Pent Up Energy – Carry / Managed Futures Why Now?

Overview

This piece examines how recent macro shocks have reshaped the landscape for carry, where drawdowns may conceal new sources of return. By viewing carry as the market’s hazard pay and applying return stacking, investors may access shifting opportunities without abandoning core allocations.

Key Topics

Policy Uncertainty, Premia Rotation, Macro Resilience, Drawdown Dynamics

The past year delivered a masterclass in why carry strategies defy simple mean-reversion logic. As our multi-asset carry portfolio weathered a turbulent period, from China’s desperate stimulus to Trump’s trade war escalation, a profound truth emerged: not all drawdowns create opportunity.

- “Is the strategy broken?”

- “Does this make carry more attractive, like buying value after a selloff?”

The first question reflects healthy skepticism born from pain. If we could identify broken strategies in real-time, market-beating returns would be trivial. But strategies with volatility running two to three times expected returns don’t break, they breathe. When Sharpe ratios live between 0.3 and 0.5, extended drawdowns aren’t bugs; they’re the price of harvesting risk premia through market cycles.

The second question reveals more sophisticated thinking and deserves an equally sophisticated answer, one that the past year’s extraordinary events have illuminated with unusual clarity.

Consider carry as the market’s hazard pay system. Higher carry emerges where quality deteriorates, liquidity evaporates, or economic risks multiply. When oil futures curves steepened into deep contango following OPEC+’s April 2025 production increase, storage providers earned elevated carry for warehousing the world’s sudden energy surplus. When the Bank of Japan’s historic tightening collided with the ECB’s aggressive easing, currency carry opportunities exploded as rate differentials reached decade-wide extremes.

Carry isn’t merely a risk premium, it’s the market’s mechanism for ensuring capital flows where danger lurks and necessity demands.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

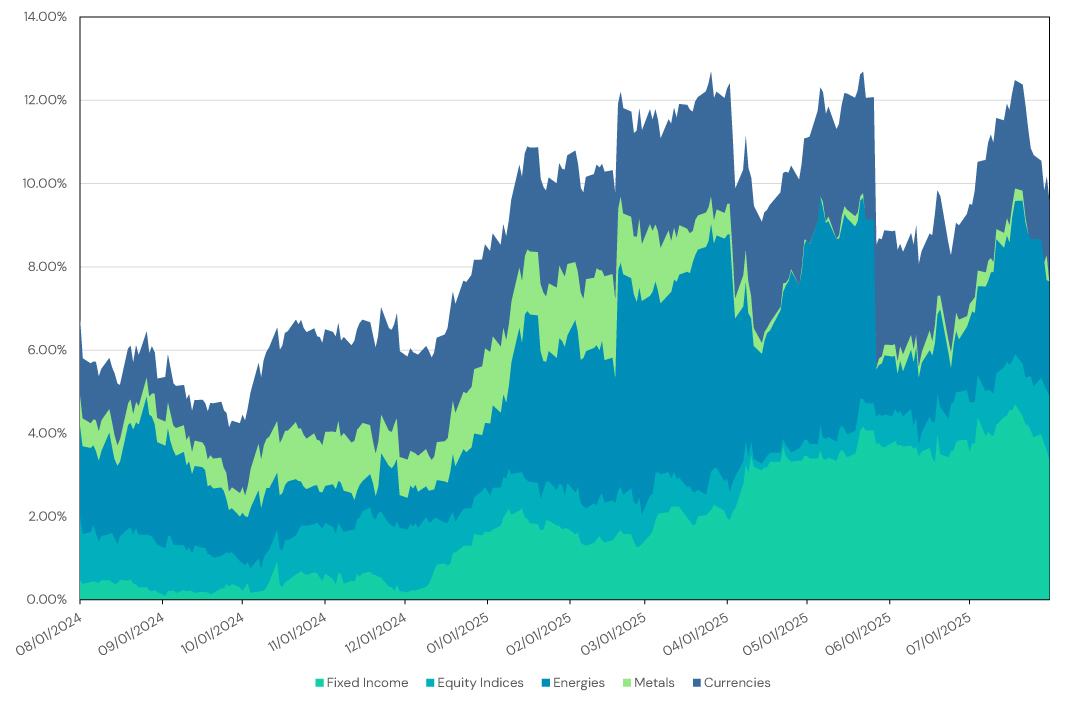

Figure 1: Sector-Level Contribution to Portfolio-Level Carry Score, Aug 1, 2024 - July 31, 2025

Source: ReSolve Asset Management; Calculations by Newfound Research. For illustrative purposes only. Asset class categories (Fixed Income, Equity Indices, Energies, Metals, and Currencies) are made up of the futures contracts traded in the Multi-Asset Carry program. Carry Score measures the annualized benefit or cost from rolling futures contracts based on prevailing term structure, financing, and convenience yield conditions. Past performance does not guarantee future results.

The chart reveals how September 2024’s Chinese stimulus package – a desperate cocktail of rate cuts, property support, and stock market intervention – initially compressed metals carry as speculative fervor erupted. But as reality set in and Trump’s February 2025 tariffs decimated trade flows, metals carry evaporated entirely while fixed income carry exploded.

