Re-Thinking the ‘40’ in 60/40: How Return Stacking May Enhance Portfolio Diversification

Overview

For decades, the 60/40 portfolio – 60% equities and 40% bonds – has served as a foundational asset allocation model for investors. It’s simple, time-tested, and grounded in a core belief: when stocks struggle, bonds typically offer stability.

But markets evolve, and recent years have shown that bonds may not always offer the same protective benefits, especially during inflationary shocks. Advisors seeking to diversify more effectively may want to consider new tools that build on the principles of the 60/40 portfolio – while enhancing the “40” to make it potentially more robust.

Key Topics

Portable Alpha, Excess Returns, Outperformance, Managed Futures

When the “40” Falls Short

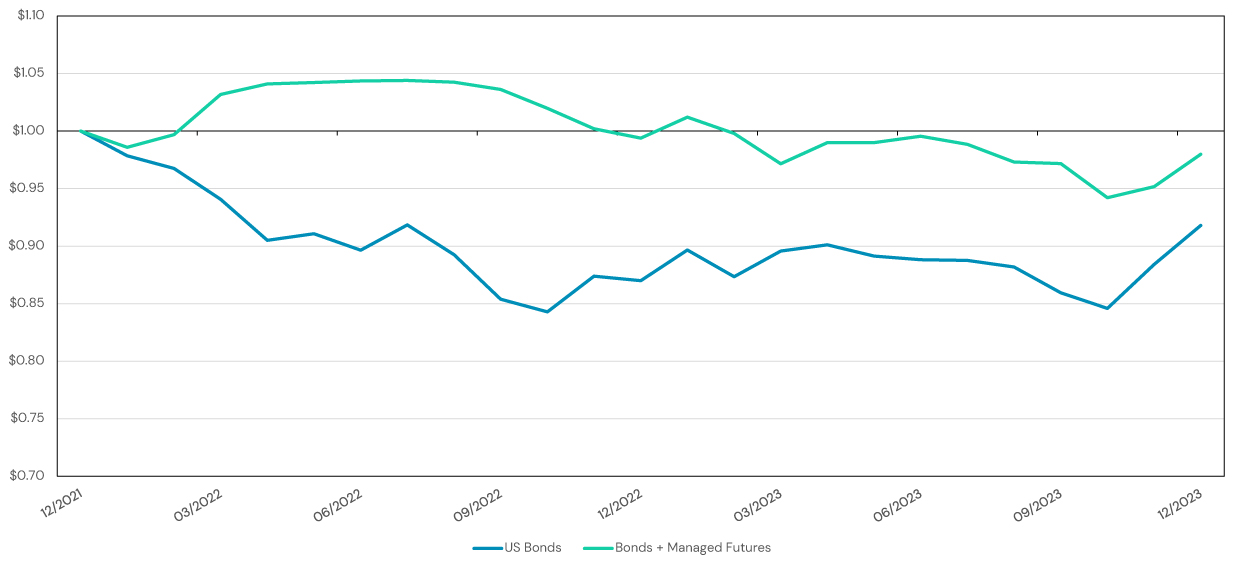

However, that pattern does not always hold. In 2022, for example, both asset classes declined sharply. The Bloomberg U.S. Aggregate Bond Index dropped more than 13%, one of its worst years in recent history. The traditional diversifying relationship broke down, largely due to rising inflation and interest rates—a market environment in which both asset classes can struggle.

In other words, the “40” in the 60/40 isn’t always a reliable diversifier, especially when inflation is a dominant concern.

Adding a Different Type of Diversifier

Managed futures offer diversification potential due to their flexibility. Unlike bonds, they aren’t structurally tied to any specific macroeconomic indicator. Instead, they adapt to changing market trends. In inflationary environments, managed futures strategies may short bonds or go long commodities—exposures that traditional portfolios may lack.

The Potential of Return Stacking

This tradeoff can lead to behavioral challenges. Instead of carving out space, advisors can use funds that combine multiple exposures in a single investment. For example, a fund that delivers 100% bond exposure and 100% managed futures exposure stacks the return streams on top of one another.

Integrating a 100/100 bond/managed futures solution into the “40” sleeve of a 60/40 portfolio may enhance diversification while preserving core bond exposure.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

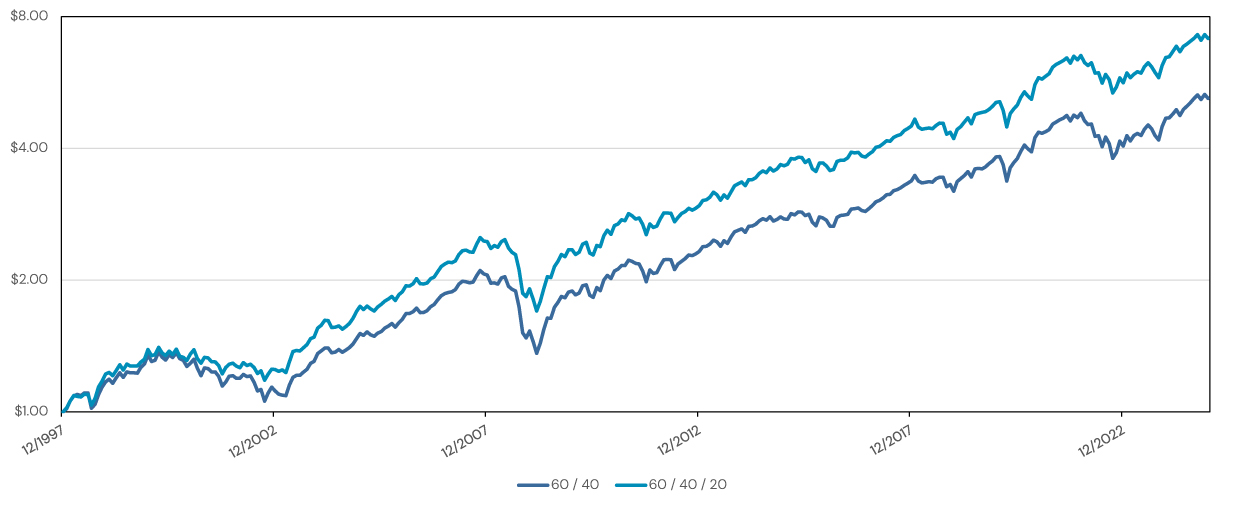

The 60/40/20 portfolio has the same total capital allocation (100%) but includes an additional return stream—managed futures—stacked on top of the bond exposure. This approach keeps core bond diversification while layering in trend-following’s adaptive potential.

