Return Stacked® Academic Review

Managed Futures Carry: A Practitioner’s Guide

Authors

Adam Butler and Andrew Butler

ReSolve Asset Management Whitepaper

Managed Futures Carry Whitepaper

Key Topics

return stacking, portable alpha, diversification, managed futures, trend following, carry, bonds, equities, yield, risk management, portfolio construction

Exploring the Economic Rationale and Methodology

In “Managed Futures Carry: A Practitioner’s Guide,” Adam Butler and Andrew Butler delve into the nuances of futures carry strategies from a practitioner’s perspective. The whitepaper offers a thorough analysis of the economic rationale behind carry strategies and examines their potential role in enhancing portfolio performance and diversification.

Carry is defined as the expected return of an investment assuming its price remains unchanged. It represents the economic benefits of holding an asset, minus the costs associated with maintaining the position. The authors dissect how carry manifests across different asset classes:

- Equities: Dividend yield minus the financing rate.

- Bonds: Yield plus roll-down minus the financing rate.

- Commodities: Convenience yield minus financing, storage, transportation, and insurance costs.

- Currencies: Foreign short rate minus the local short rate.

The study spans over three decades of data, covering equities, bonds, commodities, and currencies. The authors employ both cross-sectional (comparing multiple assets at a single point in time) and time-series strategies to analyze carry. Their methodology accounts for market correlations and aims to neutralize exposures to major benchmarks like the S&P 500 and U.S. Treasury futures. Practical considerations such as transaction costs are addressed, highlighting efficiencies achievable through trade netting and weight smoothing.

Analyzing Key Insights Through Figures

The whitepaper presents compelling evidence of the benefits of integrating carry and trend-following strategies into traditional portfolios. The following figures illustrate the cumulative growth achieved by stacking these strategies atop standard equity and bond indices.

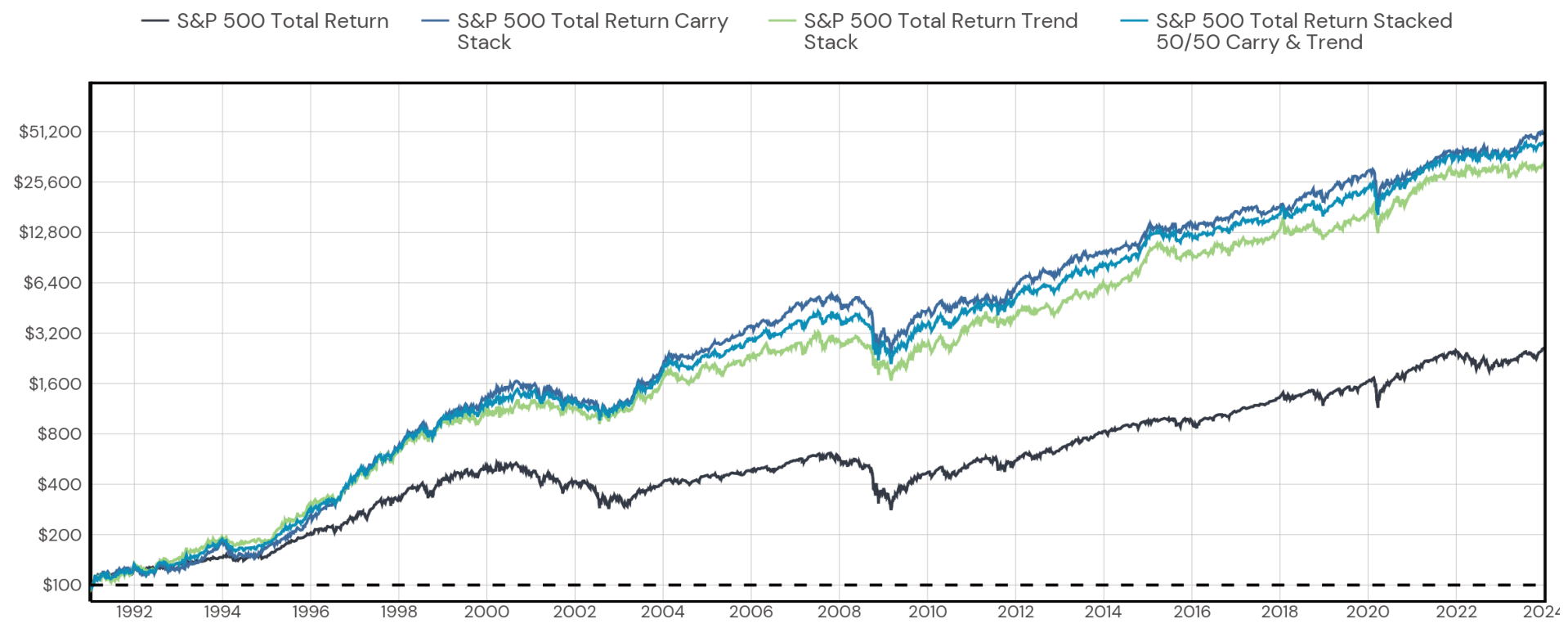

Figure 1: Cumulative Growth of S&P 500 Total Return Index Stacked with Carry and Trend (Original: Figure 28)

Data sourced from CSI Data and Standard & Poor’s. Authors’ calculations. Trend and Carry performance is hypothetical and net of estimated trading slippage and commissions. Past performance is not indicative of future results. See disclaimers in the original document for more information.

Figure 1 demonstrates that portfolios stacking carry and trend-following strategies on top of the S&P 500 Total Return Index exhibit significantly higher cumulative growth compared to the benchmark alone. Notably, the inclusion of these strategies does not exacerbate drawdowns, suggesting an improvement in risk-adjusted returns.