This wasn’t random rotation – it was carry responding to tectonic shifts in global economics:

– The Great Divergence. While the Fed held rates steady at 4.25-4.5% through July 2025, the ECB slashed from 3.5% to 2.5% in six consecutive cuts. Meanwhile, the Bank of Japan shocked markets with its January hike to 0.5%-the highest since 2008. These diverging paths created the widest G3 rate differentials in over a decade.

– The Trade War Escalation. Trump’s February declaration of a “national emergency” to justify 10% China tariffs quickly spiraled into 145% levies by May, with China retaliating through targeted agriculture and energy tariffs. The disruption to global supply chains fundamentally altered commodity term structures.

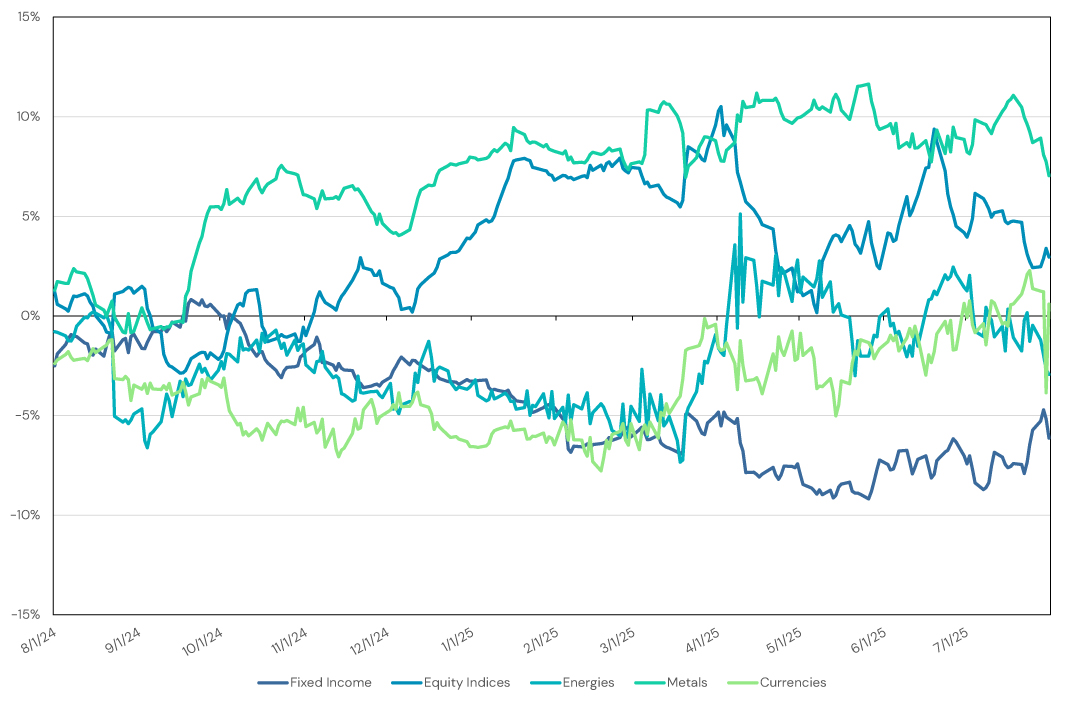

Figure 2: Volatility-Adjusted Target Weights by Sector over Time, Aug 1, 2024 - July 31, 2025

Source: ReSolve Asset Management; Calculations by Newfound Research. For illustrative purposes only. Target Weights reflect target allocations and may not reflect the actual weights held within portfolios. Holdings are subject to change. Volatility-Adjusted Target Weights multiply Target Weights by a 63-day exponentially weighted volatility measure. Asset class categories are consistent with those in Figure 1.

The portfolio’s response tells the story: structural positions in fixed income expanded as central bank divergence created persistent carry opportunities. Currency allocations swung wildly as the yen strengthened from intervention fears while emerging market currencies collapsed under tariff pressure. Commodities saw episodic opportunities – surging when OPEC extended cuts through March 2025, collapsing when April’s production increase met May’s trade war peak.

The year’s extraordinary events crystallized carry’s fundamental duality:

This was textbook risk-premium re-pricing, which is the spring loading for future returns.

This was fundamental re-rating, i.e. the market acknowledging that “this time isn’t different” for Chinese stimulus.

Central Bank Divergence Creates Persistent Carry: The ECB-Fed-BOJ trinity’s opposing paths have created the most durable carry opportunities in fixed income and currencies since the European debt crisis. With the ECB targeting 2% by mid-2025 while the BOJ eyes 1%, these differentials won’t compress quickly.

Trade Wars Reshape Term Structures: Trump’s tariff escalation didn’t just impact spot prices, it fundamentally altered forward curves across commodities. Oil’s brief backwardation in February gave way to steep contango by June as trade volumes collapsed 60%. These structural shifts create new carry opportunities for those willing to warehouse disruption risk.

