Return Stacked® Academic Review

Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency

Authors

Narasimhan Jegadeesh and Sheridan Titman

The Journal of Finance, Vol. 48, No. 1 (Mar., 1993), pp. 65-91

https://www.bauer.uh.edu/rsusmel/phd/jegadeesh-titman93.pdf

Unveiling the Profitability of Momentum Strategies

In their seminal 1993 paper, Narasimhan Jegadeesh and Sheridan Titman explored the efficacy of momentum strategies in the U.S. equity market and their implications for market efficiency. They investigated whether investors could achieve abnormal returns by employing relative strength strategies—buying stocks that have performed well in the past (“winners”) and selling those that have underperformed (“losers”).

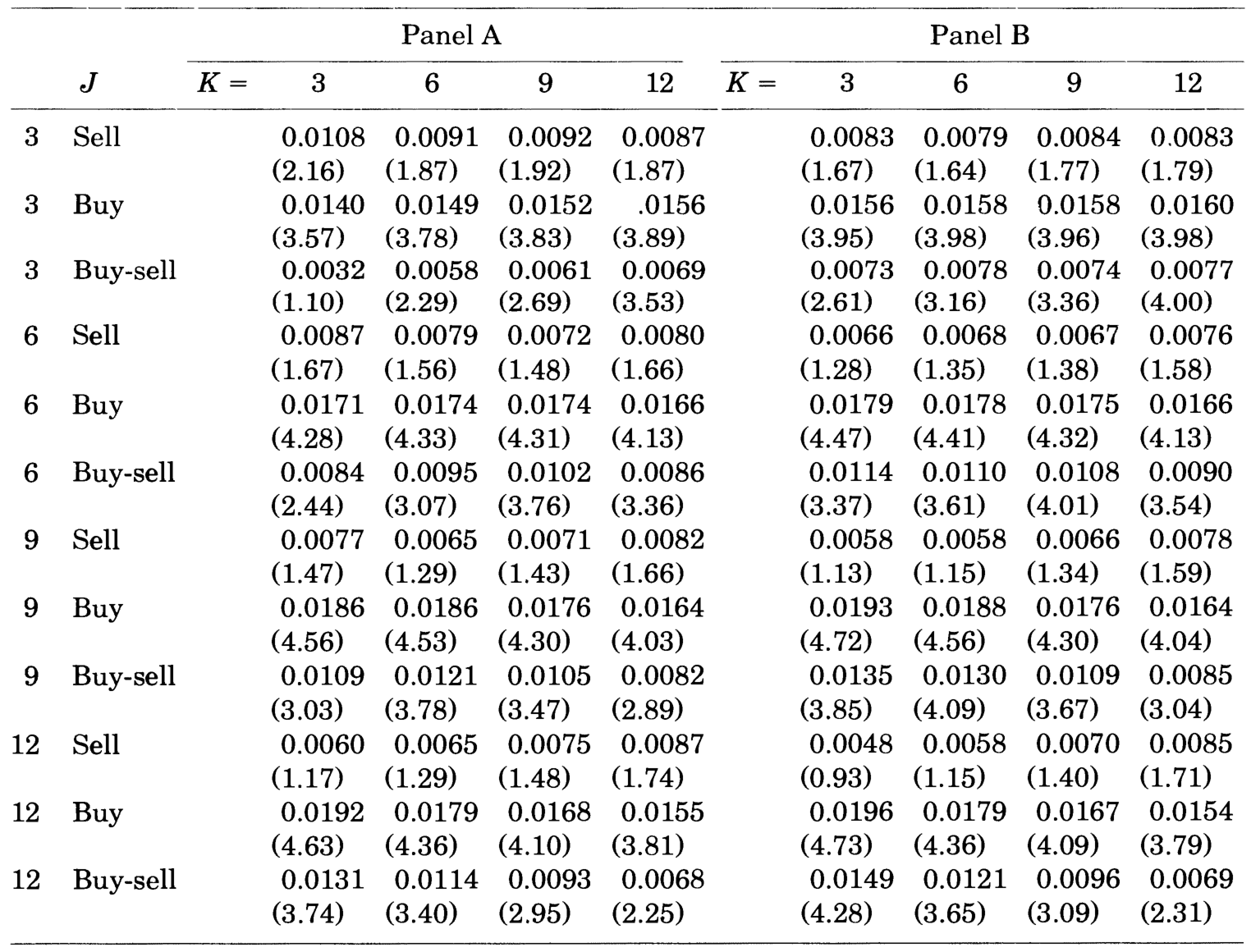

Using data spanning from 1965 to 1989, the authors constructed portfolios based on stocks’ past returns over formation periods ranging from 3 to 12 months. They then evaluated the subsequent performance of these portfolios over holding periods of similar durations. To ensure their findings were robust, they accounted for factors such as market microstructure effects by introducing a one-week lag between the formation and holding periods.

Analyzing Performance and Key Insights

Jegadeesh and Titman found compelling evidence that momentum strategies yield significant positive returns. They demonstrated that these returns could not be fully explained by systematic risk factors or market-wide influences, suggesting that delayed price reactions to firm-specific information contribute to the momentum effect.

Figure 1: Average Monthly Returns of Relative Strength Portfolios (Original: Figure I)

Notably, strategies that selected stocks based on the previous 6 to 12 months of performance and held them for 3 to 12 months consistently generated significant positive returns. For example, the 12-month formation and 3-month holding period strategy yielded an average monthly return of 1.49% with the one-week lag (Panel B).

Figure 2: Cumulative Returns of Zero-Cost Momentum Strategy Over 36 Months (Original: Figure VII)

The study also highlighted that the momentum profits persisted for up to 12 months but began to reverse over longer horizons. The cumulative returns peaked around 9.5% in the first year but tapered off to approximately 4% by the end of the third year, indicating a degree of mean reversion in the long term.

Implications for Portfolio Construction and Return Stacking

Jegadeesh and Titman’s findings have profound implications for portfolio management, particularly in the context of return stacking—a strategy that involves layering multiple, diversifying return streams to enhance overall portfolio performance. Incorporating momentum strategies can add a valuable source of uncorrelated returns, improving diversification and potentially boosting risk-adjusted returns.

For instance, integrating trend-following strategies, which capitalize on momentum across various asset classes, can provide a form of portable alpha when overlaid on a core investment portfolio. This approach aligns with the principles discussed in Trend Following Strategies and the concept of Portable Alpha, where investors seek to enhance returns without significantly increasing overall risk.

However, the observed pattern of momentum reversal over longer periods underscores the importance of dynamic risk management and periodic rebalancing. Investors employing momentum within a return stacking framework must be vigilant about the potential for mean reversion and the impact of transaction costs and market liquidity.

Concluding Thoughts

The research by Jegadeesh and Titman offers valuable insights into the behavior of stock prices and the viability of momentum strategies. Their evidence of persistent momentum profits challenges the notion of fully efficient markets and suggests that investors can exploit certain predictable patterns for gain.

Incorporating momentum strategies into a diversified portfolio, particularly through return stacking techniques, can enhance performance by adding unique return drivers. By thoughtfully combining momentum with other uncorrelated strategies and employing prudent risk management, investors can construct more robust portfolios aimed at achieving superior long-term results.