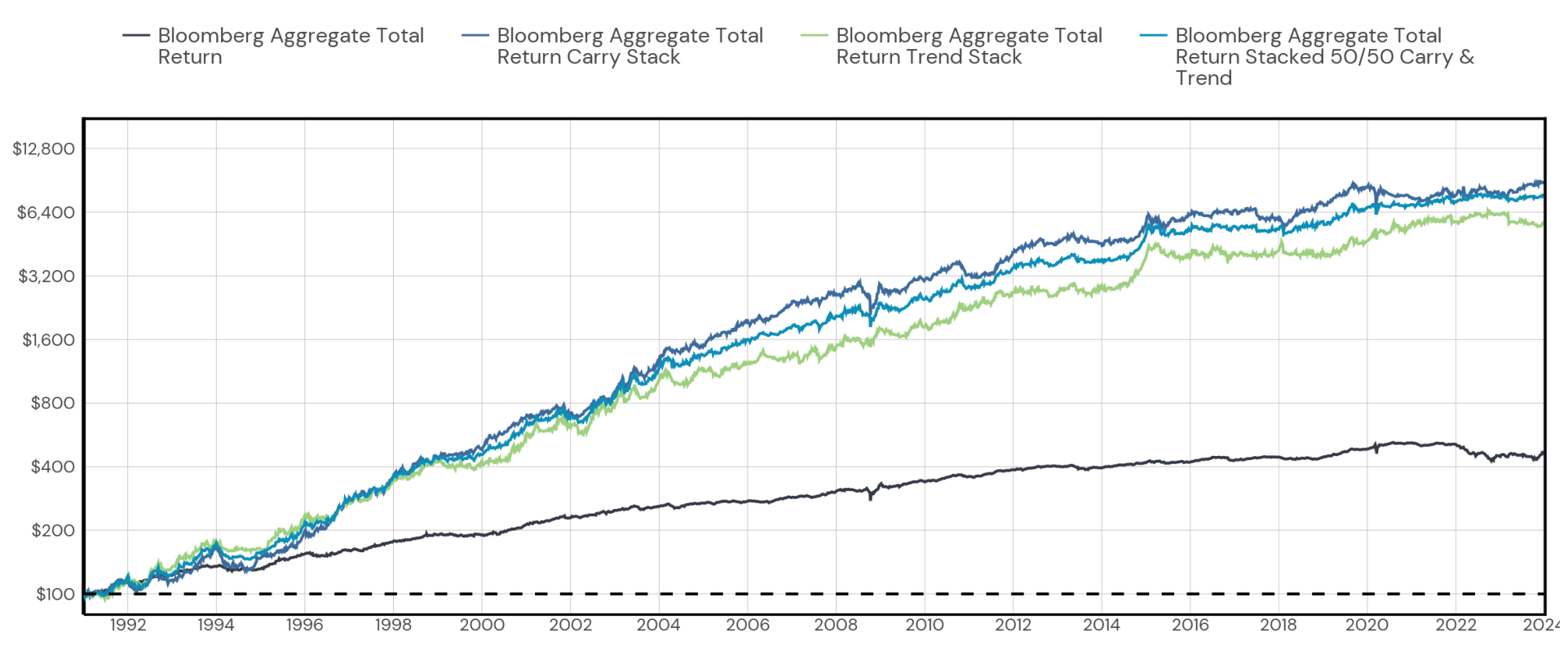

Figure 2: Cumulative Growth of Bloomberg Barclays Aggregate Bond Index Stacked with Carry and Trend (Original: Figure 29)

Data sourced from CSI Data and Bloomberg. Authors’ calculations. Trend and Carry performance is hypothetical and net of estimated trading slippage and commissions. Past performance is not indicative of future results. See disclaimers in the original document for more information.

Figure 2 extends this analysis to bond portfolios. Stacking carry and trend strategies atop the Bloomberg Barclays Aggregate Bond Index results in substantial return enhancements while maintaining minimal impact on drawdowns. This suggests that these strategies can add value across different asset classes.

Integrating Carry Strategies into Return Stacked Portfolios

Carry strategies, due to their low correlation with traditional asset classes, are ideal candidates for return stacking. They provide an additional source of return that does not rely on asset appreciation. When combined with trend-following strategies—long or short positions based on price trends in various assets—the potential for diversification and performance enhancement increases.

For investors interested in the mechanics and benefits of return stacking, the concept is explored in detail in the article Diversification 2.0: Understanding Return Stacking and the Evolution of Portfolio Construction. Additionally, the role of carry strategies in generating futures yield is discussed in Managed Futures Yield: A Primer on Carry.

The integration of carry and trend-following strategies aligns with the notion of portable alpha—generating excess returns (alpha) independently of the market’s movements and “porting” this alpha onto existing portfolios. This approach is elaborated in Portable Alpha: Enhancing Returns through Uncorrelated Strategies.

Conclusion

“Managed Futures Carry: A Practitioner’s Guide” provides robust empirical support for the inclusion of futures carry strategies in diversified portfolios. The authors demonstrate that these strategies can enhance returns while potentially reducing overall portfolio risk due to their low correlation with traditional assets.

Key takeaways for investors and portfolio managers include:

- Enhanced Risk-Adjusted Returns: Incorporating carry and trend-following strategies can potentially elevate the efficient frontier, offering higher returns for a given level of risk.

- Diversification Benefits: The low correlation of carry strategies with traditional asset classes can help mitigate portfolio volatility, especially during periods of market stress.

- Practical Implementation Considerations: Addressing transaction costs, market correlations, and exposure neutralization is critical for the real-world application of these strategies.

The study underscores the importance of looking beyond traditional asset classes to improve portfolio resilience and efficiency. By thoughtfully integrating uncorrelated strategies such as carry and trend following, investors can better navigate complex market environments and enhance long-term performance.