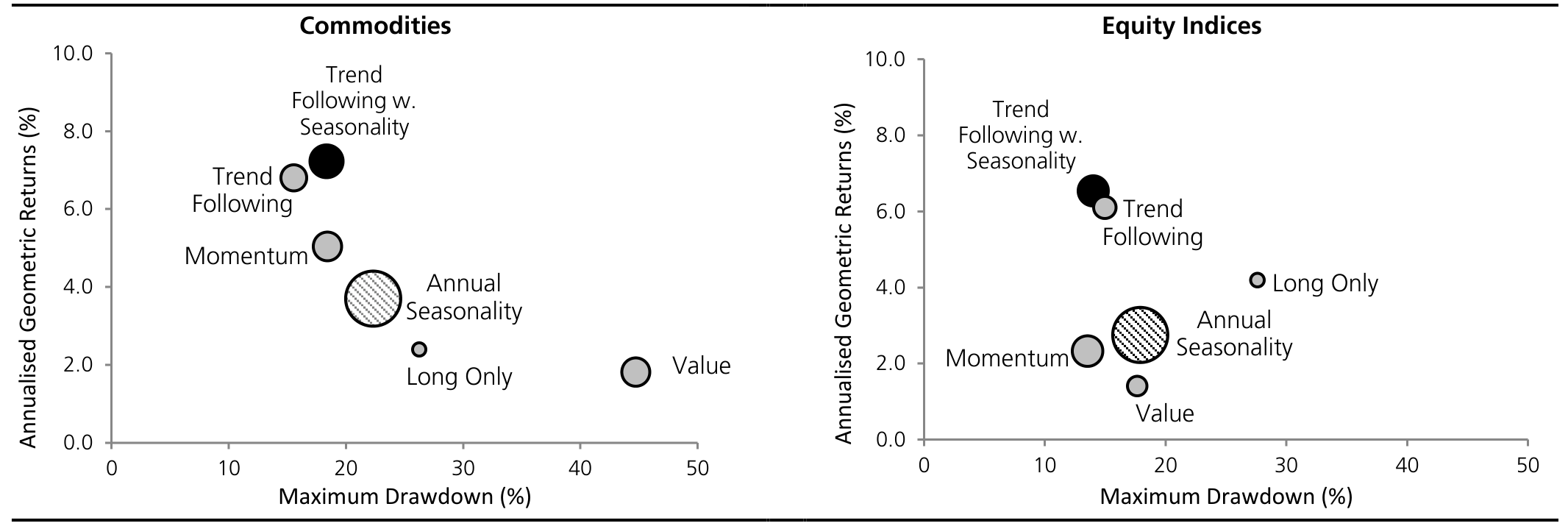

Figure 2: Risk & Return for Dynamic Leveraged Commodity and Equity Index Strategies (Volatility Target at 7%) (Original: Figure 7)

Figure 2 illustrates that the seasonality-adjusted trend-following strategy achieves a favorable risk-return profile with manageable turnover. It delivers higher returns for a given level of risk compared to the standard trend-following strategy, validating the effectiveness of combining seasonality with trend-following.

Implications for Return Stacked Portfolios

Adding a managed futures strategy that incorporates seasonality adjustments can improve diversification and capital efficiency in a portfolio. This approach aligns with the goals of return stacking by layering complementary strategies to achieve superior risk-adjusted returns while maintaining reasonable transaction costs.

Conclusion

Nick Baltas’s “Multi-Asset Seasonality and Trend-Following Strategies” underscores the potential of combining different investment signals to enhance portfolio performance. While direct trading on seasonality poses practical challenges due to high transaction costs, integrating seasonality into trend-following strategies offers a viable solution. This hybrid strategy not only improves returns but also enhances risk-adjusted performance, providing valuable insights for investors seeking to optimize their portfolios through sophisticated techniques like return stacking.