Figure 1: 60/40 Vs. 60/40/20 Growth of One Dollar

Figure 2: Performance During Equity Drawdowns

| Global Equities | US Bonds | Managed Futures | 60 / 40 | 60 / 40 / 20 | |

| 2000 – 2002 (Dot-com Crash) | -46.2% | 28.6% | 64.6% | -22.8% | -15.9% |

| 2008 (Financial Crisis) | -48.0% | 5.4% | 24.9% | -30.1% | -27.0% |

| 2022 (Rising Rates) | -25.4% | -14.6% | 21.0% | -21.1% | -17.9% |

Managed futures strategies offer exposure to commodities—an asset class that has traditionally outperformed during inflation shocks. During the 2022 inflation-driven drawdown, many managed futures funds were positioned to benefit from declining bond prices and rising commodity markets, helping offset losses from traditional holdings.

Figure 3: Performance During 2022 – 2023

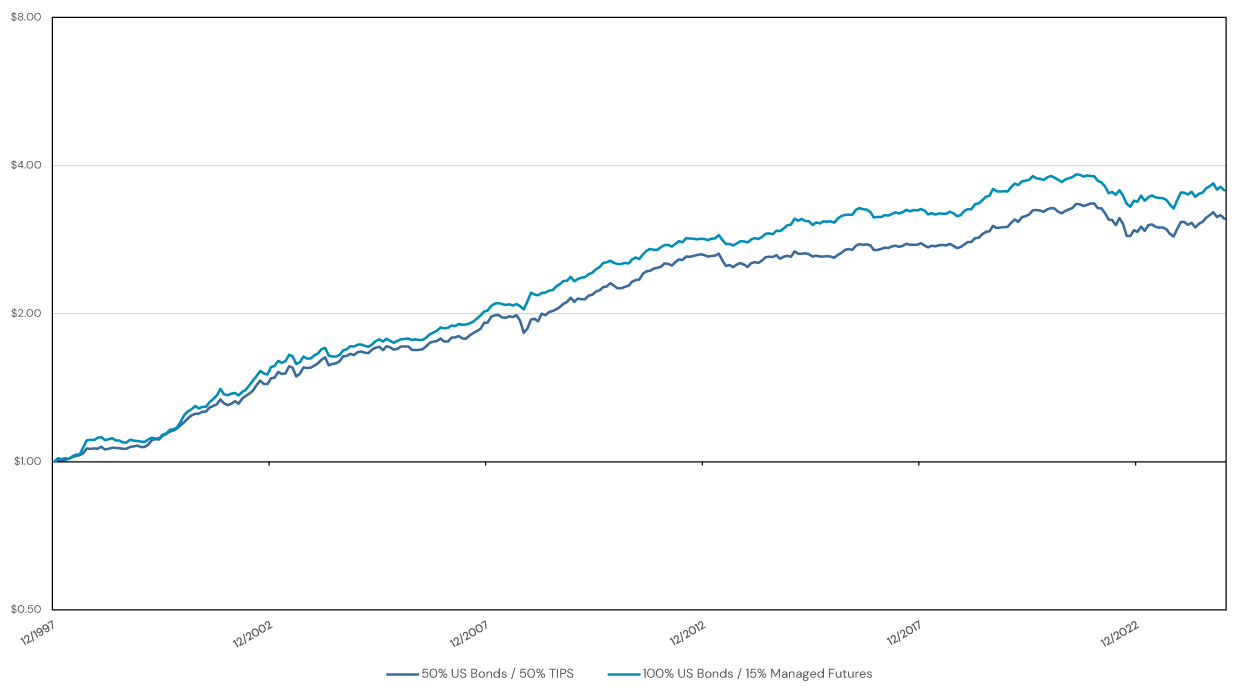

In fact, inflation-protected bonds have historically looked like a stacked 100% Bond + 30% Commodity strategy. Stacking managed futures may offer a compelling alternative to static commodity exposure, as it has historically provided similar inflation-protection without the same downside exposure to deflationary environments.

Figure 4: Comparison of TIPS and Managed Futures in a Bond-Centric Portfolio

Return stacking seeks to create more resilient portfolios by addressing a broader range of risks and return drivers, without requiring advisors or clients to give up familiar exposures.

Key Takeaways for Financial Advisors

- The 60/40 portfolio is a strong foundation, but bonds may not always serve as reliable diversifiers—especially during inflationary shocks.

- Managed futures trend following strategies can adapt to changing market trends and have historically provided diversification during periods when traditional asset classes faced challenges.

- Stacking managed futures on top of existing bonds allows advisors to potentially enhance the “40” allocation without giving up core bond exposure.

- In stress periods, a stacked 60/40/20 portfolio has historically experienced smaller drawdowns than a traditional 60/40.

- For advisors seeking smarter diversification, return stacking offers a capital-efficient, behaviorally friendly approach to improving client outcomes.