Stimulus Efficacy Determines Duration: China’s massive intervention temporarily altered carry dynamics, but the speed of reversal revealed market skepticism. When stimulus addresses symptoms rather than causes, carry opportunities prove fleeting.

Volatility Scales Everything: The explosion in realized volatility exemplified by the USD/JPY’s 20% range, oil’s $30 swings, etc., mechanically reduced position sizes even where carry improved. This vol-adjustment protected capital but muted the capture of improving carry conditions.

Here’s what makes this moment fascinating yet treacherous: portfolio-level drawdowns have coincided with dramatically improved carry in select sectors while others have seen complete evaporation. Unlike value investing where lower prices mechanically improve ratios, carry’s opportunity set has bifurcated violently.

Fixed income and currency carry have rarely looked more attractive. The ECB’s commitment to reaching 2% while the Fed remains on hold creates a carry gradient not seen since 2012. Japan’s methodical normalization adds another dimension as Mrs. Watanabe unwinds decades of carry trades.

Yet commodity carry remains challenged. OPEC+’s decision to gradually increase production through September 2026 caps upside in energy curves. Metals face the double headwind of Chinese overcapacity and trade war disruption.

The implication is profound: conviction in carry strategies can’t rest on portfolio-level metrics but requires granular assessment of each sector’s fundamental drivers. When central banks diverge, currencies offer carry. When trade wars disrupt, commodities lose it. When stimulus fails, metals re-rate. Each sector dances to its own drummer.

For sophisticated investors, the relevant question isn’t “has carry gotten cheaper?” but rather “where has disruption created compensation?” The violent rotation from metals to fixed income, the explosion in currency differentials, the episodic opportunities in energy aren’t signs of strategy failure but of markets functioning exactly as they should, pricing risk in real-time as the world reshapes itself.

This distinction matters because carry strategies, unlike purely behavioral anomalies, tap into the fundamental machinery that keeps global markets functioning. They profit from providing essential services: duration risk absorption when central banks diverge, currency risk warehousing when rates separate, commodity storage when supply and demand disconnect.

The past year taught us that drawdowns in carry strategies often mark transitions rather than failures. Today’s positioning, concentrated in fixed income and currencies while light in commodities, suggests the strategy has successfully navigated from yesterday’s opportunities to tomorrow’s.

The strategy isn’t broken, it’s evolving with unprecedented velocity. The opportunities aren’t disappearing, they’re shape-shifting as the global order reconstructs. And for investors who understand that carry is fundamentally about being paid to stand where others fear to tread, this moment of maximum uncertainty may paradoxically offer maximum opportunity.

Welcome to the next chapter of systematic carry investing, where Darwin beats mean reversion and adaptation rewards the nimble. In a world where central banks diverge, trade wars rage, and stimulus efficacy wanes, carry doesn’t get cheaper; it gets different. And different, for those paying attention, can be extraordinarily profitable.

Return stacking achieves more than $1.00 of exposure for each $1.00 invested, using capital-efficient derivatives to maintain core allocations while freeing capital for alternatives. The elegance lies not in reducing carry’s volatility, but in removing its opportunity cost. When you don’t have to sell stocks and bonds to access carry, the psychological equation fundamentally changes.

Consider our analysis: fixed income carry improved even as positions lost money (risk-premium re-pricing), while metals carry evaporated alongside losses (fundamental re-rating). An investor who sold equities to buy carry would have suffered twice – from carry’s drawdown and from missing the equity rally. But stacked atop a core portfolio, carry’s gyrations become tolerable volatility in an enhancement layer rather than devastating opportunity cost in the foundation.

This proves especially powerful given carry’s nature. Unlike momentum strategies that follow prices, carry stands against them: long duration when curves steepen, long commodities in contango, long struggling currencies with high yields. These positions are psychologically brutal in isolation but manageable when your core portfolio remains intact. Capital-efficient implementation allows investors to harvest these uncomfortable risk premia without abandoning familiar ground.

The past year’s violent rotations, e.g. metals collapsing while fixed income carry exploded, would break anyone who funded carry by selling core positions during an equity rally. But implemented through return stacking, these shifts become exactly what sophisticated investors seek: a strategy that adapts to changing opportunity sets while preserving the behavioral anchor of traditional allocations.

In a world where carry can deteriorate even as it loses money, the ability to maintain exposure without sacrificing core positions isn’t just convenient, it’s essential. Return stacking doesn’t promise to make carry’s drawdowns profitable, but something more valuable: it makes them survivable. And for a strategy whose opportunity set shifts as violently as we’ve witnessed, survivability is the precondition for success.

Disclaimer

This commentary is provided for informational purposes only and should not be construed as investment advice. Carry scores reflect the annualized benefit or cost from rolling futures contracts based on prevailing term structure, financing, and convenience yield conditions. All target weights are volatility-adjusted using 63-day exponentially weighted measures. Past performance does not guarantee future results. The views expressed are those of the authors and do not constitute investment advice.

Results reflect the performance of the carry portion of our Multi-Asset Portfolio at target allocation levels but do not reflect the performance of the entire portfolio.